Exempt Market Dealers Beware! Get Ready Before the Regulators Come Knocking!

In May 2014, the British Columbia Securities Commission (the BCSC) published its 2014 Annual Compliance Report Card (the Report Card). The Report Card summarized certain compliance deficiencies that were identified by the BCSC at BC-based portfolio managers, investment fund managers and exempt market dealers (EMDs) during compliance reviews conducted between April 1, 2013 and March 31, 2014 (the Review Period).

The BCSC oversees 109 firms of which 80 are asset management firms and 29 are dealers focused on product sales.

Why should registrants care about the Report Card?

Registrants should care about the Report Card since the BCSC will focus its efforts in 2014 on the top five deficiencies discussed below. Registrants literally have a road map for a compliance review and should take action to ensure they are compliant with their regulatory obligations.

In the event of non-compliance, the BCSC can take various actions against a firm and its registrants including:

- requiring a firm to rectify its compliance program;

- recommending terms and conditions on a firm or registrant's registration to reduce the risk of non-compliance

- recommending the suspension of registration; or

- taking enforcement action.

What were the top five deficiencies?

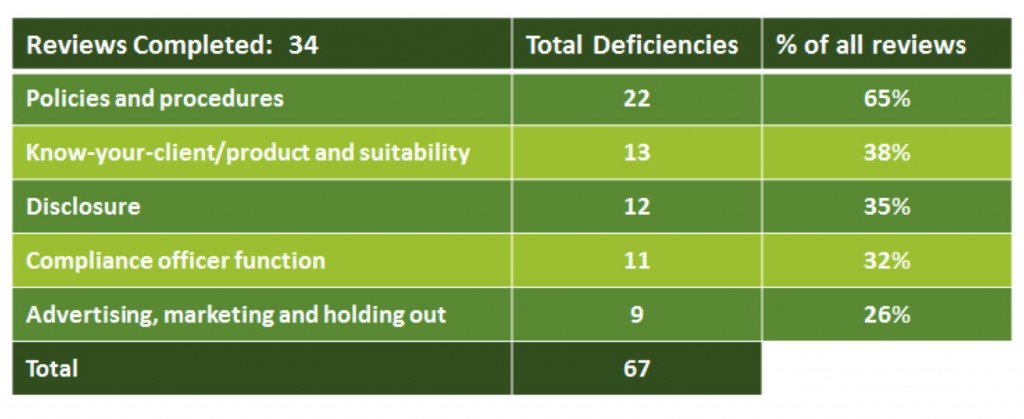

The BCSC conducted 34 compliance reviews, examinations and inspections during the Review Period and found, on average, 3.8 deficiencies per review with the top five set out in the graphic below.

The above top five make up approximately 51% of all compliance deficiencies found by the BCSC during its review.

A more detailed discussion of the compliance concern are discussed below.

1. Policies and Procedures – Policies and procedures deficiencies were observed in 65% of compliance reviews. Many policies and procedures manuals (PPMs) did not reflect the current state of the firms' businesses and staff were often not trained on the content of their PPMs. The BCSC recommended building in regular reviews of, and updates to, the PPMs to reflect ongoing changes to the firm's business or regulatory landscape and implementing timely training programs.

2. Know-your-client (KYC), know-your-product (KYP) and suitability obligations– The Report Card stated that 38% of the firms reviewed showed weakness in their KYP and KYC obligations and consequently, could not demonstrate that they adequately satisfied their regulatory obligations. Suitability is the cornerstone obligation of all registrants and the BCSC refers registrants to CSA Staff Notice 31-336 – Guidance for Portfolio Managers, Exempt Market Dealers and Other Registrants on the Know-Your-Client, Know-Your-Product and Suitability Obligations, published on January 9, 2014, for guidance on meeting their obligations.

3. Disclosure and conflicts – Disclosure deficiencies were found in 35% of the firms reviewed. The Report Card found that firms often fell short of delivering to clients the relationship disclosure information that a reasonable investor would consider important about their relationship with a firm. Particular concern was expressed about the effect this would have on managing conflicts of interest, especially in situations where registrants deal in securities issued by them, or in securities issued by connected issuers or product manufacturers. This is particularly apparent when dealers sell the proprietary product of a related issuer. For example, consider a mortgage investment corporation (MIC) setting up its own EMD to sell securities of the MIC – a related issuer of the EMD.

4. Compliance Officer Function – In 32% of compliance reviews conducted, the Chief Compliance Officer (CCO) was found to be deficient in complying with National Instrument 31-103. Examples of compliance failures included delegating responsibility to staff who lack the necessary skills, a lack of supervision of associate advising representatives, a lack of independent review of the advising or dealing activities where the CCO was also the firm's advising or dealing representative and a lack of documentation of reviews of compliance matters by the CCO.

5. Advertising, marketing and holding out – 26% of firms were deficient in advertising, marketing and holding out compliance. The deficiencies included carelessness about website information and office signage, not disclosing the basis of return (total return or price appreciation), not referencing the benchmark, not disclosing if returns are gross or net of fees, and advertising average, firm-wide performance instead of time-weighted performance in appropriate composites. The Report Card encouraged educating staff on common deficiencies and pointed to the guidance in CSA Staff Notice 31-325 – Marketing Practices of Portfolio Managers.

6. Unregistered personal corporations - Although not in the top five deficiencies, the payment of commissions or management fees to personal corporations rather than registered entities was flagged as a recurring deficiency among firms.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.