- within Tax topic(s)

- in Asia

- with readers working within the Business & Consumer Services, Technology and Media & Information industries

- within Tax topic(s)

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- with readers working within the Business & Consumer Services and Media & Information industries

- within Tax, International Law and Corporate/Commercial Law topic(s)

Introduction to Corporate Income Tax (CIT) in Poland

Corporate Income Tax (CIT) in Poland is a crucial element of the national tax system, applying to limited liability companies, joint-stock companies, limited partnerships, limited joint-stock partnerships, and certain non-corporate organizations. The primary goal is to tax the income of legal entities.

CIT Rates:

- Standard rate: 19%

- Reduced rate: 9% (for small taxpayers and startups)

How Taxable Income is Calculated

Taxable income under CIT is the difference between revenue and tax-deductible expenses.

- Tax-deductible costs must be directly connected to revenue generation.

- If deductible costs exceed revenue, the taxpayer reports a tax loss.

The 9% CIT Rate - Who Can Benefit?

Since 2019, the 9% CIT rate has been available for taxpayers whose annual revenue does not exceed EUR 2 million.

Conditions:

- Must have the status of a small taxpayer.

- EUR to PLN conversion is based on NBP exchange rate from the first business day of October of the prior tax year.

Exclusions:

- Entities formed via certain restructurings.

- Startups exceeding the EUR 2M threshold.

CIT Return Deadlines and Payments

Companies must file their annual CIT return within 3 months after the end of the tax year.

- For calendar year taxpayers, the deadline is March 31 of the following year.

- The same deadline applies to tax payment.

Revenue Sources and Loss Utilization

CIT differentiates between two income sources:

- Capital gains - e.g., dividends, share disposals

- Operating income - from business activity

Loss Carry-Forward Rules:

- Carry forward losses for up to 5 years

- Max 50% deduction per year or one-time deduction of up to PLN 5 million

Interest Deductibility and Debt Financing

Rules:

- Interest payments can be deducted once paid or capitalized.

- Investment-phase interest increases asset value and is deductible via depreciation or upon disposal.

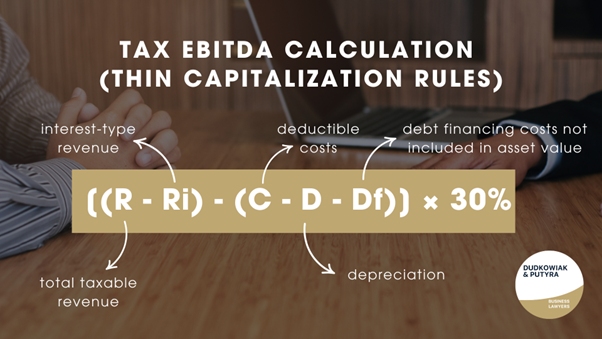

Tax EBITDA Calculation (Thin Capitalization Rules)

Formula:

[(R - Ri) - (C - D - Df)] × 30%

- R - total taxable revenue

- Ri - interest-type revenue

- C - deductible costs

- D - depreciation

- Df - debt financing costs not included in asset value

Limitation: greater of PLN 3 million or 30% of tax EBITDA.

Exemptions and Special Considerations

- Public infrastructure projects are exempt

- Transfer pricing rules can limit deductibility if debt is excessive or interest is non-market level

Initial Value and Depreciation

Key Rules:

- Minimum asset value: PLN 10,000

- Straight-line depreciation is the default

- Accelerated, reduced, and one-off depreciation available

Included in Initial Value:

- Purchase cost

- Installation and transport

- Investment-period interest

- FX differences and improvements > PLN 10,000

Minimum Tax on Commercial Buildings

- Rate: 0.035% monthly

- Applies to rented/leased properties > PLN 10 million value

- May be offset against CIT or refunded

Minimum Income Tax (from 2024)

Applies to entities that:

- Report an operating loss, or

- Have income-to-revenue ratio ≤ 2%

Rate: 10% of calculated base (or 3% simplified)

Exemptions:

- New companies (first 3 years)

- 30% drop in revenue

- Small taxpayers

- Bankruptcy or restructuring

Hybrid Mismatches and Deductibility Restrictions

From 2021, hybrid mismatches (e.g., different treatment in two jurisdictions) are not eligible for tax deductions or exemptions.

Applies to:

- Corporate structures

- Financial instruments like loans or bonds

Shifted Income Tax

Introduced in 2022, targets cross-border payments to related entities outside Poland.

Covered transactions:

- Intangible services (e.g., consulting)

- Royalties

- Debt financing

Rate: 19%

Applies when:

- The recipient is taxed at <14.25% or exempt

- The costs exceed 3% of total tax-deductible costs

Exemptions: Entities in the EU/EEA with real business activities.

Estonian CIT - Deferral-Based Model

Benefits:

- Tax deferral until profit distribution

- No separate tax accounting required

- Effective tax rates: 20% (small businesses), 25% (others)

Eligibility:

- Shareholders must be individuals

- No holdings in other companies

Tax is triggered only when:

- Profits are distributed or

- Assets are transferred

Polish Holding Company (PSH)

Key Benefits:

- 100% CIT exemption on dividends and capital gains

Conditions:

- Holding ≥10% shares for ≥2 years

- No links to tax havens

- Not part of a tax capital group

Bad Debt Relief in CIT

For creditors: Reduce tax base if unpaid >90 days from the due date

For debtors: Increase tax base for overdue liabilities >90 days from the due date

Applies if:

- Both parties are Polish CIT/PIT taxpayers

- The transaction is business-related

Exclusions:

- Related-party transactions

- Compensation and set-offs

Poland's Corporate Income Tax system is layered and offers a variety of models, rates, and reliefs. Choosing the right structure - whether the classic 19%, reduced 9%, Estonian model, or holding company strategy - can lead to significant financial and operational advantages. Businesses should plan strategically and consult tax professionals to maximize compliance and benefits.

Need More Tax Insights?

Visit our blog for in-depth articles on taxation in Poland, including VAT, WHT, bad debt relief, and real-life compliance strategies.

FAQ - Frequently Asked Questions About CIT in Poland

- Is every company subject to CIT in

Poland?

No - only specific legal forms like LLCs and JSCs are taxed. - What qualifies as a "small

taxpayer"?

Annual revenue under EUR 2 million (converted to PLN). - How long can I carry forward a loss?

Up to 5 years, max 50% per year or a one-time PLN 5 million deduction. - Can new businesses use the 9% CIT rate?

Yes, until they exceed the revenue cap. - What's the difference between classic and Estonian

CIT?

Estonian CIT defers taxation until dividends are paid. - Must I pay the minimum income tax if I have a

loss?

Yes, unless you qualify for an exemption.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.