- within International Law topic(s)

- in Ireland

- within International Law, Strategy, Government and Public Sector topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Oil & Gas and Telecomms industries

Last week, the Federal Resources Minister, Madeleine King, led a roundtable with Australian state and territory resources ministers on, among other things, supporting Australia's minerals industry, amidst the Federal Government's current industry consultations on a promised Critical Minerals Strategic Reserve.1 Such a reserve is just one initiative within a broader context of sustained policy focus on critical minerals in many countries. Particularly over the past couple of years, this has started to translate into actions with significant impacts on global markets and supply chains. Major financial incentives, State-backed projects, tightened investment and export rules and conscious cross-jurisdictional collaborations are shaping a dynamic environment in this emerging sector, including M&A and equity capital raising opportunities.

In our last KWM insight, we charted Australia's accelerated drive through 2024 towards supporting investment in the critical minerals lifecycle, including importantly downstream processing. These initiatives included the proposed A$7 billion Critical Minerals Production Tax Incentive aimed at supporting the processing sector, new Federal grants totalling A$21 million for projects in vanadium, graphite, and rare earths, and a significant A$475 million commitment to Iluka Resources' Eneabba Rare Earths Refinery project in Western Australia.

Tell me in 2 minutes

Key themes in this year's activity are:

Downstream processing: A rapid escalation in downstream processing capability is the fundamental focus.

- Emphasis on processing projects approved by the European Union

- US Executive Order expediting Federal red tape for critical minerals production projects, including mining, processing, refining and smelting

- Australia's Critical Minerals Production Tax Incentive is now law

Cross-border: The focus is cross-boundary - countries are investigating their critical minerals supply chains and are engaging in cross-jurisdictional investment in critical minerals projects.

- Treatment of critical minerals in US tariffs

- Global distribution of projects approved by the European Union

Funding initiatives: There is increased, earmarked public funding for projects and government policies and support for the critical minerals industry, such as stockpiling policies, price floors and offtake agreements.

- 10 year price floor guarantee for MP Materials' rare earths project and US purchase commitments for magnets

- USD$1 billion investment package for critical minerals supply chain

- European Union's new Stockpiling Strategy

- Australia's prospective Critical Minerals Strategic Reserve

- Canada's Federal funding for Critical Mineral Infrastructure and proposed extension of Mineral Exploration Tax Credit

Rare earths: Rare earth elements are a key policy focus due to their highly vulnerable and 'more' critical nature.

- US Department of Defense and MP Materials public-private partnership – MP Materials operates the only significant US rare earths mine and processing plant

- 7 of the projects approved by the European Union related to rare earth elements

