- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Technology and Media & Information industries

We are pleased to provide this twice-annual report summarising notable mergers and acquisitions activity in South and Southeast Asia, highlighting transactions over US$100 million in aggregate value. This edition features deal making in the region over the six month period of March through August 2025.

Conyers offers extensive expertise in this area, having advised on a number of the cross-border M&A transactions involving Bermuda, BVI and Cayman Islands entities in the region, from initial structuring, due diligence to deal completion, in addition to advising on and corporate governance considerations.

MARKET UPDATE

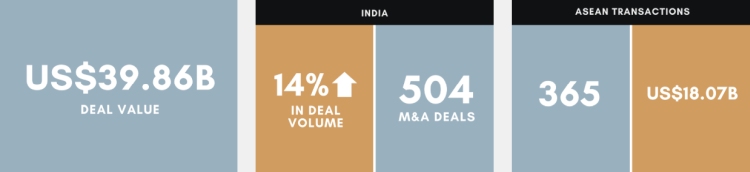

India's M&A landscape during this period was marked by a shift toward fewer but larger transactions, with a total announced deal value of US$50 billion in H1 and into August 2025.

Two mega cross-border deals announced in July are worth noting. Schneider Electric S.E. (ENXTPA:SU) entered into an agreement with respect to a US$6.35 billion acquisition of the remaining 35% stake in Schneider Electric India. Expected to close in the coming months, this transaction marks a strategic progression in Schneider Electric's investment in India—recognising it as a high-potential domestic market and a critical component of its multi-hub strategy, featuring a regional R&D and supply chain base that also supports other emerging markets. Also in July, Tata Motors Limited (BSE:500570) agreed to acquire Italian automotive leader Iveco Group N.V. (BIT:IVG) from Dutch company Exor N.V. (ENXTAM:EXO) and others for US$4.4 billion. The deal is aimed at acquiring 100% of Iveco's common shares with a subsequent delisting of Iveco Group.

In India, sectors driving market activity included energy, consumer goods and services, manufacturing and technology. Despite macroeconomic headwinds and new US tariffs on Indian exports introduced in August, investor sentiment remained resilient, especially in sectors aligned with energy transition and digital infrastructure.

The picture emerging from Southeast Asia has been one of emerging momentum amid persistent challenges. While the region experienced a muted M&A environment in 2024, the first half of 2025 showed signs of resurgence, particularly in high-growth sectors. With interest rates expected to decline and sovereign wealth funds actively supporting local industries, Southeast Asia is poised for accelerated M&A activity through late 2025. Digital infrastructure, telecommunications, healthcare, industrials and the financial services sector have all contributed to deal flow and are expected to continue to do so into Q4 of this year. Sustainability and ESG are key sectors to watch, as clean energy and environmental services (e.g., water treatment, waste management) gain traction. Logistics and supply chain players are also proving to be a post-pandemic priority for corporates and sponsors.

Continue scrolling to access the comprehensive list of South and Southeast Asian M&A deals valued at US$100 million and above during the six month period of March through August 2025.

M&A ACTIVITY IN SOUTH AND SOUTHEAST ASIA | MARCH - AUGUST 2025

Outlook

Looking ahead, India's M&A market is expected to remain robust through late 2025, building on its strong first half. The trend toward fewer but larger transactions is expected to continue, although new U.S. tariffs on Indian exports(effective since August) may dampen cross-border activity, especially in export-driven sectors.

Southeast Asia is projected to experience a dynamic rebound in M&A activity driven by sectoral momentum, macroeconomic shifts, and strategic investor behaviour. With the U.S. Federal Reserve initiating rate cuts and Asian central banks expected to follow, financing costs are dropping—boosting deal volumes, and there is rising interest from Japanese, Chinese, and global multinationals, especially via Singapore.

Of course, there are always challenges to watch, including tightening regulatory complexity in some regions and sectors, and the geopolitical hurdles associated with persistent trade tensions and regional instability.

