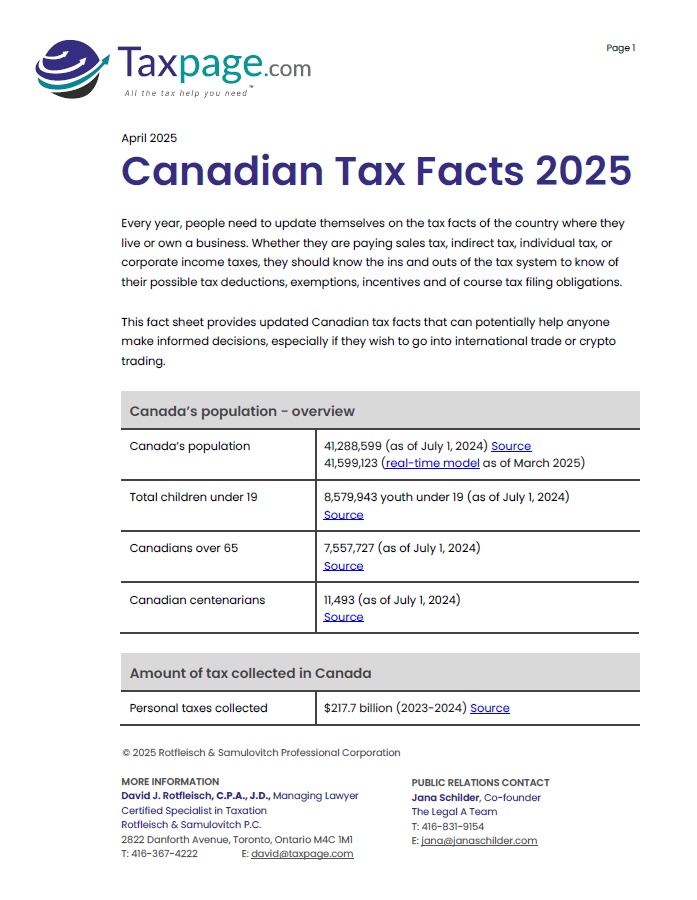

Every year, people need to update themselves on the tax facts of the country where they live or own a business. Whether they are paying sales tax, indirect tax, individual tax, or corporate income taxes, they should know the ins and outs of the tax system to know of their possible tax deductions, exemptions, incentives and of course tax filing obligations.

This fact sheet provides updated Canadian tax facts that can potentially help anyone make informed decisions, especially if they wish to go into international trade or crypto trading.

The 50-page "Canadian Tax Facts 2025" is a free download at Taxpage.com, the firm's main website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.