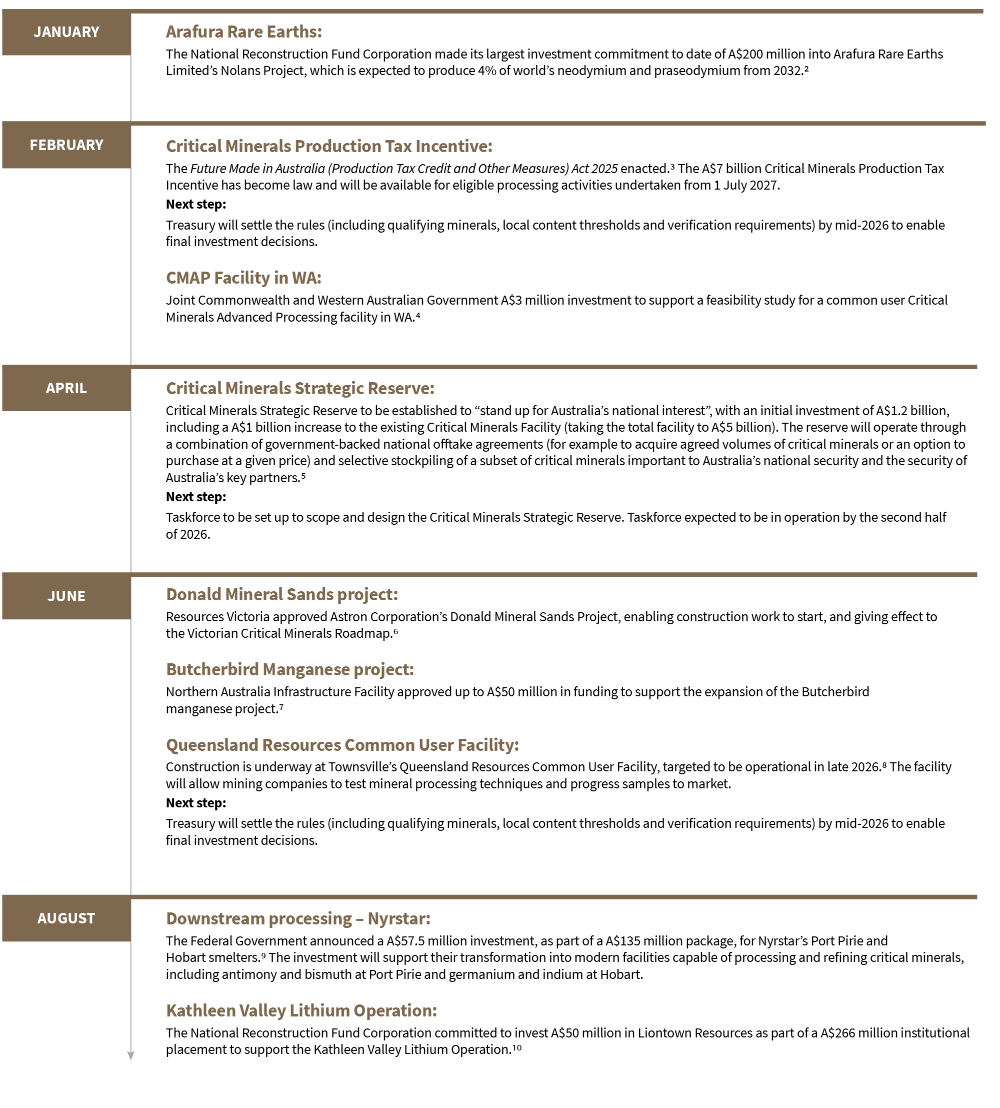

Australia snapshot: tax incentives for processes, a strategic reserve and projects investments

In 2025 to date, Australia has continued its policy support for investment in critical minerals including processing. Key developments include:

