- within Transport and Insurance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Business & Consumer Services and Insurance industries

Family enterprises are unique, and family business issues can be complicated to navigate due in part to competing interests. For family business owners that are planning for succession and inter-generational business continuity, careful consideration must be given to balancing the perspective of each stakeholder.

The goal of family enterprise advising is to minimize the conflict between various stakeholders with the goal of ensuring long term success of the family business and the protection of various family assets and wealth.

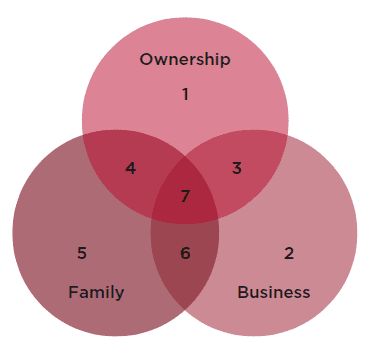

Some of the key principles of family enterprise advising are based on the three-circle model for family business systems, developed in 1978 by the Harvard Business School. The three circle model identifies three interdependent groups that comprise the family business system: family, business and ownership. Due to this overlap, there are seven interest groups/stakeholders present with a connection to the family business. The interest groups are:

- external investors, who own part of the business but do not work in the business and are not members of the family

- non-family management and employees

- owners who work in the business but are not family members

- family members who own shares in the business but are not employees

- family members who are not actively involved in the business either as employees or owners

- family members who work in the business but do not own shares

- owners who are family members and work in the business

A visual representation of the three-circle model is as follows. The numbers correspond to the interest groups discussed above.

Each of the seven interest groups identified by the framework has its own legitimate viewpoints, goals, concerns and dynamics and at times these viewpoints may conflict. Family enterprise advising focuses on solutions to minimize conflicting viewpoints and to ensure the stakeholders function properly and mutually support each other, so that the family business succeeds in the long term. Accordingly, family enterprise advising looks at succession and inter-generational planning in a holistic view, with an emphasis on the development of what many professionals refer to as "soft-skills." Focusing on the "soft-skills" can allow advisors to develop succession and inter-generational plans that address and minimize conflict between various stakeholders and allow for the growth of the family business and the protection of family wealth.

This blog highlights the "soft-skills" behind succession and inter-generational planning.

While corporate and tax professionals often focus on "traditional skills" which are the technical details of a plan, they often disregard the driving factors behind the enterprising family and the reason for developing a plan. An example of such "traditional skills" is the technical details of commencing an estate freeze in favour of the business owner's children and the associated tax implications of such a freeze. Hence, "traditional skills" are skills that are used to implement a plan.

"Soft-skills" on the other hand, are a set of questions that an advisor should consider or ask when developing a succession and inter-generational plan. It is these questions that drive the plan and provide for the implementation of "traditional skills." The issues which surface from focusing on the "soft-skills" are often really what is important to the client.

When working with enterprising families, some of the "soft-skill" questions that advisors should consider are:

- What to do with a business, sell or transition to the next generation?

- Will the shares of the business be sold or gifted to the next generation?

- Who should be the next CEO or President of the company?

- What types of policies should be developed for the operating

company? Generally, the policies should look at:

- the employment of family members

- compensation of family members

- how to deal with underperforming family members

- prenuptial agreements in case of issues that arise within the family

- What impediments/concerns do you have with family succession?

- How will estate plans be structured?

- What is the purpose of the family's wealth?

- Which family members will have access and control to the family's wealth?

- What will the family invest in and what will it not invest in?

- What happens if there is a divorce in the family?

- How will conflict be managed between branches and differing generations of the family?

- Will in-laws be welcomed and taught about the family's history and traditions?

- How will the next generation be prepared to become responsible stewards of shared family wealth?

- Who will champion the family's customs and lead their activities into the next generation?

Much of family enterprise advising is based on the three-circle model for business systems. The goal of family enterprise advising is to minimize the conflict between various stakeholders as evidenced by the three-circle model with the goal of ensuring long term success of the family business and the protection of various family assets and wealth. Business families are complicated and a "one-size-fits-all" approach does not apply. Similarly, overly complicated plans which only focus on technical aspects may cause conflicts within the enterprising family which is counter to the development of such a plan. Family enterprise advising is more than just dealing with operating companies, advisors should consider other types of wealth held by an enterprising family when making such a plan.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.