- within Coronavirus (COVID-19), Litigation and Mediation & Arbitration topic(s)

Q2 2025 Updates

Europe

ESMA

Launch of Euronext ETF Europe Platform

In May 2025, Euronext announced the launch of Euronext ETF Europe, a new platform dedicated to the listing and trading of Exchange Traded Funds ("ETFs"). The new platform, scheduled to go live in September 2025, aims to unify the European platform by consolidating ETF listings from across Euronext's markets, providing a single and harmonised platform for issuers and investors. The platform will be designed to improve liquidity by centralising trading and settlement as well as introducing new services and partnerships to support the ETF lifecycle, including improved market making, post-trade services and investor education initiatives. In line with this, the Italian regulator has also published a consultation paper on simplifying the process of listing funds in Italy. Further information on this is detailed below.

We will continue to monitor developments and provide updates as further information becomes available.

Update of the Frequently Asked Questions Concerning Cross-border Marketing of UCITS

On 18 June 2025, the European Securities and Markets Authority ("ESMA") confirmed in its Frequently Asked Questions ("FAQ") that where a UCITS gives prior written notice to the competent authorities of both the UCITS home and host Member States, of a change to the information communicated in the initial notification letter submitted in accordance with Article 93(1) of the UCITS Directive (2009/65/EC) that the documents referred to in Article 93(2) of the UCITS Directive, do not need to be included.

Furthermore, amendments to fund documents should not be covered by the obligation of written notice of Article 93(8) of the UCITS Directive.

ESMA Publishes Discussion Paper on the Simplification of Data Reporting Requirements of Investment Funds

On 23 June 2025, ESMA published a discussion paper on how to integrate funds reporting, aiming to reduce the burden for market participants. The aim of the paper is to identify opportunities to harmonise and simplify the current reporting framework for funds, including both UCITS and AIFs. The discussion paper will cover the entirety of funds' data reporting from content and format to frequency and transmission to the national competent authorities ("NCAs").

Market participants are welcome to provide feedback on the discussion paper up to 21 September 2025, with the assessment of the responses and cooperation with the relevant authorities to follow. ESMA aims to publish the final report with its conclusions and recommendations by April 2026.

Croatia

HANFA Initiates a Public Consultation on Easing Regulatory Requirements for Investment Funds.

On 15 April 2025, the Croatian Financial Services Supervisory Agency ("HANFA") initiated a public consultation aimed at identifying and removing unnecessary and stringent rules that go beyond those set out under the applicable EU law for UCITS and AIFs. This initiative forms part of HANFA's broader objective to align the Croatian regulatory framework more closely with EU standards and to facilitate a more efficient and competitive environment for fund management and cross-border marketing. The consultation sought feedback from industry participants on specific provisions under Croatian law that exceed the minimum standards established by relevant EU legislation, including the UCITS Directive and the Alternative Investment Fund Managers Directive ("AIFMD").

The consultation closed on 2 May 2025 with HANFA undertaking a review of the submissions received from industry participants.

Guernsey

Developments on the Guernsey Private Investment Fund Regime

On 19 May 2025, the Guernsey Financial Services Commission ("GFSC") announced a more streamlined and simplified Private Investment Fund ("PIF") Regime for fund managers and investors.

The PIF regime now consolidates two of the previous "routes" meaning there are now two distinct types of PIFs, which include:

- Qualifying PIFs which include professional Investors, Experienced Investors, UK & EU Professional Investors and US Accredited Investors; and

- Family PIFs.

Under the recent developments, there is no longer a requirement on investor numbers. Previously the number of qualifying investors in a PIF was 50 with the number of investors to whom the offer could be made to being 200. There is also no obligation to produce a formal prospectus, although a suitable offering document must be provided to investors. PIFs are also subject to lighter-touch regulation compared to other fund types, with the focus on the suitability of investors and the experience of the fund's governing body. There is also now a fast-track regulatory approval process, provided the application is complete and all requirements are met, the GFSC aims to approve PIFs within one business day.

Ireland

Mutual Recognition of Funds Framework between Ireland and Hong Kong

On 14 May 2025, the Central Bank of Ireland ("CBI") and the Securities and Futures Commission ("SFC") of Hong Kong entered into a new memorandum of understanding, establishing a Mutual Recognition of Funds ("MRF") framework. This framework enables eligible Hong Kong-domiciled collective investment schemes ("CIS") and their management companies to be marketed to the public in Ireland, and vice versa, under a streamlined approval process. The initiative aims to facilitate cross-border investment while maintaining robust investor protection standards.

