- within Consumer Protection topic(s)

- within Consumer Protection topic(s)

- with readers working within the Retail & Leisure industries

- within Consumer Protection, Food, Drugs, Healthcare, Life Sciences and Strategy topic(s)

Summary

In 2025 H1, China's gross domestic product (GDP) grew faster than in the same period last year, and the country maintained robust development momentum. Policies designed to boost consumption continued to be launched, further supporting domestic demand and driving growth in household consumption. In H1, consumer spending became the key driver and cornerstone of economic growth.

Amid a decline in oil prices, seasonality in domestic demand, and uncertainty in foreign trade, China's inflation rate remained stable, with the core consumer price index (CPI) gradually rebounding. The inflation rate in the United States has been mild; but in June, CPI rebounded as a result of a rise in core CPI and energy prices, pointing to the start of an upward trend for core inflation.

In 2025 H1, the government continued to expand the trade-in programme to boost domestic demand, resulting in strong growth momentum in the sale of related products. In addition, measures designed to boost consumption improved and expanded service consumption, driving a continuous rebound in the consumer market. With "health" becoming an important consumer touchpoint for enterprises to build businesses, accelerate research and development (R&D), and enhance synergies in the supply chain, health products and services continued to contribute to the stable development of the consumer market.

In the first half of 2025, the pace of investment and financing in the consumer and retail sector slowed, with capital management models being increasingly integrated and innovated. Meanwhile, traditional capital instruments were integrated with emerging financial innovations, resulting in the formation of a multi-layered and scenario-based capital operational system.

Moving forward, China is set to continue to implement policies to boost consumption, steadily increase residents' income, and promote the sustained and healthy development of the consumer market.

Sub-sectors covered in the report

Macro-economic landscape

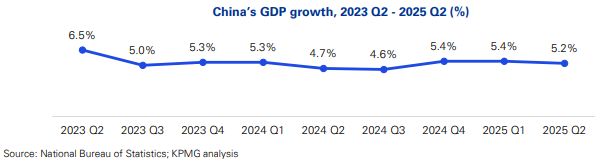

In 2025 H1, China's economic growth maintained a stable and positive trend, with GDP increasing by 5.3% year-on-year (YoY), reflecting an increase of 0.3% compared to the full year and first half of 2024.

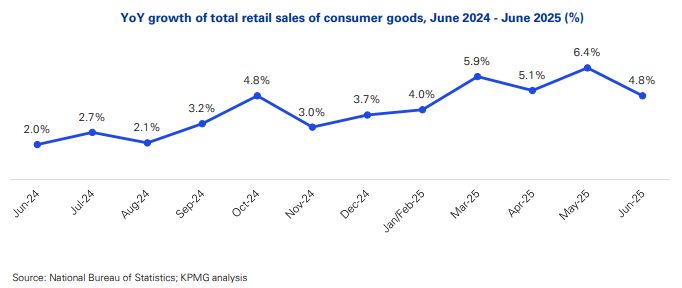

Due to the effective implementation of policies to boost consumption and domestic demand, the growth of consumption and domestic demand accelerated, with consumer spending accounting for over 50% of economic growth and becoming the main driver of GDP growth. In addition, driven by supportive policies such as measures to "stabilise employment and increase income," nationwide per capita disposable income has increased, boosting people's willingness to consume. As a result, total retail sales of consumer goods climbed 5.0% YoY, representing a positive development trend.

Consumption has become the cornerstone of economic growth. In 2025 H1, economic growth remained steady and trended upward, and the consumer market became more vibrant. Various macro-economic policies also provided strong support for the development of the consumer market in the second half of the year, laying a solid foundation for the achievement of annual targets.

Economic growth remained steady in 2025 H1, with consumption becoming the main driver of GDP growth

Gross domestic product (GDP)

In 2025 H1, while facing multiple challenges such as the complex and ever-changing international economic and trade environment and certain domestic difficulties, China implemented more proactive macro-economic policies, with a focus on stabilising employment, business, markets, and expectations. As a result, the domestic economy grew steadily, with GDP increasing by 5.3% YoY, up 0.3 percentage points compared with both the full year and the first half of 2024. In the first half of 2025, robust domestic demand contributed 68.8% of GDP growth, among which final consumer spending contributed 52.0%, becoming the main driver of GDP growth. Going forward, the central and local governments will introduce policies and measures to boost consumption; and effectively implement action plans to upgrade consumption, "stabilise employment and increase income," expand the supply of high-quality products and services, and promote the steady development of the consumer market.

Disposable income per capita

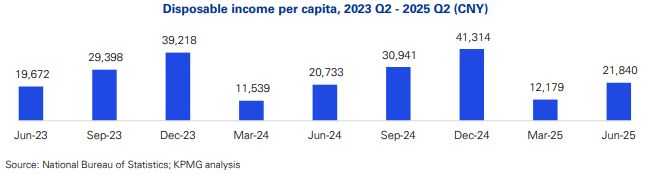

In 2025 H1, China's disposable income per capita grew by 5.3% in nominal terms over the same period in the previous year and by 5.4% in real terms after excluding price factors. The rapid rise of wages and salaries, net income from transfer, and net business income is an important factor supporting the growth of residents' income. From the perspective of employment, under the influence of a package of policies to stabilise and boost employment, the national surveyed unemployment rate in urban areas in 2025 H1 remained stable, averaging 5.1%, which was 0.2 percentage points lower than in the same period last year1. Employment conditions remained stable in 2025 Q2, with an increase in labour demand in various industries, and a significant increase in employment compared to 2025 Q12. In addition, policies for boosting consumption drove domestic consumption demand upward. Coupled with an increase in travel demand during the Spring Festival, May Day, and Dragon Boat Festival holidays, the service and tourism sectors saw favourable development. The per capita net business income of residents rose by 5.3%, in line with the national growth rate of residents' income.

Retail sales growth

In 2025 H1, the consumer goods and retail markets recorded an excellent performance. According to data from the State Council Information Office, total retail sales of consumer goods grew 5.0% YoY in 2025 H1, and 5.4% YoY in 2025 Q2, up 0.8 percentage points compared with Q1, reflecting an upward trend. Service retail also grew at a faster pace, posting YoY growth of 5.3%. With the supply of high-quality services improving and expanding, and consumption scenarios becoming increasingly diverse and personalised, service consumption as a share of overall consumption rose3.

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.