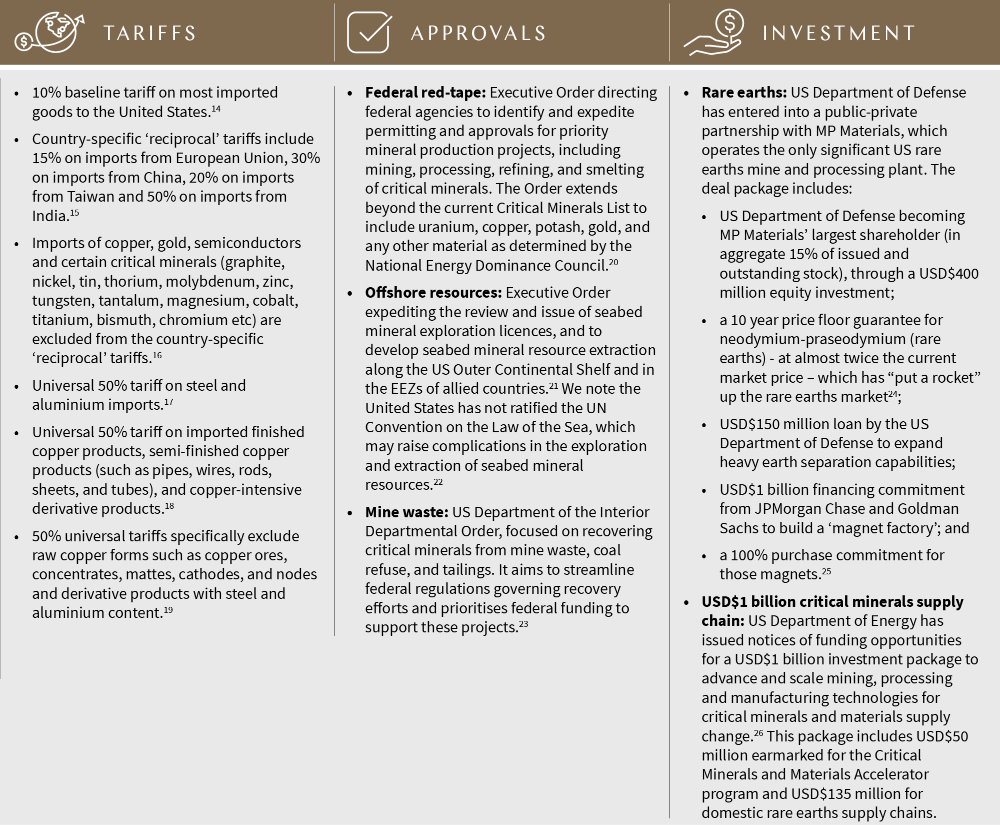

United States snapshot: Executive Orders, tariffs, expedited approvals and Government investment

This year, there has been a series of Executive Orders focused on critical minerals, as well as broader developments within the United States in:

- tariffs prioritising domestic processing

- expedited approvals of critical minerals projects

- Government investment and support.

These policy initiatives are further contextualised by the United States' relatively low level of domestic critical minerals resources, reliance on imported critical minerals and its consequent ongoing interest in the critical minerals resources in Ukraine and Greenland.

According to the International Energy Agency, 91% of rare earth elements are processed in China.11 Lynas, an Australian company, is one of the only major operators outside China, representing 4% of global refined production from its operations in Malaysia.12 The United States accounts for 1% of the global refined production from the MP Materials refinery in the United States and NP Materials refinery in Estonia.13

European Union snapshot: project investment stockpiling strategy & national funds

