- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- within Criminal Law, Immigration and Cannabis & Hemp topic(s)

Goodwin is presenting a two-part publication series covering life sciences trends involving license deals, M&A, and financing for Greater China's life sciences sector. See the first post in the series here.

2023 and 2024 (Through End of Q3) China Life Sciences (Pharmaceutical/Biotech) M&A Deal Highlights

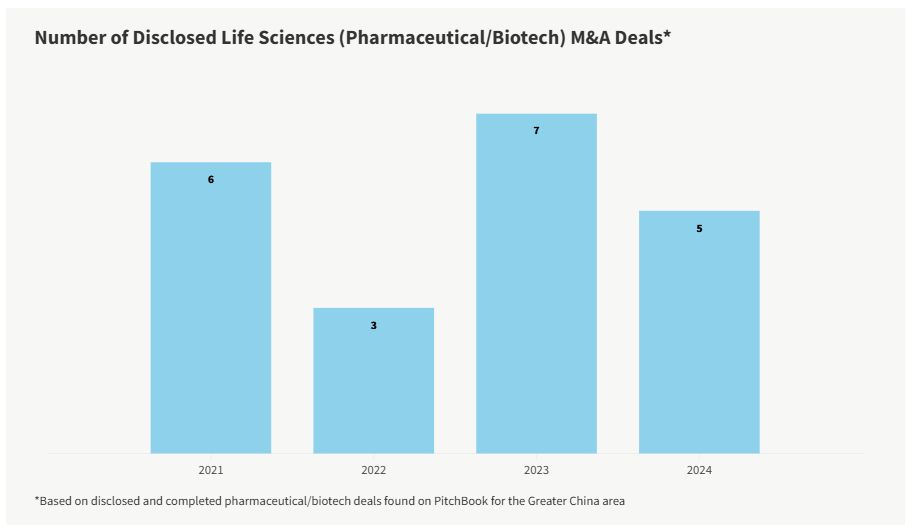

While the overall Chinese M&A market fluctuated from 2021 to 2023 due to the pandemic and other factors, the life sciences pharmaceutical and biotech market remained relatively stable. Though the number of deals dipped in 2022, in 2023, it quickly recovered to 2021 levels. Through the end of third-quarter 2024, the deal count is trending similar to 2023's count with one quarter left to go. Notably, there are 10 deals that have been announced or are in progress but have yet to be completed.

A snapshot of notable deals from the 2024 (through end of Q3) Greater China life sciences pharmaceutical/biotech M&A deal landscape

|

Notable 2024 (Through End of Q3) Life Sciences (Pharmaceutical/ Biotech) M&A Deals* |

|||||

|

Acquiree/seller |

Acquirer/purchaser |

Asset(s) |

Deal value |

Date announced |

|

|

Shanghai Henlius Biotech |

Fosun Pharma |

Antibody |

$1.71 billion |

June 24, 2024 |

|

|

Proteologix, Inc.** |

Johnson & Johnson |

Antibody |

$850 million |

May 16, 2024 |

|

|

CP Pharmaceutical (Qingdao) |

Qingdao Guoxin Development (Group) |

Small molecule |

$253 million |

February 6, 2024 |

|

|

Green Cross Hong Kong Holdings |

Boya Bio-Pharmaceutical Group |

Antibody |

$251 million |

July 17, 2024 |

|

|

SanReno Therapeutics |

Novartis |

Antibody |

Undisclosed |

January 5, 2024 |

|

*Based on pharmaceutical/biotech deals found on PitchBook

for the Greater China area.

**Johnson & Johnson acquired Proteologix, Inc., from Pharmaron

Beijing Co., Ltd and other shareholders. Pharmaron Beijing Co.,

Ltd., is a Chinese company.

Goodwin represented Proteologix, Inc., in its acquisition by Johnson & Johnson

On June 21, 2024, counseled by Goodwin's Life Sciences team, Proteologix, Inc., a privately held biotechnology company that specializes in providing therapeutics for patients with immune-mediated diseases, was successfully acquired by Johnson & Johnson (J&J) (NYSE: JNJ) for $850 million in cash, with the possibility of an extra milestone payment. One of the drivers of the acquisition was two key bispecific antibodies: PX128, which targets IL-13 plus TSLP and is set to enter Phase 1 testing for moderate to severe atopic dermatitis (AD), also known as eczema, and moderate to severe asthma; and PX130, which targets IL-13 plus IL-22, and is in preclinical development for moderate to severe AD.

Henlius-Fosun deal

On June 25, 2024, Fosun Pharma (Fosun) announced its plan to buy out Shanghai Henlius Biotech (Henlius), a biopharmaceutical company, for $1.71 billion. Henlius's focus on innovative drugs likely drove Fosun's desire to acquire the biopharmaceutical company and diversify Fosun's offerings. Of Henlius's innovations, it developed drugs such as the first China-developed biosimilars, HANQUYOU (trastuzumab) and HANSIZHUANG (serplulimab), the latter of which is a novel monoclonal antibody (mAb) that targets the programmed cell death protein (PD-1) as the initial treatment used for patients with small-cell lung cancer. Notably, Fosun plans to take Henlius private from the Hong Kong Stock Exchange.