NOTABLE TRANSACTIONS

- Mumbai-based manufacturer UltraTech Cement Limited (NSEI:ULTRACEMCO) acquired the cement business of Kolkata-based Kesoram Industries Limited (NSEI:KESORAMIND) for US$6.45 billion. (March)

- Delhi-based renewable energy producer ONGC Green Limited acquired PTC Energy Limited from PTC India Limited (NSEI:PTC) for US$111.29 million. (March)

- Mumbai-based power producer JSW Energy Limited (BSE:533148) acquired a 74% stake in Hyderabadi coal power project KSK Mahanadi Power Company Limited for approximately US$1.855 billion. (March)

Hong Kong private funds CVC

Capital Partners Asia VI (A) L.P., CVC Capital Partners Investment

Asia VI L.P managed by CVC Capital Partners Asia VI Limited, CVC

Capital Partners Asia VI (B) SCSp managed by CVC Capital Partners

Asia VI GP S.à.r.l. and Jersey-domiciled Aquilo GP Limited

acquired a 26% stake in Jaipur-based mortgage finance company Aavas Financiers Limited

(NSEI:AAVAS) from Mumbai-based private equity firm Kedaara Capital Investment Managers

Limited and others for US$369.39 million. (March)

Hong Kong private funds CVC

Capital Partners Asia VI (A) L.P., CVC Capital Partners Investment

Asia VI L.P managed by CVC Capital Partners Asia VI Limited, CVC

Capital Partners Asia VI (B) SCSp managed by CVC Capital Partners

Asia VI GP S.à.r.l. and Jersey-domiciled Aquilo GP Limited

acquired a 26% stake in Jaipur-based mortgage finance company Aavas Financiers Limited

(NSEI:AAVAS) from Mumbai-based private equity firm Kedaara Capital Investment Managers

Limited and others for US$369.39 million. (March)- Anzen India Energy Yield Plus Trust (NSEI:ANZEN), a fund managed by Mumbai-based Edelweiss Real Assets Managers Limited acquired Rajasthani solar project developer Solzen Urja Private Limited (formerly known as Renew Sun Waves Private Limited) from ReNew Private Limited for an enterprise value of US$182.9 million. (March)

Delhi-based airport developer

GMR Airports Infrastructure Limited

(NSEI:GMRINFRA) acquired an additional 10% stake in Delhi International Airport Limited

from German airport owner and operator Fraport AG (XTRA:FRA) for

US$126 million, bringing its total shareholding to 74%.

(March).

Delhi-based airport developer

GMR Airports Infrastructure Limited

(NSEI:GMRINFRA) acquired an additional 10% stake in Delhi International Airport Limited

from German airport owner and operator Fraport AG (XTRA:FRA) for

US$126 million, bringing its total shareholding to 74%.

(March). Mumbai-headquartered investment

bank JM Financial Limited

(BSE:523405) acquired an additional 42.99% stake in JM Financial Credit Solutions

Limited from Inh Mauritius 1 Fund managed by First Finance

Delaware LP for US$153.55 million, bringing its total shareholding

to 89.67%. (March)

Mumbai-headquartered investment

bank JM Financial Limited

(BSE:523405) acquired an additional 42.99% stake in JM Financial Credit Solutions

Limited from Inh Mauritius 1 Fund managed by First Finance

Delaware LP for US$153.55 million, bringing its total shareholding

to 89.67%. (March)- Mumbai-based real estate development finance company JM Financial Credit Solutions Limited acqired an additional 71.79% stake in JM Financial Asset Reconstruction Company Limited from JM Financial Limited (BSE:523405) for US$102.57 million. (March)

US private equity firm I Squared

Capital Advisors, LLC acquired Philippine Coastal Storage & Pipeline

Corporation from Singapore-based Keppel Infrastructure Trust (SGX:A7RU) and Philippine

infrastructure holding company Metro

Pacific Investments Corporation (OTCPK:MPCF.F) for US$346

million. (March)

