- within Corporate/Commercial Law topic(s)

- in South America

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

The Maltese tax regime has historically been based on a full imputation system, further enhanced by a network of over 70 Double Taxation Agreements (DTAs), and by the possibility to apply for unilateral tax relief for countries with whom a DTA is not in place. The corporate tax rate for a company incorporated in Malta is 35%. There are instances, however, in which the features of the Maltese tax system might be beneficial and lead to cost-effective and tax-efficient solutions for businesses.

We have previously written about the Consolidated Group Rules, which were added to the legislation in 2019, introducing the concept of fiscal unity and resulting in cash flow advantages where only the effective tax rate (5%/10%) must be paid, eliminating the requirement to pay the full 35% tax and wait for the refund for Malta-based companies; the Notional Interest Rate Deduction introduced in 2017 which encourages equity financing (providing a tax deductible expense on the value of the company equity) as opposed to debt financing, resulting in tax savings while at the same time stimulating investment and supporting entrepreneurship; the Participation Holding Exemption under which, in certain cases, dividends received from the subsidiary company are not subject to taxation in Malta from a shareholding as low as 5%.

In this article, we will delve into the Maltese Double-Tier (or Two-Tier) structure and the benefits for shareholders.

Tax Refund for Shareholders Resident Abroad

With regards to corporate taxation, non-Maltese resident shareholders can claim, upon the distribution of dividends, a tax refund of 6/7ths for active income and 5/7ths on passive income. This would bring the effective taxation to 5% in case of active income and to 10% in case of passive income.

The refund is to be claimed by the shareholders, who will receive the refund by the Maltese tax authorities, which are bound to pay the refund within a reasonable timeframe by a bank transfer to the shareholder anywhere in the world. For example, if a trading company generates an income of €100, the company will pay €35 as tax, while €65 will go to the shareholder as dividends. The shareholder would then receive a tax refund of €30 from the Maltese tax authorities, bringing the effective taxation to 5%.

Fig. 1 – Tax refund system for a Maltese company with a non-resident shareholder.

The Two-Tier Structure

In this scenario, popularly referred to as the Maltese Double Tier Structure, there would be a structure whereby a Malta Holding company holds shares in another Maltese company, for instance, a trading company. By doing this, the tax refund is not received by the shareholder, but by the Holding company. The Holding company can then remit the full amount, consisting of the dividend income plus the tax refund, to the shareholders.

For example, if a trading company generates an income of €100, the company will pay €35 as tax, and €65 will go to the holding company as dividends. The holding company would then receive a tax refund of €30 from the Maltese tax authorities. After this, the Holding company may distribute €95 to the shareholder.

The Double-Tier structure is particularly effective when the Malta Company engages in trading activities, but can be applied also to investment, rental and Intellectual Property activities.

Fig. 2 – Tax refund system for a Two-Tier structure.

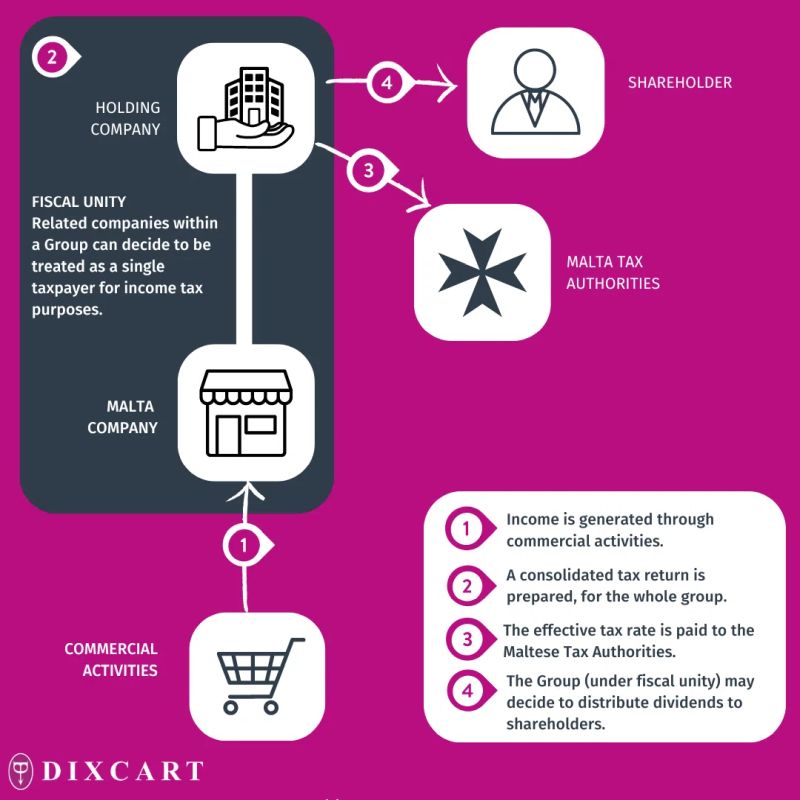

The Two-Tier Structure with Fiscal Unity – Cashflow Benefit Option

The Double-Tier structure can be created under the regime of fiscal unity. In this case, the 'Group' (Holding Company and Trading Company) would need to prepare consolidated financial statements and present a consolidated tax return to the Maltese Tax Authorities, and therefore only the effective tax rate will be charged. The advantages of this regime include simplified tax management, enhanced efficiency and significantly improved cash flow. For more information on the fiscal unity, please read this article on the Dixcart website: Malta Introduces Consolidated New Group Rules – Offering Cash Flow Advantages. It is important to underline that the fiscal unity regime is optional, and the decision is at the prerogative of the company.

Fig. 3 – Tax refund system for a Two-Tier structure with the regime of fiscal unity.

Dixcart in Malta

The Dixcart office in Malta has a wealth of experience across financial services and offers legal and regulatory compliance insight. Our team of qualified Accountants and Lawyers are available to set up structures and help to manage them efficiently.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.