SanReno-Novartis deal

In January 2024, Novartis, a global medicines company, acquired SanReno Therapeutics (SanReno) for an undisclosed amount. SanReno is a clinical-stage company that specializes in the development and innovation of novel treatments for kidney disease. Although SanReno was established only in late 2021, it quickly became a noteworthy player in China's pharmaceutical space due to its exclusive licenses in Greater China to the assets atrasentan and zigakibart. These two drugs are used to treat immunoglobulin A (IgA) nephropathy, a specific type of kidney disease characterized by the buildup of immunoglobulin antibodies in the kidney. This deal is one of the few acquisitions through which a multinational pharmaceutical corporation acquired a Chinese biotech company.

A snapshot of notable deals from the 2023 Greater China life sciences pharmaceutical/biotech M&A deal landscape

|

Notable 2024 (Through End of Q3) Life Sciences (Pharmaceutical/ Biotech) M&A Deals* |

|||||

|

Acquiree/seller |

Acquirer/purchaser |

Asset(s) |

Deal value |

Date announced |

|

|

AstraZeneca |

Gracell |

CAR-T |

$1.2 billion |

December 2023 |

|

|

Jiangxi Zhenshiming Pharmaceutical |

Undisclosed |

Small molecule |

$520 million |

March 2023 |

|

|

Lanzhou Foci Pharmaceutical |

Gansu Provincial (state-owned assets investment group) |

Small molecule |

$270 million |

November 2023 |

|

|

F-Star Therapeutics, Inc. |

invoX Pharma |

Antibody |

$161 million |

March 2023 |

|

|

Bristol Myers Squibb** |

LianBio |

Small molecule |

$360 million |

October 2023 |

|

*Based on disclosed pharmaceutical deals found on PitchBook

for the Greater China area.

**The Bristol Myers-LianBio deal is a termination of license deal

but functions like an asset acquisition.

AstraZeneca-Gracell deal

The largest disclosed China life sciences deal of 2023 was the AstraZeneca-Gracell deal. AstraZeneca entered into an agreement to acquire Gracell Biotechnologies (Gracell), a Chinese clinical-stage biopharmaceutical company, for $1.2 billion. AstraZeneca, an Anglo-Swedish pharmaceutical company, hopes to further its cell therapy goals through this acquisition. Specifically, this merger will add GC012F, a CAR-T therapy that targets both 19 (CD19) and B-cell maturation antigen (BCMA), to AstraZeneca's pipeline. GC012F is currently in its clinical stage and is being studied as a treatment for myeloma, autoimmune disorders such as systemic lupus erythematosus, and other hematological malignancies.

The next section will further discuss CAR-T cell-therapy's significance in the Chinese life sciences market.

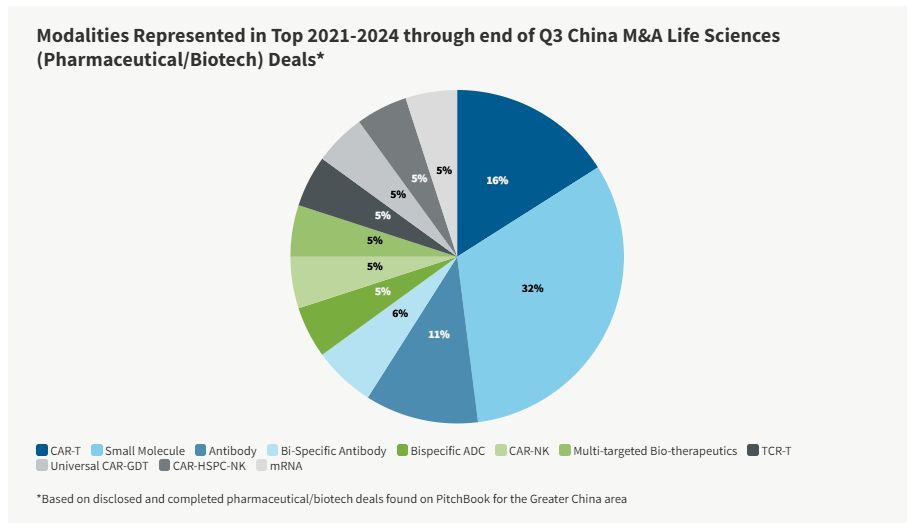

Trends in Modalities

From 2021 to 2023, small molecules were a prevalent modality present in China life sciences M&A deals. There may be a number of reasons for this: small molecules are generally smaller and simpler in structure, easier to design and develop, and subsequently more predictable. Despite small molecule's strong presence, CAR-T cell therapies have gained significant popularity in recent years. First, many regard CAR-T therapies as a revolutionary approach to cancer treatment. Second, the CAR-T cell-therapy market is expected to reach $35.9 million globally by 2032. Third, China currently leads the CAR-T therapy space in terms of clinical trials. Notably, of all CAR-T clinical trials, China conducts half of them — double the number of trials currently conducted in America. Therefore, CAR-T cell therapies may continue to grow their presence in Chinese life sciences M&A deals.