US private equity firm I Squared

Capital Advisors, LLC acquired Philippine Coastal Storage & Pipeline

Corporation from Singapore-based Keppel Infrastructure Trust (SGX:A7RU) and Philippine

infrastructure holding company Metro

Pacific Investments Corporation (OTCPK:MPCF.F) for US$346

million. (March)- Gurugram-based online consumer payment processor PayU Payments Private Limited acquired a 43.5% stake in Mumbai digital payments platform Mindgate Solutions Private Limited from Mr. George Sam Kavalackal and Guhan Muthuswamy for a valuation of approximately US$200 – $250 million. (March)

- Mumbai-headquartered ICICI Bank Limited (NSEI:ICICIBANK) acquired the remaining 25.15% stake in ICICI Securities Limited (NSEI:ISEC) for US$621.82 million. (March)

Private equity and venture

capital fund Alpha Wave Ventures II, LP, managed by New York-based

sponsor Alpha Wave Global, LP, and Abu Dhabi-based venture capital

firm Chimera Capital Limited acquired an 8.93% stake in

Mumbai-based hybrid seed producer Advanta Enterprises Limited from UPL

Limited (BSE:512070) for US$250 million. (March)

Private equity and venture

capital fund Alpha Wave Ventures II, LP, managed by New York-based

sponsor Alpha Wave Global, LP, and Abu Dhabi-based venture capital

firm Chimera Capital Limited acquired an 8.93% stake in

Mumbai-based hybrid seed producer Advanta Enterprises Limited from UPL

Limited (BSE:512070) for US$250 million. (March) Delhi-based renewable energy

company Ongc NTPC Green Private

Limited acquired Bengaluru-based Ayana Renewable Power Private

Limited from private equity and venture capital firms National Investment and Infrastructure Fund

Limited, British International Investment plc, Green Growth

Equity Fund managed by EverSource

Capital Group, BII South Asia Renewables Limited and CDC India Opportunities

Limited at an implied enterprise value of US$2.244 billion.

(March)

Delhi-based renewable energy

company Ongc NTPC Green Private

Limited acquired Bengaluru-based Ayana Renewable Power Private

Limited from private equity and venture capital firms National Investment and Infrastructure Fund

Limited, British International Investment plc, Green Growth

Equity Fund managed by EverSource

Capital Group, BII South Asia Renewables Limited and CDC India Opportunities

Limited at an implied enterprise value of US$2.244 billion.

(March)- Bangkok-based Gulf Energy Development Public Company Limited (SET:GULF) acquired the remaining 52.6% stake in Intouch Holdings Public Company Limited for US $3.387 billion. (April)

Delaware public company Iron Mountain Incorporated

(NYSE:IRM) acquired the remaining 36.61% stake in

Thane-based Web Werks India Pvt.

Ltd. (nka Iron Mountain Data Centers) from Nikhil Rathi and

Nishant Rathi for US$162.42 million. (April)

Delaware public company Iron Mountain Incorporated

(NYSE:IRM) acquired the remaining 36.61% stake in

Thane-based Web Werks India Pvt.

Ltd. (nka Iron Mountain Data Centers) from Nikhil Rathi and

Nishant Rathi for US$162.42 million. (April) Ho Chi Minh City based real

estate operating company Gateway Thu

Thiem Joint Stock Company acquired a 42% stake in South Rach Chiec City Llc from

Singapore investment holding company Keppel Ltd. (SGX:BN4) for US$101.87

million. (April)

Ho Chi Minh City based real

estate operating company Gateway Thu

Thiem Joint Stock Company acquired a 42% stake in South Rach Chiec City Llc from

Singapore investment holding company Keppel Ltd. (SGX:BN4) for US$101.87

million. (April) Dubai-based Renew Exim Dmcc

acquired a 20.83% stake in Mumbai-based construction and civil

engineering company ITD Cementation

India Limited (BSE:509496) for US$236.05 million.

