- within Wealth Management topic(s)

- with readers working within the Retail & Leisure industries

- within Wealth Management topic(s)

- with readers working within the Media & Information industries

- within Wealth Management, Insurance and Technology topic(s)

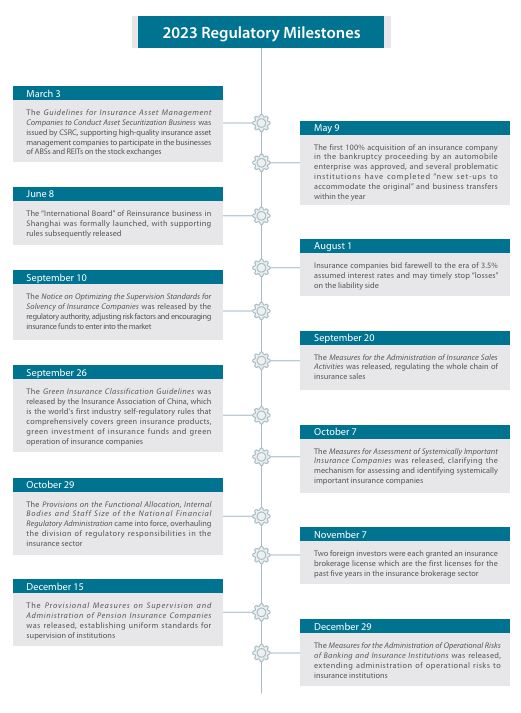

2023 REGULATORY MAINLINE REVIEW

New Asset and Wealth Management Institution Supervision Department established by NFRA for unified supervision of trust, wealth management and insurance asset management companies

With the overall reshaping of the top-level framework for financial regulation, there was also put in place a dedicated regulatory structure for the trust, wealth management, and insurance asset management sectors. The "Provisions on the Functions, Structure, and Staffing of the National Financial Regulatory Administration", released in November 2023, made significant changes to how asset management businesses were regulated. This took the form of a new Department called "Asset and Wealth Management Institution Supervision Department" under NFRA, which took over some of the functions of the previous Trust Department, Insurance Fund Operation Department and Innovation Department under the then CBIRC, and brought the trust companies, bank wealth management and insurance asset management companies all under a unified regulatory framework.

On December 27, 2023, the Asset and Wealth Management Institution Supervision Department published an article, emphasizing the attributes of the role of asset and wealth management as "entrusted by people, managing wealth on behalf of people". The article further clarified the regulatory direction and determination to "enhance the effectiveness of supervision, build first-class asset management institutions, and improve the quality and efficiency of service to the real economy". In effect, the establishment of the Asset and Wealth Management Institution Supervision Department unifies the supervisory standards of the trust, wealth management and insurance asset management sectors. The objective was to eliminate the arbitrage space due to the inconsistency of supervisory standards and, by having a unified set of regulations, bring about healthy competition within the sectors. The Asset and Wealth Management Institution Supervision Department was also charged with strengthening risk control and improving the efficiency of regulation.

These measures should help protect the legitimate rights and interests of investors, maintain the stability of the financial market and promote the development of the real economy.

The impact of the Asset and Wealth Management Institution Supervision Department on the development of the trust, wealth management and insurance asset management sectors is without doubt significant. These changes will help promote a much more efficient, well-regulated and safer investment environment, as well as acting as a good platform for China's asset and wealth management sectors to flourish.

An improved regulatory environment enabled the asset management sector to benefit the real economy

The role of the asset management sector to serve the real economy was underscored during 2023.

Private Equity

At the State Council's regular policy briefing in July 2023, Zhang Qingsong, vice-governor of the PBOC, proposed an expansion of funding by venture capital funds into start-ups and small enterprises. The State Council's "Opinions on the Implementation of Promoting the High-quality Development of Inclusive Finance", issued in October 2023, went further than this, calling for the "raising, investing, managing and withdrawing" of private equity and venture capital funds to be made more efficient, and encouraging the investment in start-ups, small businesses, science and technology, and agricultural enterprises, bringing regulations in line with commercial practice.