Through the end of third-quarter 2024, there have been a number of China life sciences M&A deals in the large molecule/biologics modality. Both the Proteologix-J&J (bispecific antibodies) and Henlius-Fosun Pharma (PD-1 antibody and HER2 biosimilar) M&A deals involved large molecule/biologics. The growth of the China biologics market continues to outpace the growth of the global biologics market, driven by increased investment in biologics research, improvements in biotechnology, increasing affordability of biologics drugs, favorable government policies, and demand for therapeutics for unmet needs, including oncology and autoimmune diseases. Given these trends, large molecule/biologics may continue to drive Chinese life sciences M&A deals.

Notable Trends in Medical Device and General Life Sciences Companies

|

Notable 2023 Medical Device-Focused M&A Deals* |

||||

|

Acquiree/seller |

Acquirer/purchaser |

Asset(s) |

Deal value |

Date announced |

|

BMX Holdco |

Suzhou Basecare Medical Corporation Ltd. |

Medical devices |

$40 million |

May 2023 |

|

Diasys Diagnostic Systems (Shanghai) |

Shenzhen Mindray Bio-Medical Electronics |

Medical devices (in vitro Diagnostics) |

$159 million |

December 2023 |

|

Casstar Medical Technology Wuxi |

Genertec Universal Medical Technology Services (Tianjin) |

Medical devices |

$64.9 million |

August 2023 |

*Based on disclosed, completed, and medical device-focused M&A deals found on PitchBook for the Greater China area.

While the primary emphasis of this article has been on pharmaceutical/biotech M&A deals and modalities, it is important to also note the significance of medical device companies in China's M&A market. Since 2015, the Chinese medical device market has grown significantly. In fact, statistics suggest that China's medical device revenue will expand by an annual growth rate of 8.3% (CAGR 2024-28), reaching $50.04 billion by 2028. Given these trends, the industry can expect to see continued medical device deals in the 2025 Greater China M&A landscape.

Drivers of Growth and Recovery in China's Life Sciences M&A Market

The return of M&A deal activity in the life sciences industry in China in 2023 to 2021 levels can be attributed to three factors: the maturing of companies funded by early investments made in 2015 and 2016, the deceleration in the global life sciences IPO market in 2022, and market challenges readjusting valuations. In 2015 and 2016, China introduced several major regulatory changes that significantly shortened the registration, review, and approval time for new drugs, propelling the life sciences industry to shift from being mere followers to becoming innovators. Combined with the 2016 introduction of the Healthy China 2030 plan (《健康中国2030》), and supported by the influx of talent returning from overseas, China experienced a boom in formation of companies focused on innovator drugs and innovative technologies between 2016 and 2021.

Founded in 2017, Gracell is one such company born from these early investments in the life sciences industry. Capitalizing on the FDA's approval of the first CAR-T cell therapy in the United States in 2017, Gracell developed innovative technology platforms designed to significantly reduce the manufacturing time and cost for autologous products while also paving the way for allogeneic products that can be administered "off the shelf." Given the growing demand for CAR-T therapy, Gracell quickly attracted investors and completed three rounds of financing between 2018 and 2020. As Gracell and other similar companies matured, early investors began seeking exit opportunities to realize returns on their investments.

Although Gracell had a successful IPO exit on NASDAQ in 2021, companies that did not exit during the peak of IPO now face the pressure to return in an increasingly competitive market. The negotiation of China's National Reimbursement Drug List (《中国国家报销药品目录》) significantly diluted the market price of drugs, and regulations prohibiting the listing of preprofit companies on public exchanges foreclosed a once-viable exit path for companies that have yet to reach profitability. Difficult market conditions in 2022 through 2024 in private capital markets also contributed to the reduction in valuations of Chinese pharmaceutical/biotech companies. As such, companies are turning to M&A as an alternative.1

Looking Ahead

We anticipate continued recovery for the market. Specifically, we expect further investments in companies with buzzworthy modalities such as CAR-T cell therapy and bispecific antibodies. That said, China's life sciences market and regulatory system is rapidly developing. With a decline in late-stage financing and a lackluster IPO market, M&A is likely to remain a viable exit strategy. However, given the lack of capital circulation, the recovery of China's M&A market may not mirror the steady growth seen globally.

Footnote

1 For more discussion on licensing trends in this sector, please visit Major Life Sciences Licensing Deal Trends in China in 2023.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.