(April)

Dubai-based Renew Exim Dmcc

acquired a 20.83% stake in Mumbai-based construction and civil

engineering company ITD Cementation

India Limited (BSE:509496) for US$236.05 million.

(April) Mumbai-based solar and

hydroelectric power developer JSW Neo

Energy Limited acquired Gurugram-based O2 Power Private Limited from

private equity/buyout fund EQT Infrastructure IV, managed by

Swedish private equity and venture capital firm EQT Partners AB and

Singapore-based Temasek Holdings

(Private) Limited at an implied enterprise value of US$1.457

billion. (April)

Mumbai-based solar and

hydroelectric power developer JSW Neo

Energy Limited acquired Gurugram-based O2 Power Private Limited from

private equity/buyout fund EQT Infrastructure IV, managed by

Swedish private equity and venture capital firm EQT Partners AB and

Singapore-based Temasek Holdings

(Private) Limited at an implied enterprise value of US$1.457

billion. (April) US investment management firm

Goldman Sachs Asset Management, L.P. acquired an unknown majority

stake in Gurgaon-based human resource software company PeopleStrong Technologies Private

Limited for US$130 million. (April)

US investment management firm

Goldman Sachs Asset Management, L.P. acquired an unknown majority

stake in Gurgaon-based human resource software company PeopleStrong Technologies Private

Limited for US$130 million. (April)- Jakarta telecommunications company PT XL Axiata Tbk (IDX:EXCL) acquired PT Smartfren Telecom Tbk (IDX:FREN) from Wahana Inti Nusantara, PT, Global Nusa Data PT, Bali Media Telekomunikasi PT and PT. Gerbang Mas Tunggal Sejahter at an implied enterprise value of US$2.326 billion. (April)

Mumbai-headquartered consumer

goods company Hindustan Unilever

Limited (NSEI:HINDUNILVR) acquired an unknown minority stake

in Jaipur-based personal care product manufacturer Uprising Science Private Limited

from Mohit Kumar Yadav, Rahul Yadav, Mauritian venture capital

firms Peak XV Partners Operations LLC and Surge Ventures II, and

UK-based venture capital firm Twenty Nine Capital Partners Limited

Partnership for US$308.84 million. (April)

Mumbai-headquartered consumer

goods company Hindustan Unilever

Limited (NSEI:HINDUNILVR) acquired an unknown minority stake

in Jaipur-based personal care product manufacturer Uprising Science Private Limited

from Mohit Kumar Yadav, Rahul Yadav, Mauritian venture capital

firms Peak XV Partners Operations LLC and Surge Ventures II, and

UK-based venture capital firm Twenty Nine Capital Partners Limited

Partnership for US$308.84 million. (April)- Ahmedabad-based Ambuja Cements Limited (BSE:500425) simultaneously acquired 37.9% and 8.9% stakes in Orient Cement Limited (NSEI:ORIENTCEM) for US$365.18 million and US$85.7 million respectively. (April)

Bengaluru-based Aster DM Healthcare Limited

(NSEI:ASTERDM) acquired a 5% stake in Hyderabad hospital

owner and operator Quality CARE India

Limited from Singapore-based BCP Asia II Topco Iv PTE. Ltd. and

Centella Mauritius Holdings Limited for US$107.52 million.

(April)

Bengaluru-based Aster DM Healthcare Limited

(NSEI:ASTERDM) acquired a 5% stake in Hyderabad hospital

owner and operator Quality CARE India

Limited from Singapore-based BCP Asia II Topco Iv PTE. Ltd. and

Centella Mauritius Holdings Limited for US$107.52 million.