For example, at the beginning of the year, the revised "Measures for the Administration of the Privately Offered Asset Management Business of Securities and Futures Business Institutions" made changes to the regulations governing issues such as installment payments, the charging of expenses and private equity portfolio investments to re-focus private equity asset management in start-ups and small enterprises. In September 2023, the AMAC issued the "Private Investment Fund Filing Guideline No. 2 - Private Equity and Venture Capital Funds", which lowered the threshold for private equity funds to allow them to increase their fundraising, removing certain restrictions and facilitating debt-to-equity conversions of convertible bonds.

Asset-backed securities (ABS)

The benefits of the use of ABSs continued to be seen throughout 2023, with a greater range of ABS products. In June, the National Association of Financial Market Institutional Investors highlighted three products that could be of particular value: real estate trust asset-backed notes (interbank quasi-REITs), asset-backed commercial paper (ABCP), and covered bonds (CBs). The CSRC directed the stock exchanges to issue guidelines to support insurance asset management companies to carry out ABS and REITs business on the stock exchanges.

Real estate finance

In order to support the leasehold sector in the housing market, in February 2023, the PBOC and the NFRA solicited opinions on their consultation paper on this area. The objective is to encourage real estate leasing companies and professional asset management institutions to hold and operate leased housing for a long period of time through real estate investment trusts. In February 2023, the AMAC launched a pilot program for real estate private equity funds, with the twin objective of making it possible for private equity funds to diversity their assets and to make it easier for real estate leasing companies to access funds. In October 2023, the CSRC expanded the asset classes of the pilot REITs to include consumption-related infrastructure. All of these initiatives should help restore and revitalize the real estate sector.

Strengthening consumer protection in the finance sector

Protecting consumer interests in the financial sector was a key part of the Party and State institutional reform launched in March 2023. There was some institutional reform: the investor protection duties, which came within the CSRC, were transferred to the NFRA. The NFRA was tasked with overall financial consumer protection, financial consumer education and establishment of a unified financial consumer complaint and reporting process, among many other responsibilities.

There were also several policy initiatives, covering everything from the sale of financial products, information disclosure, and reporting of consumer complaints to dispute resolution. In September 2023, the NFRA issued the "Circular on the Further Standardization of Financial Product Advertisement and Endorsement Activity" to all supervisory bureaus, banks, insurance companies and other institutions. The circular set out standards regarding financial product advertising and endorsement activities, negative public opinion response plans, advertising partners, and product displays. The State Council's "Opinions on the Implementation of Promoting the High-quality Development of Inclusive Finance", issued in October 2023, called for the establishment of regulations to regulate the sale of financial products, the sales processes of financial institutions, complaints procedures and how financial disputes should be resolved. In December 2023, the NFRA issued "Doing a good job of '8+5+5+3' - asset management for a strong financial country in the 21st century", which called for a strengthening of consumer protection in all client groups, from high-net-worth clients through to ordinary clients. Various measures set out in the document included better information disclosure and timely handling of investor complaints.

Administrative enforcement (which is separate from judicial enforcement) was handed down in a number of instances during the year, both by the CBIRC and the CSRC. The types of misbehavior in relation to asset management institutions included the use of unlicensed salespeople, misleading sales, irregularities in management, failure to disclose and absence of internal controls within companies. Both institutions and the responsible people within them were sanctioned under the "dual-punishment system".

In December 2023, the Shanghai Financial Court publicized five typical private equity cases that the court had heard in recent years. The relevant cases reflect adequate protection of the legitimate rights and interests of private equity investors.

Trust sector regulation focused on a unified approach and on risk prevention and control

There was further refinement of the classification of trust businesses in 2023. At the beginning of the year, the then CBIRC issued the official version of the "Notice on Regulating the Classification of Trust Businesses of Trust Companies" (the "Trust Classification Notice"), which came into effect on June 1, 2023. Trust businesses were formally classified into three major categories: asset service trusts, asset management trusts, and charity trusts, broken down into 25 different types of business. The Trust Classification Notice marked the formal launch of the regulatory reshaping of the trust sector and set out a three-year transition period during which trust businesses have been given an opportunity to restructure to come in line with the new classifications.

