China's regulatory system of anti-money laundering ("AML") and combating the financing of terrorism ("CFT") aims to secure national security and maintain the stability of the financial market. In 2019, the Financial Action Task Force ("FATF") published the fourth-round mutual evaluation report on mainland China, showing gaps in meeting the FATF standards. Since then, the country has made great efforts and progress in strengthening its AML/CFT system. Key developments and trends include:

1. Compliance with international standards

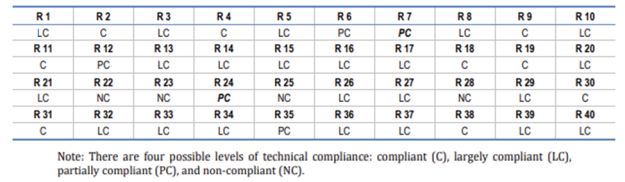

China has made further steps to close gaps towards the FATF standards. By November 2022, China was compliant or largely compliant on 31 out of 40 FATF Recommendations, as shown in Figure 1 compared with 22 in the 2019 FATF Mutual Evaluation.

FIGURE 1: Technical compliance ratings of FATF Recommendations

Reference: 2022 FATF 3rd Enhanced Follow-up Report &

Technical Compliance Re-Rating.

China is expected to enhance areas of non-compliant or partially compliant recommendations over the coming years. These include:

- preventive measures related to politically exposed persons (R.12),

- targeted financial sanctions related to terrorism and terrorist financing, as well as proliferation (R.6, R.7),

- regulation and measures of Designated non-financial Businesses and Professions ("DNFBPs") (R.22, R.23, R.28),

- transparency and beneficial ownership of legal persons (R.24) and arrangements (R.25), and

- powers and responsibilities of competent authorities and other institutional measures related to sanctions (R.35)

2. Intensifying supervisory and enforcement activities

The People's Bank of China ("PBoC") recently published its China Anti-Money Laundering Report 2021. The statistics show increased supervisory and enforcement activities.

As shown in Figure 2, PBoC conducted 2,391 interviews and 6,679 site visits throughout 2021. Both numbers are higher compared with 2017, indicating the continuous supervisory effort of the regulator despite the pandemic interruption.

FIGURE 2: AML supervisory activities by PBoC in 2017 and 2021

Reference: PBoC Anti-Money Laundering Reports of 2017

and 2021.

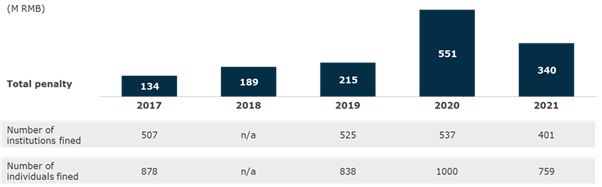

Figure 3 illustrates the AML enforcement actions taken by PBoC. In 2021, the numbers of institutions and individuals punished were 401 and 759 respectively, lower than the corresponding figures in 2017. Yet, the total fines in the respective periods increased by 154%, up to RMB 340 million. The average fine per case increased significantly. Even though there was a drop in the total penalties in 2021 on a year-over-year comparison, we believe the overall upward trend is likely to continue.

FIGURE 3: AML enforcement actions by PBoC from 2017 to 2021

Reference: PBoC Anti-Money Laundering Reports of 2017, 2018,

2019,

2020

and 2021.

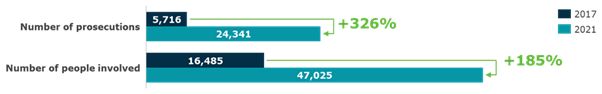

China in the past has tended to focus on prosecuting upstream crimes rather than money laundering offences. This seems to be shifting as demonstrated in Figure 4. In 2021, over 24,000 cases of money laundering-related crime were prosecuted, involving approximately 47,000 individuals. The case amount is over four times the corresponding figure in 2017.

FIGURE 4: Prosecution of money laundering-related crime in 2017 and 2021

Reference: PBoC Anti-Money Laundering Reports of 2017

and 2021.

3. Development of AML laws and regulations

In recent years, several AML laws and regulations were promulgated and released for trial or comments. The revision of the "Anti-Money Laundering Law of the People's Republic of China" has been ongoing since 2021. The new version is expected to set the cornerstone for a modern and risk-based AML/CFT approach and to define related rights and obligations of the broader society beyond financial institutions. The "Measures for the Supervision and Administration of Anti-Money Laundering and Counter-Terrorist Financing of Financial Institutions" and the "Guidelines for the Self-Assessment of Money Laundering and Terrorist Financing Risks by Corporate Financial Institutions" further specify regulators' expectations for AML-related internal control and risk assessment, while extending the scope of the compliance monitoring to cover CFT as well.

Apart from improving fundamental AML/CFT laws and regulations, China's regulators have also advanced guidelines on several specific topics or areas, such as customer due diligence, AML in cross-border transactions and securities trading. In particular, China banned all cryptocurrency trading and transactions in late 2021.

The revisions to China's AML law are expected to be finalized soon, and the regulators will likely promulgate more supplementary guidelines to further align with FATF Recommendations.

4. Enhanced interdepartmental and international cooperation

China's AML system is multidimensional and requires the mutual effort of regulators within and across the border. Over 20 departments are members of the Inter-Ministerial Joint Conference on AML. Led by PBoC, the departments work together on AML laws, regulations, measures, and actions. Internationally, China has established cooperation with 60 overseas financial intelligence agencies, sending and receiving AML-related intel.

The enhanced cooperation has assisted with the maturing of China's AML system and will likely become part of the system itself.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.