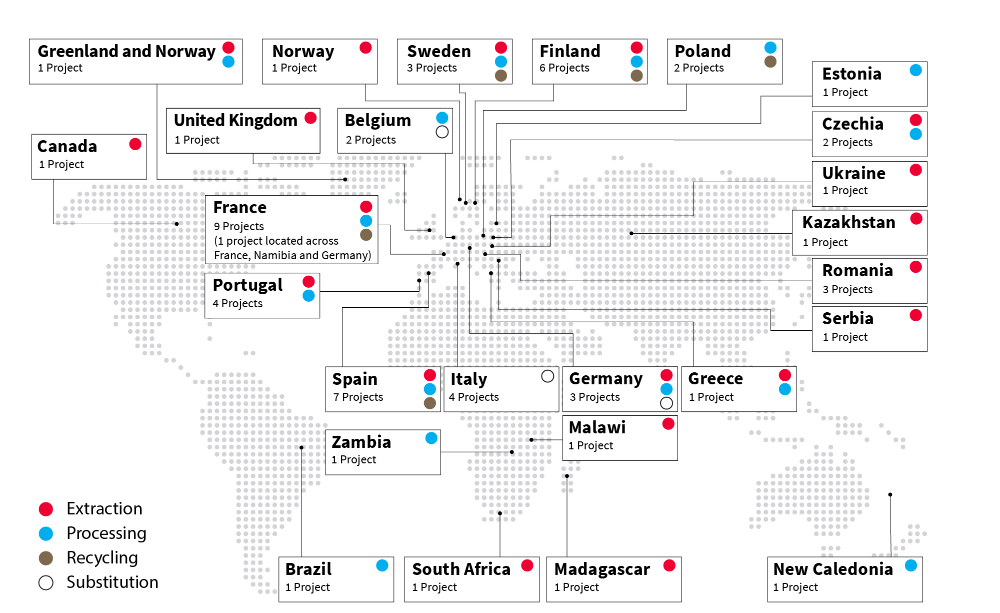

60 Projects Receive Approval under the CRMA

'Europe currently depends on third countries for many of the raw materials it needs the most. This is a landmark moment for European sovereignty as an industrial powerhouse' - Stéphane Séjourné, Executive Vice-President for Prosperity and Industrial Strategy.27

In 2025, the European Union's critical minerals policy has been directed through the Critical Raw Materials Act (CRMA), which came into force in [2024].28 The CRMA includes benchmarks for 2030 domestic capacities, including targeting 40% of EU annual consumption for processing of strategic raw materials.29 On 25 March, the EU Commission approved 47 EU-based projects, and on 4 June approved 13 non-EU projects (including in Greenland, Ukraine, Norway, Brazil, Madagascar and New Caledonia).30

Locations and types of CRMA projects

Source: Data sourced from European Commission31

While no projects are currently based in Australia, over 10% of the projects approved in the EU have Australian links and 3 projects are led by Australian companies.32

Critical raw materials projects will receive a single point of contact in each EU country, responsible for streamlining permit approvals. Selected projects enjoy shorter permitting timeframes and improved access to funding from the European Investment Bank.33 The European Investment Bank's new critical minerals initiative includes an expected €2 billion financing, a new CRM Task Force and a dedicated one-stop shop to build and manage a pipeline of projects, advisory activities and technical expertise.34

EU Stockpiling Strategy

Several jurisdictions already have stockpiling policies in place – for example, the United States' National Defense Stockpile35, the Japan Oil, Gas and Metals National Corporation metal stockpiling policy36 and South Korea's Rare Metals Supply Plan37 – or are currently designing a stockpiling policy (such as Australia's planned Critical Minerals Strategic Reserve).

In July 2025, the European Commission announced its EU Stockpiling Strategy.38 The EU Stockpiling Strategy extends beyond critical minerals, covering essential goods like food, water, oil, fuel and medicine. The strategy will complement the EU Critical Raw Materials Centre, which will be established in Q4 2026 to handle joint purchasing of critical raw materials.39 Its scope may be extended to coordinate strategic stockpiles, conduct supply chain monitoring and design financial products to invest in upstream supply in the EU and other countries.40

National funds

In March 2025, the Netherland's national investment body announced plans to set up a public-private investment fund to help secure access to critical raw materials for both the Netherlands and Europe.41 Similar funds are already up and running in other EU countries, including France, Germany and Italy.

Canada snapshot: Infrastructure Funding and Special Economic Zones

Canada is capitalising on its rich mineral resources - focusing on industrial policy supported by government funding and initiatives.

Federal Funding for Critical Mineral Infrastructure

The C$1.5 billion Critical Minerals Infrastructure Fund, announced in 2023, became fully operational in March 2025.42 It prioritises infrastructure projects like roads, rail, and renewable energy connections in key areas such as Ontario's Ring of Fire and Québec's James Bay lithium district. In its first round of funding, C$303 million was allocated to six ready-to-go projects and 25 pre-construction initiatives, with applications for another C$500 million in funding under review.43

In March 2025, the federal government proposed an extension of the 15% Mineral Exploration Tax Credit until 31 March 2027, which - if enacted - would inject a further C$110 million into mineral exploration investments.44

Provincial Funding and Expedited Approvals

Ontario:

- The creation of a "Made-in-Ontario" critical minerals supply chain will be supported by C$3.1 billion in loans, grants and scholarships to support Indigenous participation, partnership and ownership in critical mineral supply chains.45

- The Ontario government has announced plans to invest C$500 million into a new Critical Minerals Processing Fund that will accelerate the province's critical minerals processing capacity.46