The Trust Classification Notice was followed by the "Notice on Issues Concerning Regulating the Departments of Trust Companies in Other Places". This aimed to create a more cohesive sector, eliminating a series of issues arising from the off-site operation within the trusts sector. In November, the "Interim Measures for the Regulatory Rating and Tiered and Categorized Regulation of Trust Companies" issued by the NFRA set up five rating modules by which trust companies are assessed, including corporate governance, capital requirements, risk management, behavioral management and business transformation. The goal is to develop a better rating system and to bring about improved supervision by regulators of trust companies.

Regulators also addressed the pressing issue of risk disposal and management within the trust sector (as they have across the financial services sector generally). In the trust regulatory work conference held in February 2023, the then CBIRC said that the industry-wide target for risky asset disposal in 2023 would amount to RMB300 billion. The Report of the State Council on the Financial Work Situation published in October 2023 and the Sixth Central Financial Work Conference both emphasized the need to address and resolve risk in the financial sector, proposing to "resolutely fight the tough battle of preventing and resolving major risks" and "risk prevention and control should be considered as an eternal theme of financial work".

Disposing of risk for trust companies remains a challenge because of their legacy businesses. While many trust companies were able successfully to offload risk – including the equity restructuring of Huarong Trust, the renaming of Anxin Trust as Jianyuan Trust, the bankruptcy of Xinhua Trust and the preliminary steps to reorganize Sichuan Trust – progress on other fronts has been slower, especially those with real estate assets. This is bound to take time to resolve.

Private investment fund regulation was revamped in order to crack down on illegal behavior

2023 was a year that ushered in a comprehensive change in the regulation of China's private investment fund sector. In July 2023, the State Council issued the "Regulations on the Supervision and Administration of Private Investment Funds", which is the first administrative regulation of the private fund sector and is a significant milestone. The Regulations consolidated and reiterated the existing regulatory requirements of the CSRC, the AMAC and other institutions so far as they related to private funds, brought the regulatory authority of private funds within the purview of the CSRC, and set out the punishments for those found to be in violation of the laws and regulations. In December 2023, the CSRC issued a consultation paper on the "Supervision and Administration Measures for Private Investment Funds" to seek public opinions. The document in effect refined previous documents. There were other important documents issued by the AMAC, including: the "Measures for the Registration and Filing of Private Investment Funds" and the supporting guidelines; the "List of Application Materials for the Registration of Private Fund Managers (Revised in 2023) "; the "Guidelines for the Operation of Private Securities Investment Funds (Consultation Paper) "; the "Guidelines for Handling the Loss of Connection of Private Fund Managers"; and the "Guidelines for Filing of Private Investment Funds".

The above series of regulatory rules reflected the implementation of differentiated supervision of different types of private funds and further improvement of the regulatory supervision of the private fund sector. All of this should lead to the healthy and stable development of the private fund sector.

As part of the process of tighter supervision, there was greater enforcement against private fund companies in breach of the laws and regulations. In December, the CSRC Shanghai branch released details of five typical cases of administrative violation. Also in December, the Supreme People's Procuratorate and the Supreme People's Court jointly issued the "Typical Cases of Stringent Combating of Private Fund Crimes According to Law", spelling out common and frequent crimes in the field of private funds such as illegal taking of public deposits, fundraising frauds, misappropriation of assets, and bribery. These cases also delineated a "red line" and a "bottom line" for the practitioners in the private fund sector, to make sure they operate to the highest standards.

Buy-side reform benefited the public fund sector and helped to boost market activity

As one of the key measures for the reform of the investment side of the capital markets, on July 7, 2023, the CSRC issued and implemented the "Work Plan for the Fee Rate Reform of Public Fund Industry", which started the process of reforms to fee rates and charging in connection with public funds. The CSRC looked to achieve 15 steps over a period of two years to address the range of fees, including management fees, transaction fees and sales fees, and to steadily reduce the fees being charged. In the first phase, the CSRC targeted management fees and custody fees, and launched the first batch of 20 floating fee rate pilot products. This process was deemed to be successful.

On December 8, 2023, the CSRC sought opinions from the public on its consultation paper, the "Provisions on Strengthening the Management of Securities Transactions of Publicly Offered Securities Investment Funds" – thus launching the second phase of fee rate reform. The main contents of the consultation paper included proposals to lower the commission rates on securities transactions carried out by public funds.