(April) Hong Kong-based and Cayman

Islands domiciled AI-driven animation streaming company Global IBO

Group Ltd completed the acquisition of Malaysian blank check

company Bukit Jalil Global

Acquisition 1 Ltd (NasdaqCM:BUJA) from Bukit Jalil Global Investment Ltd.

in a de-SPAC reverse merger transaction valued at US$8.28 billion,

resulting in the establishment of GIBO Holdings Limited

(NasdaqGM:GIBO). (May)

Hong Kong-based and Cayman

Islands domiciled AI-driven animation streaming company Global IBO

Group Ltd completed the acquisition of Malaysian blank check

company Bukit Jalil Global

Acquisition 1 Ltd (NasdaqCM:BUJA) from Bukit Jalil Global Investment Ltd.

in a de-SPAC reverse merger transaction valued at US$8.28 billion,

resulting in the establishment of GIBO Holdings Limited

(NasdaqGM:GIBO). (May) Private fund Clayton, Dubilier

& Rice Fund Xii, L.P., managed by New York-based private equity

firm CD&R Associates XII, L.P, acquired a 10.87% stake in Sanofi Consumer Healthcare India Limited

(NSEI:SANOFICONR) in a tender offer transaction valued at

US$146 million and an implied enterprise value of US$1.3 billion.

(May)

Private fund Clayton, Dubilier

& Rice Fund Xii, L.P., managed by New York-based private equity

firm CD&R Associates XII, L.P, acquired a 10.87% stake in Sanofi Consumer Healthcare India Limited

(NSEI:SANOFICONR) in a tender offer transaction valued at

US$146 million and an implied enterprise value of US$1.3 billion.

(May)- An undisclosed buyer acquired Indonesian power producers PT Minahasa Cahaya Lestari and PT Gorontalo Listrik Perdana from PT TBS Energi Utama Tbk (IDX:TOBA) for US$144.8 million. (May)

Dutch commodity chemical

manufacturer Indorama Netherlands B.V. acquired a 24.9% stake in

Mumbai-based plastic packaging manufacturer EPL Limited (BSE:500135) from US

alternative asset management firm Blackstone Inc. (NYSE:BX) for

US$220.16 million and at an implied enterprise value of US$964.57

million. (May)

Dutch commodity chemical

manufacturer Indorama Netherlands B.V. acquired a 24.9% stake in

Mumbai-based plastic packaging manufacturer EPL Limited (BSE:500135) from US

alternative asset management firm Blackstone Inc. (NYSE:BX) for

US$220.16 million and at an implied enterprise value of US$964.57

million. (May) Private Dubai company Renew Exim

Dmcc acquired a 46.64% stake in Mumbai-based construction and

engineering services provider ITD

Cementation India Limited (BSE:509496) from Italian-Thai Development Public Company

Limited (SET:ITD) for US$381.08 million. (May)

Private Dubai company Renew Exim

Dmcc acquired a 46.64% stake in Mumbai-based construction and

engineering services provider ITD

Cementation India Limited (BSE:509496) from Italian-Thai Development Public Company

Limited (SET:ITD) for US$381.08 million. (May)- Mumbai-based agribusiness Godrej Agrovet Limited (NSEI:GODREJAGRO) acquired an additional 47.38% stake in Hyderabad-based Creamline Dairy Products Limited from certain promoter shareholders and others for US$106.64 million. (May)

KKR Asian Fund IV SCSp, managed

by New York private equity and real estate investment firm KKR

& Co. Inc. (NYSE:KKR) and KIA EBT II Scheme 1, acquired a 50.4%

stake in Bengaluru-headquartered HealthCare Global Enterprises Limited

(NSEI:HCG) from Singapore-based healthcare service provider

Aceso Company Pte Ltd.

(May)

KKR Asian Fund IV SCSp, managed

by New York private equity and real estate investment firm KKR

& Co. Inc. (NYSE:KKR) and KIA EBT II Scheme 1, acquired a 50.4%

stake in Bengaluru-headquartered HealthCare Global Enterprises Limited

(NSEI:HCG) from Singapore-based healthcare service provider

Aceso Company Pte Ltd.

