- within Compliance and Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Healthcare industries

Introduction

On June 18, 2012 Japan's Ministry of Energy, Trade and Industry (METI) approved a system of feed-in tariffs (FIT) for renewable energy generation.1 The new FIT program presents a rare suite of new business opportunities in the development of renewable energy in Japan. The push for renewable energy production is aimed at cutting reliance on nuclear, oil and liquefied natural gas for Japan's energy needs. Japan's investment in clean energy will help the world's third-biggest economy shift away from a reliance on nuclear power after the Fukushima disaster.2

The Opportunity in Japan

Bloomberg estimates that the Japanese market in solar PV could be worth nearly $10 billion, due to the very generous FIT tariffs that are being offered by Japan's METI.3 The high tariff rates will increase the demand to participate in the program, not only by local solar panel makers such as Panasonic and Sharp, but also by international firms vying for a piece of the Japanese market.

With renewable energy subsidies falling in established markets, the Japanese market represents a chance for investors to benefit from the tariff-driven returns.

Japan's Feed-In- Tariff Program

The Agency for Natural Resources and Energy (ANRE) is a department of METI and is responsible for Japan's policies in regard to energy and natural resources. The Japanese FIT program is similar to other FIT programs around the world. The Japanese government will pay tariffs to businesses, individual households and other organizations to generate renewable electricity. That power is then sold to the utilities at a fixed rate over a set period of time. The utilities will offset the costs of the new tariffs by charging their customers a surcharge for electricity generated from renewable sources. METI estimates that consumers will be required to pay an additional 1.2% per month on average for a 300 kWh electricity bill.4

The new FIT program began on July 1, 2012 and electric utilities are obligated to purchased electricity from suppliers of renewable electricity that have obtained the approval of METI. Utilities will also be obligated to inter-connect their electric transmission and other electricity facilities with the power generation facilities of the specified suppliers.

The terms of the power purchase agreements, including the price and annual period will be set by METI and executed by the electric utility operators.

Under the new program, utilities will buy solar, biomass, wind, geothermal and hydro power. The tariff price is based on the type of renewable fuel and the contract capacity. For instance, solar power firms with nameplate capacity of more than 10 kW can charge $0.53/kWh over 20 years. Firms with nameplate capacity of less than 10 kW can also charge $0.53/kWh, but only for 10 years.5

The wind power firms with nameplate capacity of more than 20 kW can charge $0.29/kWh for 20 years, while projects yielding under 20 kW can get $0.73/kWh for 20 years.6

Geothermal plants producing more than 15 MW get $0.35 for 15 years, while those producing under 15 MW get $0.53/kWh, for 15 years.7

At $0.73/kWh Japan's kWh tariff rates for wind are among the highest, if not the highest, in the world.

There are some obstacles to the Japanese FIT program, METI does not guarantee a grid connection and it is up to the suppliers to cover all grid connection costs. Additionally, planning barriers in Japan are significant and may substantially increase development costs and delay deployment.

Given the likely barriers and capital investment required, the potential of the market opportunity is difficult to assess. However, it is estimated that solar and wind projects over 20 kWh could produce equity returns of 44% and 51% respectively.8 The Japanese government seems to be committed to making the FIT project a success since, for the first time in 40, years Japan will not be using nuclear energy as the government has closed down all 50 nuclear plants for maintenance.9 Even though the nuclear reactors will be restarted as the maintenance and safety checks are completed, the shut down underscores the government's commitment to renewable energy production. Further, as of July 2nd of this year, 44 solar and wind power facilities have received approval to join the program.10

The standard terms and conditions of Japan's new FIT program and detailed pricing are available at the MEIT's website at www.meti.go.jp.

How It Measures Up Against Ontario

It is important to note that Japan has filed a complaint with the World Trade Organization asserting that the domestic content requirements of Ontario's FIT program are in violation of The General Agreement on Tariffs and Trade (GATT).11 As a result, it is not surprising that Japan's FIT program does not contain a domestic content requirement.

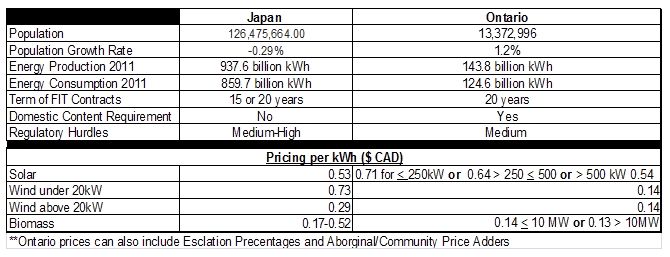

Ontario is a sub-national energy market with a population of 13.3 million people12, compared to Japan which is a national market with a population 126.4 million people.13 Unlike Ontario, Japan's utilities market is divided into ten regulated companies and the nation is the fourth largest consumer of electricity in the world.14 In 2011, Japan produced 937.6 billion kWh of electricity and consumed 859.7 billion kWh15, compared to Ontario's total energy production of 143.8 billion kWh and consumption of 124.6 billion kWh.16 The Fukushima disaster last year has placed a strain on Japan's energy resources and the opportunities to develop renewable energy solutions in Japan are currently very lucrative.

Since the launch of Ontario's FIT program in 2009, the province has made significant progress in developing cleaner renewable energy through wind, solar, and bioenergy projects. Ontario is projected to increase its capacity of renewable energy from about 1,700 MW in 2010 to 10,700 MW by 2018.17 Many analysts expect similar results with the launch of Japan's FIT program.

The table below provides a high level comparison between the FIT programs in Japan and Ontario.

Footnotes

1 Japan's METI approves feed-in tariffs for solar PV generationSolar Server (June 20, 2012), online: Solar Server Online Portal to Solar Energy http://www.solarserver.com.>.

2 Yuko Inoue and Leonora Walet, Japan approves renewable subsidies in shift from nuclear powerReuters (June 18, 2012), online: Reuters Edition UK < http://uk.reuters.com.

3 Chisaki Watanabe, Solar Boom Heads to Japan Creating $9.6 Billion MarketBloomberg (June 18, 2012), online: Bloomberg http://www.bloomberg.com >.

4 Supra Note 1

5 Ibid

6 Ibid

7 Ibid

8 Japan Renewable Energy Feed-In Ready for SignatureSustainable Business (26 April 2012), online: Sustainable Business.com < http://www. sustainablebusiness.com >

9 Ibid

10 Feed-in tariff era gets under wayThe Japan Times(2 July 2012), online: The Japan Times Online < http://www. japantimes.co.jp >.

11 Julius Melnitzer, Japan seeks WTO hearing on Ontario's Green Energy ActLegal Post, online: Financial Post http://business.financialpost.com >.

12 Ontario Fact Sheet 2012 (6 June 2012), online; Ontario Ministry of Finance http://www.fin.gov.on.ca.

13 Background Note: Japan (5 March 2012), online: U.S. Department of State http://www.state.gov >.

14 The World Factbook JapanCIA, online: CIA The World Factbook https://www.cia.gov.

15 Ibid

16 Center for Energy, Ontario-Statistics, online; Center for Energy http://www.centreforenergy.com.

17 2011 Annual Report of the Auditor General of Ontario, Electricity Sector Renewable Energy Initiatives (Ontario: Auditor General of Ontario, 2011) at 93.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.