These changes effectively helped to reduce the costs to investors of investing in public funds. They also had the result of encouraging asset management companies to improve their research and development capabilities, to invest more in equities and generally to bring about a more settled public funds sector.

On September 12, 2023, the CSRC issued the "Circular on Matters Relating to Further Optimization of Securities Trading Models of Public Fund Managers", which allowed for the fact that smaller and medium-sized asset managers trading in public funds might be disadvantaged through the lower fees they could charge. The Circular suggested that these asset managers might have greater flexibility and should have lower operating costs.

The CSRC proposed reducing the registration conditions for index funds, suggesting to heads of public fund management companies that they issue more public funds comprising equities and broaden the investment scope and strategy of public funds. The CSRC also proposed supporting the National Social Security Fund, the Basic Pension Fund, and the Annuity Fund, expanding the scope of investments in the capital markets, and creating a policy environment conducive to the entry of medium- and long-term funds into the market.

By supporting the investment side of the market, the reforms are intended to draw on the advantages of the asset management sector and boost investor confidence, thus further stimulating the capital markets.

Pension finance became one of the five "significant sectors" and a key part of wealth management

Pension finance was formally listed as one of the five significant sectors at the Central Financial Work Conference in October 2023. What this means is that pension finance is seen as one of the key areas of wealth management.

Policies developments

The NFRA issued a series of documents relating to pension insurance at the end of 2023. First, the release of the "Interim Measures for the Supervision and Administration of Pension Companies" filled a regulatory gap that existed, meaning that there was no specialized supervisory regulations for pension insurance companies. The Measures set out applicable regulatory requirements for pension insurance companies in terms of asset management, business scope, and risk control, among others, which provided clear guidance on how pension insurance companies should focus on their main business. Secondly, the "Notice on Matters Concerning Promoting the Development of Exclusive Commercial Pension Insurance" was another step in creating a multi-level and multi-pillar pension insurance system; and the "Notice on Relevant Matters Concerning the Transition from the Pilot Program of Individual Tax-Deferred Commercial Pension Insurance into Private Pensions" provides more incentives for individuals to participate in privately run pension plans by offering tax inducements.

Market developments

As personal pension schemes have gradually been introduced, these has encouraged a range of businesses to enter the market, including insurance companies, securities companies, banks and trust companies, who have launched a range of personal pension products. As of December 31, 2023, there were 50 personal pension fund sales institutions, including 19 commercial banks, 24 securities companies and seven independent fund sales institutions. There were 178 personal pension products, 49 more than existed in 2022.

So far as pension finance was concerned, at the beginning of 2023, the Banking Wealth Management Registration and Depository Center issued the "Implementation Measures for the Management of the Industry Information Platform for Personal Pension Financial Products (for Trial Implementation) " and the "Notice on the Formal Implementation of the Information Reporting of Personal Pension Investment Financial Products", which explicitly required commercial banks and wealth management companies selling personal pension investment financial products to use a dedicated financial management industry platform. As of the end of 2023, six wealth management companies had issued 23 personal pension financial products.

With the support of policies and active participation of market players, there has been an appreciable growth in the market of pension products.

Steady progress in opening up the wealth management sector with several policies favoring cross-border collaboration

In 2023, the asset management and wealth management sector continue to make steady progress. A number of foreign-funded institutions successfully started their business in China. For example, BNP Paribas Agribank Wealth Management Co. Ltd. (法巴农银理财有限责任公司) opened in June, becoming the fifth joint venture wealth management company in China. The CSRC approved the establishment of Schroders Fund (施罗德基金), Allianz Fund (安联基金) and Lianbo Fund (联博基金), which are wholly owned by foreign investors, and also approved the 100% control by JPMorgan Asset Management Holdings Inc. over China International Fund Management Co., Ltd. (上投摩根基金) and the 100% control by Morgan Stanley over Morgan Stanley Huaxin Fund Management Company Limited.

Opening-up favorable policies

Favorable policies conducive to the entry of foreign capital into China's asset management market and facilitating cross-border cooperation were also introduced. In August 2023, the CSRC updated the service guide for administrative licensing matters regarding the approval of the establishment of public fund management companies, and shortened the time that it would take for public fund management companies to set up in business (to 120 days).