(May)- Ahmedabad-headquartered energy producer Adani Energy Solutions Limited (NSEI:ADANIENSOL) acquired Delhi-based WRNES Talegaon Power Transmission Limited from REC Power Development and Consultancy Limited for US$194.09 million. (May)

- Gurugram-headquartered automotive manufacturer Sona BLW Precision Forgings Limited (NSEI:SONACOMS) acquired RED Business from Escorts Kubota Limited (NSEI:ESCORTS) for US$190.3 million. (June)

- Ahmedabad-based Ambuja Cements Limited (BSE:500425) acquired a 26% stake in Orient Cement Limited (NSEI:ORIENTCEM) for US$251.22 million. (June)

Singapore-based Scgp Rigid Packaging Solutions Pte

Ltd. acquired the remaining 30% stake in Vietnamese plastics

manufacturer Duy Tan Plastics

Manufacturing Corporation for US$108.53 million. (June)

Singapore-based Scgp Rigid Packaging Solutions Pte

Ltd. acquired the remaining 30% stake in Vietnamese plastics

manufacturer Duy Tan Plastics

Manufacturing Corporation for US$108.53 million. (June) New York alternative asset

management firm Blackstone Inc. (NYSE:BX) acquired Kolkata-based

residential and commercial real estate developer South City Projects (Kolkata)

Limited from sellers Merlin

Group, Sureka Group, Emami Limited (BSE:531162), JB Group, Shrachi

Group Limited and Rameswara

Group for US$376.41 million. (June)

New York alternative asset

management firm Blackstone Inc. (NYSE:BX) acquired Kolkata-based

residential and commercial real estate developer South City Projects (Kolkata)

Limited from sellers Merlin

Group, Sureka Group, Emami Limited (BSE:531162), JB Group, Shrachi

Group Limited and Rameswara

Group for US$376.41 million. (June)- Mumbai-headquartered Vanya Corporation Private Limited acquired manufacturing company Vadraj Cement Limited for US$210.02 million. (June)

Indonesian palm oil producer

PT Ciliandra Perkasa acquired

an additional 30.68% stake in palm oil refining company PT Adhitya Seraya Korita from

Singapore company First Resources

Limited (SGX:EB5) for US$373 million. (June)

Indonesian palm oil producer

PT Ciliandra Perkasa acquired

an additional 30.68% stake in palm oil refining company PT Adhitya Seraya Korita from

Singapore company First Resources

Limited (SGX:EB5) for US$373 million. (June) Singapore company Aquilo House Pte. Ltd. acquired a

3.32% stake in Jaipur-based housing finance lender Aavas Financiers Limited

(NSEI:AAVAS) from Partners Group Private Equity (Master

Fund), LLC, a fund managed by Swiss private equity firm Partners

Group AG for US$51.11 million; and a 15.60% stake in Aavas Financiers Limited

(NSEI:AAVAS) from UK holding company Lake District Holdings

Limited for US$240.49 million. (June)

Singapore company Aquilo House Pte. Ltd. acquired a

3.32% stake in Jaipur-based housing finance lender Aavas Financiers Limited

(NSEI:AAVAS) from Partners Group Private Equity (Master

Fund), LLC, a fund managed by Swiss private equity firm Partners

Group AG for US$51.11 million; and a 15.60% stake in Aavas Financiers Limited

(NSEI:AAVAS) from UK holding company Lake District Holdings

Limited for US$240.49 million. (June)- Ahmedabad-headquartered electricity producer Adani Power Limited (NSEI:ADANIPOWER) acquired Mumbai-based power generation company Vidarbha Industries Power Limited for US$461.60 million. (July)