Further information on the MRF and how we can assist can be found in our update, "Ireland and Hong Kong Launch Mutual Recognition of Funds Regime

Italy

CONSOB Launches Consultation with the Financial Market to Simplify Process of Listing Funds in Italy.

On 27 June 2025, Commissione Nazionale per le Società e la Borsa ("CONSOB") published a publication consultation paper for market participants on proposed amendments to the Issuers' Regulation (adopted by resolution no. 11971 of 14 May 1999) aimed at eliminating the obligation, under Articles 59 and 60, to prepare and publish a listing document for the admission to trading on a regulated Italian market of units or shares of open-ended EU collective investment undertakings ("UCIs").

The amendments under consultation would remove the obligation to prepare and publish the listing document for the admission to trading of open-ended EU UCIs and reserved open-ended AIFs managed by an EU AIFM along with updating related articles (including Article 103-bis on ongoing disclosure obligations) and the Appendix to Annex 1B, to ensure equal treatment between Italian and foreign UCIs and to simplify the information regime for investors.

The proposed change would be seen to reduce administrative burdens and costs for issuers seeking to list on the Italian market and would also align with listing requirements in other EU jurisdictions.

The consultation will be open to market participants until 12 July 2025, with comments to be received via Invio osservazioni - AREA PUBBLICA - CONSOB or by post to CONSOB directly at Research and Regulation Division, Via G. B. Martini, 3 – 00198 ROME.

Luxembourg

Update of the Frequently Asked Questions Concerning the Luxembourg Law of 12 July 2013 on Alternative Investment Fund Managers

On 20 May 2025, the Commission de Surveillance du Secteur Financier ("CSSF") published an updated FAQ on Luxembourg Law of 12 July 2013 on alternative investment fund managers The FAQ has undertaken several updates, specifically to Questions 1(B)(C), 2(C), 10(E), 11(D), 12(D), 14(J)(N) and 23(I)(J). The updates range from the concept of AIFs covering authorised entities only, how a depositary should maintain records, marketing of EU AIFs to retail investors and the requirement for annual reports under Article 20(1) of the Law of 2013. The FAQ is available to download from the CSSF website.

CSSF Publishes Circular on the Information to be Submitted in Relation to Investment Funds Not-authorised by the CSSF

On 26 June 2025, the CSSF published Circular CSSF 25/894 which provides comprehensive guidelines for the submission of information and documentation relating to investment funds that are not authorised by the CSSF. This circular introduces detailed procedures and mandatory templates for various notifications and reporting obligations, all of which must be submitted via the CSSF's eDesk platform.

The circular details a list of fund documentation which must be provided to the CSSF for an initial notification of a non-authorised fund along with a list of documentation required for updated notifications such as addition of new sub-funds, a liquidation or merger of a sub-fund and other material changes. The CSSF requires the use of specific templates, now available on its website, for all specified documents. These templates are provided in Excel or Word format and must be completed, exported to PDF-text format, and then uploaded to the eDesk platform.

The Circular is available to download from the CSSF website.

Spain

ComisiÛn Nacional del Mercado de Valores Introduces Key Regulatory Changes

On 5 March 2025, the Comisión Nacional del Mercado de Valores ("CNMV") published Circular 1/2025, introducing significant amendments to the regulatory framework governing investment funds, venture capital entities and related institutions in Spain.

The key modifications will include:

- Valuation and Operational Rules for Collective Investment Institutions, including frequency of Net Asset Value calculations, performance fee regulations and risk diversification and leverage limits.

- Harmonisation of reporting requirements and accounting framework updates.

- Annual compliance reporting which states that depositaries of entities regulated under Law 22/2024 must now submit their annual compliance reports electronically by the end of June each year.

- Electronic submissions and updated templates for financial statements and regulatory returns.

The changes, which will come into force twenty days after publication in the Official Gazette are designed to enhance supervisory practices, align with ESMA guidelines, and improve transparency, operational efficiency, and compliance across the investment sector. Certain reserved statements will become effective on 31 December 2025.