In addition, local favorable policies for the opening up of the asset management sector are frequently issued. These included "Several Opinions on Accelerating the Construction of the Core Functional Area of the Global Asset Management Center in Lujiazui Financial City of Pudong New Area". The Shanghai Pudong New Area passed policies to make Pudong a global asset management center to attract institutional investors and asset management institutions from all over the world and encourage the world's top asset management service companies to base themselves in Pudong; Shenzhen released the "Shenzhen Local Financial Supervision Bureau on Accelerating the Construction of Shenzhen International Wealth Management Center's Opinions", which seeks to attract up to 300 wealth management companies to the Shenzhen International Wealth Management Center before end of 2025, including Qualified Foreign Limited Partners (QFLPs), Qualified Domestic Investors Overseas Investment (QDIE), and Wholly Foreign-Owned Private Equity Institutions.

Other initiatives also have ambitious objectives. The "Opinions on Financial Support for Comprehensively Deepening Reform and Opening Up of Qianhai Shenzhen-Hong Kong Modern Service Industry Cooperation Zone" have the goal of allowing Hong Kong private banks and family wealth management companies and Hong Kong asset management companies to set up joint venture wealth management companies in the Qianhai Cooperation Zone.

As can be seen, China is very keen to open up its asset management and wealth management sector and to attract high-quality foreign institutions.

Cross-border cooperation

Two years after the launch of the Cross-border Wealth Management Connect pilot, the regulators have refined the rules to optimize the conditions for investor access, including securities companies in the scope of participating institutions, expanding the scope of qualified investment products for "Southbound Connect" and "Northbound Connect", and increase the quota for individual investors, among other measures, all intended to facilitate the interconnection of the wealth management sector in Guangdong, Hong Kong and Macao Bay Area. The Northbound Swap Connect was officially launched in May 2023, allowing overseas investors from the different countries and regions to participate in the Mainland interbank derivatives market.

2024 REGULATORY OUTLOOK

The Trust Law is expected to be revised alongside with asset management being characterized as a trust structure

Since the release of the Minutes of the National Courts' Civil and Commercial Trial Work Conference (the "Minutes") in 2019, there have been definite moves to designate asset management businesses as a trust relationship. The Minutes set out requirements for asset management companies, such as the prohibition of rigid payment, fiduciary obligations of managers, and the prohibition of capital pooling, all of which are line with the principles of the Trust Law. In particular, after the establishment of the Asset and Wealth Management Institution Supervision Department (see above), wealth management, trust and insurance asset management have been unified into the same institution for supervision, emphasizing the role of the institution of "entrusted by people, managing wealth on behalf of people".

The Trust Law has been in force for more than 20 years since its promulgation in 2001, and some of its provisions have not kept pace with changing business requirements. In October 2023, PBOC Governor Pan Gongsheng mentioned in the State Council's report on the status of the financial work that one of the priorities of the financial work in the next step is to strengthen the financial legal system, specifically mentioning the plan of revising the Trust Law. We can therefore expect to see the Trust Law revised in 2024 and we expect the revision of the Trust Law will focus on the following aspects: first, refining the obligations of trustees, distinguishing between active management and administrative management types of trust business, and stipulating the duties of trustees in various business segments; second, in the context of the transformation of the three classifications of business in the trust sector, the Trust Law is likely to improve the trust property registration process and offer preferential tax policies for public welfare trusts. This will enable trust organizations to carry out non-cash asset management trusts, asset service trusts and public charity trusts.

Common regulatory standards for wealth, trust and insurance asset management will better protect wealth management customers

The establishment of the Asset and Wealth Management Institution Supervision Department means that the supervision of the asset management sector has become more centralized and unified. We expect that, in 2024, the unified regulatory rules for the three types of institutions may be issued, which will gradually align the regulatory standards of trust, wealth management and insurance asset management institutions in terms of institutional access and business. As for insurance asset management organizations, they will gradually develop to manage insurance funds for individual investors, enabling them to further enhance their asset management and wealth management capabilities. All financial consumers will benefit from legal protection, from very high net worth individuals to those who have very small investments. We expect that, under the new regulatory structure, generally applicable financial consumer protection rules for the three types of institutions will be introduced, covering matters such as customer suitability and information disclosure.