BPEA EQT Mid-Market Growth

Partnership fund managed by Swiss global private equity and venture

capital firm EQT AB (publ) (OM : EQT) acquired Maharashtrian home

loan provider Niwas Housing Finance

Private Limited from IndoStar Capital Finance Limited

(NSEI:INDOSTAR) for US$203.98 million. (July)

BPEA EQT Mid-Market Growth

Partnership fund managed by Swiss global private equity and venture

capital firm EQT AB (publ) (OM : EQT) acquired Maharashtrian home

loan provider Niwas Housing Finance

Private Limited from IndoStar Capital Finance Limited

(NSEI:INDOSTAR) for US$203.98 million. (July) Noida-based conglomerate Jubilant Bhartia Group acquired a

40% stake in Hindustan Coca-Cola

Beverages Private Limited from Atlanta, Georgia-based The

Coca-Cola Company (NYSE:KO) for US$1.38 billion. (July)

Noida-based conglomerate Jubilant Bhartia Group acquired a

40% stake in Hindustan Coca-Cola

Beverages Private Limited from Atlanta, Georgia-based The

Coca-Cola Company (NYSE:KO) for US$1.38 billion. (July)- Gurugram-based supply chain solutions provider Delhivery Limited (NSEI:DELHIVERY) acquired the remaining 21.12% stake in logistics company Ecom Express Limited for US$160.13 million. (July)

Singapore company PTTEP Joint Development SG PTE. LTD.

acquired Thailand-headquartered Hess

International Oil Corporation from Cayman Islands company

Hess Asia Holdings Inc and Hess (Bahamas) Limited for US$450

million. (July)

Singapore company PTTEP Joint Development SG PTE. LTD.

acquired Thailand-headquartered Hess

International Oil Corporation from Cayman Islands company

Hess Asia Holdings Inc and Hess (Bahamas) Limited for US$450

million. (July) Dutch partnership Renault Group

B.V. acquired a 51% stake in Renault

Nissan Automotive India Private Limited from

Japanese-headquartered Nissan Motor Co., Ltd. (TSE:7201) and Nissan

Overseas Investments B.V. for US$413.12 million, thus becoming its

sole owner. (August)

Dutch partnership Renault Group

B.V. acquired a 51% stake in Renault

Nissan Automotive India Private Limited from

Japanese-headquartered Nissan Motor Co., Ltd. (TSE:7201) and Nissan

Overseas Investments B.V. for US$413.12 million, thus becoming its

sole owner. (August)- Chennai-based agricultural company Coromandel International Limited (NSEI:COROMANDEL) acquired a 52.98% stake in Hyderabad-based agrochemical producer NACL Industries Limited (BSE:524709) from KLR Products Ltd for US$153.93 million. (August)

- Chandigarh-based pharmaceutical company Ind-Swift Laboratories Limited (NSEI:INDSWFTLAB) acquired Ind-Swift Limited (BSE:524652) for US$127.91 million. (August)

Philippine-headquartered Security Bank Corporation (PSE:SECB)

acquired a 25% stake in HC Consumer

Finance Philippines, Inc. from Japanese diversified bank

MUFG Bank, Ltd. for US$186.42 million. (May)

Philippine-headquartered Security Bank Corporation (PSE:SECB)

acquired a 25% stake in HC Consumer

Finance Philippines, Inc. from Japanese diversified bank

MUFG Bank, Ltd. for US$186.42 million. (May)- Singapore palm oil producer First Resources Limited (SGX:EB5) acquired a 91.17% stake in Indonsian oil palm plantation businesss PT Austindo Nusantara Jaya Tbk (IDX:ANJT) from PT Memimpin Dengan Nurani, PT Austindo Kencana Jaya, Sjakon George Tahija and George Santosa Tahija for US$476.12 million. (May)

- Hyderabad-based Suven Pharmaceuticals Limited (NSEI:SUVENPHAR) acquired contract development and management organization and API platform Cohance Lifesciences Limited for US$984.24 million. (May)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.