The Financial Action Task Force (FATF) has removed the Cayman Islands from a list of countries whose anti-money laundering regimes are under increased monitoring.

The global AML standard setter confirmed in June that the Cayman Islands had satisfied all the elements of an agreed action plan.

At the organisation's plenary in Paris on 27 Oct., FATF members accepted a report by the Americas Joint Group and its recommendation to take the Cayman Islands off the so-called grey list.

The sub-group of the FATF International Cooperation Review Group visited the Cayman Islands in early September 2023 to verify AML practices, as well as government's commitment and efforts to comply with global AML standards going forward.

Compliant and effective

Cayman Finance CEO Steve McIntosh welcomed the FATF's recognition of the Cayman Islands' anti-money laundering regime as compliant and effective.

"Our proven regulatory and legal framework is one of the key reasons why asset managers, investors and other clients have full confidence in doing business in the Cayman Islands," he said.

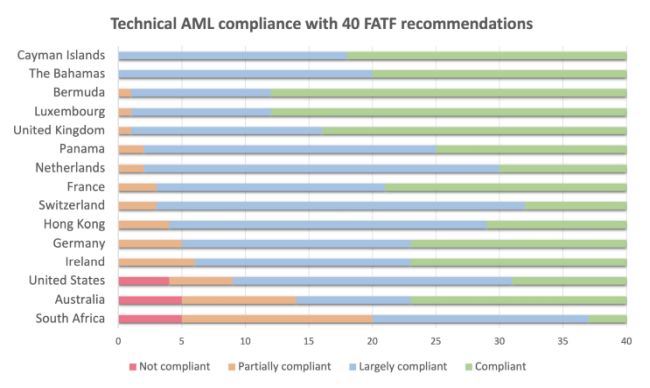

"The FATF process recognises that the Cayman Islands not only has one of the highest levels of technical compliance with global anti-money laundering standards, but also that they are effectively applied in practice."

The Financial Action Task Force (FATF) reviews anti-money laundering (AML) regimes both in terms of technical compliance with 40 FATF recommendations in laws and regulations and their effectiveness in managing the specific AML risks a country is exposed to. The Cayman Islands has globally one of the highest levels of technical AML compliance, which exceeds that of many advanced economies. The FATF has now confirmed that this extensive regulatory framework is also applied effectively in practice but has yet to update Cayman's effectiveness in its consolidated assessment ratings, which this chart is based on. Source: FATF/Cayman Finance.

The Cayman Islands is subject to ongoing reviews by various regulatory bodies around the world, covering a wide range of AML, tax transparency and governance issues.

McIntosh said, "Standard setters such as the FATF and the European Union have meticulously reviewed Cayman's regulatory capacity and practices and confirmed they meet global standards for transparency, anti-money laundering, and tax good governance at least on par with, if not better, than most major economies."

To maintain this status, a lot of work had gone into further strengthening Cayman's financial services legislation and the implementation of new regulations, he added.

Strengthened AML regime

In March 2019, the Caribbean Financial Action Task Force, which supports the work of the global standard setter for anti-money laundering in the region, recommended 63 actions for the Cayman Islands to complete to further strengthen its regime, following a peer review.

By February 2021, Cayman had completed 60 of these actions. However, the FATF placed Cayman on its monitoring list and agreed an action plan to implement the remaining three items.

Of these three, the Cayman Islands Monetary Authority satisfied a recommended action regarding effective sanctions in June 2021. The Ministry of Financial Services and Commerce met the second recommended action, in relation to beneficial ownership, in October 2022. And the final action item with respect to demonstrating Cayman's ability to investigate and prosecute complex anti-money laundering-related offences was fulfilled in May 2023.

"Cayman's consistent adherence to global standards is a testament to the strong collaborative relationship between the Cayman Islands government and the financial services industry," the Cayman Finance CEO said. "On behalf of the board and members of Cayman Finance, we congratulate the entire government delegation and all those in the many departments and agencies that contributed to bringing this FATF review to a successful conclusion."

Minister of Financial Services André Ebanks commented on the efforts of the public and private sectors, stating, "Today's outcome confirms our reputation as a well-regulated jurisdiction in AML matters.

"We have demonstrated that we are a global partner in financial services. And with this tremendous achievement, the Cayman Islands is on the move, looking to bolster our commercial offerings for sound business, and our corresponding compliance regime."

The delisting completes the FATF's 4th-round mutual evaluation process. The next review of Cayman's AML regime will commence in 2025, with evaluations expected to begin in 2026.

Cayman Islands Premier Wayne Panton said: "This is the culmination of the tireless efforts, advocacy and diplomacy from the Attorney General, Minister Ebanks, and countless public servants across various ministries, portfolios, law enforcement and regulatory bodies. Our financial services industry also gave their full cooperation, walking every step of this journey with us, and our public has been very supportive of our progress in meeting the FATF standard."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.