Transformation of trust business still progressing, boosted by innovative new opportunities

With the implementation of the Trust Classification Notice (see above), the future development of trust companies will have clear norms to follow. In the process of business transformation, asset management trusts will be an important area for regulators. There will be new opportunities for public welfare charity trusts. In particular, the amendment to the Charity Law passed at the end of 2023 has improved the chapter on charity trusts, stipulating that individuals, legal persons and unincorporated organizations will enjoy tax incentives when they set up charity trusts to carry out charitable activities. This initiative should play a positive role in promoting charity trusts in the future. We expect the "Measures for the Administration of Trust Companies (the "Measures") " to be revised in 2024. We expect that the newly revised Measures will echo the requirements of the Trust Classification Notice, emphasizing the legal obligations of trustees and spelling out prohibited acts in trust business. The new Measures are also likely to strengthen the regulatory requirements on risk management and internal controls adopted by trust companies, while guarding against undue interference by shareholders.

"Survival of the fittest" continues to drive the goals of regulators in supporting the high-quality development of the private fund sector

In the coming year, we expect more consultation papers, including the "Measures for the Supervision and Administration of Private Investment Funds" and the "Guidelines for the Operation of Private Securities Investment Funds", will be issued to round up the system of rules for the supervision and administration of private funds.

Only the fittest and best private fund managers will survive – that is the intention of the regulators and the desired outcome of new regulatory rules. The private fund sector will also benefit from the introduction in early 2023 of the registration system for capital markets. Private securities investment companies will have more scope for the businesses in which they invest. Those with specializations may be able to capitalize on gaining market share. Exit channels will become more open for private equity investment companies. As a result of the narrowing of the valuation premium between the primary and second markets, which means there is less incentive to have short-term gains, private equity investment companies will look for longer-term gains, requiring them to be better informed about companies' longer-term prospects.

In 2023, Beijing, Shanghai, Guangzhou, Jiangsu, Zhejiang and other more developed private equity investment regions introduced policies to support the local private equity investment sector. We believe that in 2024, these and other localities will continue to introduce policies to refine the regulatory rules governing private equity investment funds. Supportive policies will include guiding investment into start-ups, small, and science-and-technology enterprises, encouraging the use of bank wealth management funds, corporate annuities and pensions, piloting the allocation of shares in kind for equity investment funds, extending the pilot of Qualified Foreign Limited Partners (QFLPs), and supporting equity investment fund managers to improve their professional expertise.

Further development of the financial infrastructure of the asset management/wealth management sector

In 2023, there were significant developments in the financial regulatory structures covering both the public fund sector and personal pension financial products. On February 10, 2023, to implement the "Opinions of the China Securities Regulatory Commission on Accelerating the High-Quality Development of the Public Fund Industry", the CSRC agreed the public trial operation of the "Fund E-Account" (基金E账户) App, which provided individual investors with a "one-stop" enquiry service for public fund accounts. On January 20, 2023, the Banking Industry Financial Management Registration and Custody Center issued the "Implementation Measures for the Management of the Industry Information Platform for Personal Pension Financial Products (for Trial Implementation) ", specifying which information needed to be made publicly available in respect of personal pension wealth management products.

At the same time, improvements to the financial infrastructure were included in national financial policy objectives. The State Council's "Opinions on the Implementation of Promoting the High-quality Development of Inclusive Finance", issued in October 2023, identified new improvements in financial infrastructure as one of the main objectives of promoting the high-quality development of inclusive finance over the next five years. The State Council's report on the status of financial work, issued in October 2023, also pointed out that it is necessary to strengthen financial infrastructure and promote integrated regulatory supervision over all aspects of financial assets, including registration and depository, clearing and settlement, trading facilities, and transaction reporting.

We expect that the structures of the asset management/wealth management sector will be further improved with policy support in 2024. The "Fund E-Account" (基金E账户) is expected to move from being a trial operation to becoming officially operational and there will be one platform set up which will contain all information relating to public funds.

We believe that more and more industries will launch corresponding information platforms to make it easier for investors to access information about their accounts, share dealings, transactions and other investment and financial information. In addition, we expect financial institutions to improve barrier-free service facilities for special groups such as older persons so that they can have access to financial services.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.