- within Corporate/Commercial Law topic(s)

- in United Kingdom

- with readers working within the Business & Consumer Services and Media & Information industries

- within Corporate/Commercial Law, International Law and Tax topic(s)

Why You Need a Polish Business Bank Account Right After Registration?

Once your company is registered in Poland, the next essential step is to open a bank account online or at a branch. Without a functioning corporate bank account, a company cannot legally operate:

- paying employee salaries,

- settling taxes with the Tax Office and ZUS,

- or receiving client payments becomes impossible.

Despite sounding simple, opening a bank account for foreign investors in Poland is complicated by strict anti-money laundering (AML) regulations. These rules require banks to perform a thorough KYC procedure (Know Your Client) before onboarding new clients.

Top Bank Account Providers in Poland

Poland hosts nearly 30 commercial banks.

The most prominent players for bank account business clients include:

- PKO Bank Polski

- Bank Pekao SA

- Santander Bank Polska

- ING Bank Śląski

- mBank

- BNP Paribas

- Bank Millennium

- Alior Bank

- Citi Handlowy

These major institutions offer full-service online banking platforms (with multilingual support), free checking account online options, and 24/7 customer service. While smaller banks also exist, their limited infrastructure and lesser familiarity with foreign clients can hinder account setup.

Modern Banking Options: Wise, N26, and Other Market Disruptors

Beyond commercial banks, services like Wise, N26, Monese, ZEN.com, and Skrill offer online multi-currency accounts. These may come with superior currency exchange rates but lack tools such as VAT white list registration and split-payment mechanisms.

Additionally, funds in these platforms are often not protected by Poland's Banking Guarantee Fund, making them riskier for business operations.

Step-by-Step Guide: Opening a Business Bank Account in Poland

Step 1: Choose How to Apply

You can apply for bank account online, in person at a bank branch, or by phone. Visiting a branch offers the fastest route but may not be practical for non-residents. Phone or online forms are convenient alternatives, though banks may later request document originals.

Step 2: Complete KYC and Submit Documents

Banks begin KYC verification immediately. This is mandatory for all foreign-owned companies. You'll be asked for:

- Company documents (e.g., Articles of Association, UBO declaration)

- Board member ID/passport copies

- Supporting documents for foreign shareholders

Expect questions about your business model, services, income sources, and projected turnover. Start-ups or companies from high-risk countries may face stricter checks or rejections.

Step 3: Wait for Compliance Decision

The bank's Compliance Department makes the final call. For non-residents, this decision is handled centrally. If rejected, there is no appeal, and banks typically do not explain the reasoning.

Step 4: Sign the Agreement

If approved, you'll be invited to sign the account agreement and related forms, such as signature cards. Most banks require an in-person visit, although a few allow signing through mobile apps with SMS authorization codes.

Step 5: Account Activation

Your business account is usually activated within 1–2 working days after signing. In some cases, activation may occur the same day.

How Long Does It Take to Open a Bank Account in Poland?

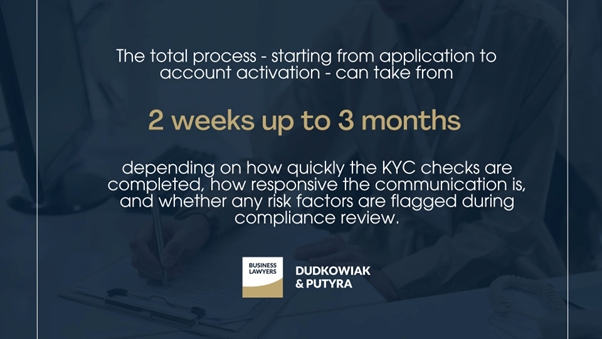

The total process - starting from application to account activation - can take from 2 weeks up to 3 months, depending on how quickly the KYC checks are completed, how responsive the communication is, and whether any risk factors are flagged during compliance review.

Once activated, it's crucial to notify the Tax Office so the account is added to the VAT white list. Payments over 15,000 PLN received into non-listed accounts may result in tax complications or shared liability between companies.

AML regulations remain in force even after activation. Banks may temporarily block transactions that appear suspicious, especially if they involve high-risk countries, until further justification is provided.

Need Legal Help Opening a Polish Business Account?

If you're navigating complex regulations and document requirements, an experienced legal partner can help you set up a bank account online or offline with precision and speed.

Contact our experts to start your process with confidence.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.