Sweden

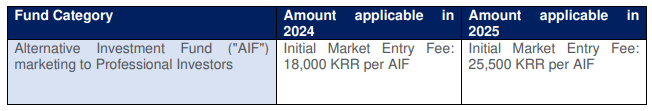

Regulatory Fees and Charges Levied in Relation to Marketing of Alternative Investment Funds to Professional Investors

The Finansinspektionen communicated the fees and charges it levies, for the year 2025 for Non-EU Alternative Investment Fund Managers. The table below summarises the updated fees and charges the Finansinspektionen levies in comparison with the previous year. Fee charges pertaining to other marketing applications in Sweden remain unchanged and the relevant 2024 rates remain applicable.

United Kingdom

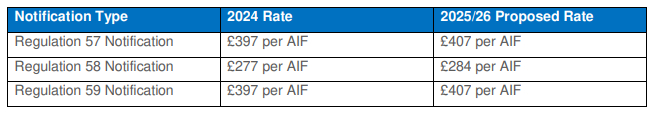

FCA Consultation Paper on Fee Rate Proposals for 2025/2026

On 08 April 2025, the FCA released a consultation paper, "CP24/7" setting out its proposed rates for fees and levies for the 2025/26 financial year. The consultation paper outlines proposals designed to apportion the FCA's costs across different fee blocks and if adopted, see changes to certain fee rates designed to reflect revised operating costs, new or evolved regulatory initiatives, and adjustments to how particular types of business should be categorised for the purposes of compliance oversight.

The consultation closed for response on 13 May 2025 with the FCA to publish feedback in their policy statement in July 2025. An update will follow once the FCA has published the outcome of the consultation.

FCA Releases Further Proposal on Product Information for Consumer Composite Investments

On 16 April 2025, the FCA released a further proposal on retail disclosure framework for Consumer Composite Investments ("CCIs") following the first consultation which closed on 20 March 2025. The latest proposal consults on remaining issues to support the regime which includes:

- A revised approach to calculation of costs;

- Revision to the cost disclosure requirements under the MiFID Org Reg;

- Transitional provisions to allow firms flexibility to move to the new regime when they are ready to do so; and

- Amendments to the FCA handbook.

The FCA also proposes to remove the requirement for calculating and disclosing implicit transaction costs, with these costs to be transparently disclosed, consistent with the summary cost figure set out in the first consultation. The FCA has indicated that it intends to issue its policy statement, including definitive rules, later in 2025.

FCA Consults on the Definition of Regulatory Capital for Investment Firms

On 24 April 2025, the FCA released a consultation paper on the definition of capital for FCA investment firms. The FCA has set out proposals to streamline and clarify the rules that determine what constitutes regulatory capital, or "own funds", for investment firms that fall within Chapter 3 of the Prudential Sourcebook for MiFID Investment Firms ("MIFIDPRU").

Currently, MIFIDPRU relies upon references to the UK Capital Requirements Regulation ("UK CRR") for specific definitions of what counts as regulatory capital. The FCA now seeks to consolidate and simplify these provisions by removing all UK CRR cross-references from MIFIDPRU by including all relevant definitions and requirements within the FCA Handbook.

The new rules do not propose any increase or decrease in the minimum capital requirements that investment firms must hold, nor does it call for any substantive changes to firms' existing capital structures rather the aim is to reduce the volume of legal text and eliminate duplications.

The FCA has emphasised that only definitional and structural aspects of the rules are to be revised, and it expects that firms which already satisfy the current regime will remain compliant once the new framework takes effect. The consultation was open until 12 June 2025, and a final policy statement is scheduled to be released in the second half of 2025. At present, the FCA intends that the new rules will come into force on 1 January 2026.

Middle East

Saudi Arabia

Capital Markets Authority Publishes Consultation on Draft Regulatory Framework for Offshore Securities Business License

On 25 May 2025, the Capital Market Authority ("CMA") called for public consultation on its Draft Regulatory Framework for the Offshore Securities Business License. The draft framework contemplates the establishment of an offshore licensing regime that will help bolster international engagement while ensuring robust investor protection. Whilst the CMA is still in the process of fine-tuning the detailed rules, the draft outlines several notable proposals, these include:

- Eligibility Criteria

- Clarification on the scope of permissible offshore activities and the extent to which it may be offered to Saudi clients

- Stricter ongoing supervision and reporting obligations

Interested parties were invited to submit their views on the proposed framework prior to 28 June 2025 with further updates to follow later in the year.

Asia Pacific

Hong Kong

The SFC Announces Adoption of FASTtrack and MoU Introduced between Ireland and Hong Kong

On 4 November 2024, the Securities and Futures Commission ("SFC") issued a circular to inform applicants seeking authorisation of unit trusts and mutual funds that "FASTtrack" would be formally adopted following a 6-month pilot period.