- The Bill 5, Protect Ontario by Unleashing our Economy Act, 2025 was enacted, amending the application of various laws to infrastructure projects. The Ontario Government will be empowered to designate "special economic zones" where certain provincial laws, regulations, and municipal by-laws can be exempted to speed up approvals and permitting.47

British Columbia: British Columbia passed Bill 15, Infrastructure Projects Act, that allows 'provincially significant projects' to receive expedited and potentially less onerous approvals and permit processes.48

On the horizon

- United States:

- Tariffs and import controls: The US Department of Commerce is due to report to President Trump in October 2025 on the potential national security risks arising from imports of processed critical minerals and derivative products.49 That report was commissioned under section 232 of the Trade Expansion Act of 1962, which could empower the President to restrict the import of products and impose further tariffs on products found to 'threaten to impair' national security, replacing or increasing current 'reciprocal' tariff rates.50

- Refresh of Critical Minerals List: The US Department of the Interior has released a draft update to its Critical Minerals List for public comment, proposing the addition of copper, silver, potash, silicon, rhenium and lead and removal of arsenic and tellurium.51 Further consideration is underway, and public comment welcomed, on the potential addition of metallurgical coal and uranium (currently classified as 'fuels').52

- United Kingdom: In August, a Cabinet policy paper on the UK's National Security Strategy 2025 foreshadowed new Industrial, Trade and Critical Minerals Strategies which will 'strengthen international collaboration to drive investment, increase access to finance, and improve government support and guidance for businesses to help them understand and mitigate risks...[with a] new Supply Chain Centre [which] will review inputs, consider the impact of future trends on demand, and determine what action may be required - such as domestic capability building, diversification or strategic international partnerships to build resilience'.53

Footnotes

3 Future Made in Australia (Production Tax Credits and Other Measures) Bill 2024

11 International Energy Agency | Overview of outlook for key minerals

12 Report from the International Energy Agency | Global Critical Minerals Outlook 2025

14 Australian Government Department of Foreign Affairs and Trade | Latest on US tariffs

15 Australian Government Department of Foreign Affairs and Trade | Latest on US tariffs

17 Australian Government Department of Foreign Affairs and Trade | Latest on US tariffs

18 Australian Government Department of Foreign Affairs and Trade | Latest on US tariffs

19 Australian Government Department of Foreign Affairs and Trade | Latest on US tariffs

22 United Nations Online Treaty Depository | United Nations Convention on the Law of the Sea

28 European Union | Critical Raw Materials Act

29 Webpage from the European Commission | Critical Raw Materials Act

30 Media Release from the European Commission | Commission selects 47 Strategic Projects to secure and diversify access to raw materials in the EU; see also Media Release from the European Commission | Commission selects 13 Strategic Projects in third countries to secure access to raw materials and to support local value creation

31 European Commission I Selected strategic projects

32 Media Release from the Delegation of the European Union to Australia | Australian companies awarded Strategic Projects under EU's Critical Raw Materials Act; see also Media Release from the Delegation of the European Union to Australia | European Commission selects three Australian-led projects as part of global Critical Raw Materials strategy

33 Webpage from the European Commission | Critical Raw Materials Act

37 Webpage from the International Energy Agency | Rare Metals Supply Plan 2.0

40 Communication from the European Commission | The Clean Industrial Deal: A joint roadmap for competitiveness and decarbonisation (see 5.1-5.2)

47 Legislative Assembly of Ontario | Bill 5, Protect Ontario by Unleashing our Economy Act, 2025

48 Legislative Assembly of British Columbia | BILL 15 – 2025 Infrastructure Projects Act

50 Webpage from the Congress of the United States | Section 232 of the Trade Expansion Act of 1962

51 Document published on the United States Federal Register | 2025 Draft List of Critical Minerals

52 Document published on the United States Federal Register | 2025 Draft List of Critical Minerals

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.