On 28 April 2025, the SFC issued a circular confirming that FASTrack would be formally adopted on 5 May 2025 for simple funds domiciled and regulated in 'mutual recognition of funds' jurisdictions that apply for authorisation for public offering in Hong Kong and now aims to grant fund authorisation within 15 business days from the submission of application. During the pilot phase, the 15-business day target for completing the authorisation process was consistently met and received positive feedback from market applicants. The SFC has indicated its intention to monitor FASTrack's operations and make ongoing enhancements where appropriate.

Market participants intending to seek SFC authorisation of their simple funds are encouraged to review the circular and assess whether FASTrack may be suitable.

For further information on the new Mou introduced between Ireland and Hong Kong, please see section "Ireland" above.

Singapore

MAS Consults on Streamlining Prospectus Requirements and Broadening of Investor Outreach Channels

On 15 May 2025, the Monetary Authority of Singapore ("MAS") issued a consultation paper on proposals to streamline prospectus disclosure requirements under the Securities and Futures (Offers of Investments) (Securities and Securities-based Derivatives Contracts) Regulations and broaden investor outreach channels for initial public offerings.

The key proposals covered in the consultation included:

- Streamlining prospectus disclosure requirements for primary listings on the Singapore Exchange ("SGX") to include clear substantive disclosures on the nature of conflicts faced along with reducing historical disclosures. The requirement to include interim financial statements will also be relaxed with issuers now only needing to provide statements covering at least the first six months of the current financial year. This aligns with practices in the US, EU and UK.

- Simplifying secondary listing processes by proposing a new set of prospectus disclosure requirements which will align with International Organization of Securities Commissions ("IOSCO") standards

- Broadening Investor Outreach Channels to allow greater flexibility to engage with both Retail and Professional Investors including earlier engagement with retail investors, pre-marketing to institutional and accredited investors and expanded pre-registration information.

Interested parties were invited to submit their views on the proposed consultation by 14 June 2025, with further details to follow in due course.

Taiwan

FSC Consults on Amendment to Regulations Governing Offshore Securities Branches

On 01 May 2025, the Financial Supervisory Commission ("FSC") of Taiwan published a consultation paper proposing an amendment to Article 9-1 of the Regulations Governing Offshore Securities Branches. The draft amendment is intended to bolster the competitiveness of offshore securities businesses operating in Taiwan along with streamlining the process involving offshore customers, therefore simplifying cross-border funds transfers and potentially reducing transactional friction.

Pursuant to the consultation, the FSC envisions the amendment to enhance the ability of offshore securities branches to provide a broader range of financial services without imposing onerous administrative burdens on their customers. The FSC hopes to position Taiwan's securities environment 12 / 13 as an appealing financial hub, attracting more international participants and fostering deeper capital market activity

Interested parties are encouraged to review the text of the draft amendment in its entirety and submit their responses to the FSC within the prescribed 60-day comment period, which runs from the day after publication and ended on 01 July 2025. Following the close of this consultation period, the FSC will likely issue a revised version of the Regulations Governing Offshore Securities Branches, with further updates to follow once available.

Americas

British Virgin Islands

British Virgin Islands Added to the FATF Monitoring List

On 13 June 2025, the Financial Action Task Force ("FATF") added the British Virgin Islands ("BVI") to its list of jurisdictions under increased monitoring due to ongoing concerns regarding strategic deficiencies in the BVI's anti-money laundering ("AML"), counter-terrorist financing ("CTF") and counter-proliferation financing ("CPF") regimes.

The BVI's inclusion is based on the findings of the Caribbean Financial Action Task Force ("CFATF") 2024 mutual evaluation report, which highlighted gaps in the BVI's rules on identifying corporate beneficial owners and other areas of regulatory oversight. Whilst the FATF has not called for the automatic application of enhanced due diligence measures to the BVI, it brings concern to regulated businesses, particularly those in the Crown Dependencies and other international financial centres.

Furthermore, should BVI be added to the EU AML blacklist and remain there until the implementation of AIFMD 2.0, they would likely be restricted in their ability to market BVI AIFs into the EU under Member States' NPPRs.

The BVI government has committed to a two-year action plan to address the FATF's concerns, focusing on improving supervision, beneficial ownership transparency, enforcement, and asset recovery. Further information is available from client update "The British Virgin Islands and the FATF "Monitoring List".

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.