Today (May 2, 2013), Ontario Finance Minister, Charles Sousa tabled the province's 2013 Budget. This year's budget, titled "A Prosperous and Fair Ontario" is committed to eliminating the deficit by 2017-18 and then reducing the net debt-to-GDP ratio to the pre-recession level of 27%.

The Wynne government presented a budget that is based on taking a "balanced approach" to eliminating Ontario's deficit. This balanced approach is achieved by keeping growth in program spending at low levels therefore allowing the government to make smart investments for Ontario's long-term prosperity, all the while balancing the budget.

Other than paralleling the tax treatment of non-eligible dividends proposed in the 2013 Federal Budget, no new taxes or tax rate changes were introduced in this Ontario Budget.

The deficit for 2012-13 is now estimated to be $9.8 billion, which is a $5 billion improvement from the deficit forecast in the 2012 Budget. For 2013-14, the deficit is projected to be $11.7 billion.

Here we summarize the major tax measures announced in today's Budget.

Business Tax Measures

Employer Health Tax (EHT)

Employer Health Tax (EHT) of up to 1.95% is paid by employers on their Ontario payrolls. All private sector employers are exempt from paying EHT on up to $400,000 of their Ontario payrolls each year, and groups of associated employers must share the exemption. The 2013 Budget proposes to increase the EHT exemption to provide greater relief for small businesses (including charities and not-for-profit organizations), while eliminating the exemption all together for larger employers.

Beginning January 1, 2014, the exemption will be increased from $400,000 to $450,000 to provide greater EHT relief to the small business sector. \ Moreover, the exemption will be adjusted for inflation every five years using the Ontario Consumer Price Index. Using projected inflation rates, the exemption is expected to rise to $500,000 in 2019.

Also beginning January 1, 2014, the exemption will be eliminated for private-sector employers (including groups of associated employers) with annual Ontario payrolls of over $5 million.

Registered charities, however, regardless of their payroll size, will continue to be eligible to claim the exemption.

Apprenticeship Training Tax Credit (ATTC)

The Apprenticeship Training Tax Credit (ATTC) was introduced in 2004 to encourage businesses to hire and train apprentices in the skilled trades. The ATTC provides businesses with a 35% to 45% refundable tax credit on the salaries and wages paid to eligible apprentices in designated construction, industrial, motive power and services trades.

The 2012 Budget proposed to better target the ATTC and help students improve their completion rates among ATTC eligible trades by eliminating the ATTC eligibility on certain programs. Consistent with the 2012 proposals, effective for expenditures incurred after March 31, 2014, the following apprenticeship trades will not be eligible for the ATTC:

- Information technology – Contact Centre – Technical Support Agent;

- Information technology – Contact Centre – Inside Sales Agent;

- Information Technology – Contact Centre – Customer Care Agent.

This measure is projected to save the government $45 million in the next fiscal year.

Renewable Fuels and Elimination of Biodiesel Exemption

In 2002, biodiesel was made exempt from the 14.3 cent per litre fuel tax under the Fuel Tax Act to encourage its use in Ontario.

The federal government introduced the renewable-content requirements, in respect of diesel fuel, effective on July 1, 2011. As a result of the federal government's initiatives, Ontario's fuel exemption for biodiesel no longer serves its intended purpose. As such, Ontario will take steps to update its green transportation-fuels policies by proposing to:

- Repeal the fuel tax exemption for biodiesel effective April 1, 2014; and

- Consult with stakeholders on a provincial mandate for greater diesel fuels.

Mining Tax System Review

The Mining Tax Act levies a 10% tax (5% for remote mines) on profits earned from the extraction of minerals (other than diamonds) in Ontario.

The 2012 Budget announced that the government would conduct a review to determine whether these rates provide Ontario with fair compensation for its non-renewable resources. The 2013 Budget affirms that the government will work with stakeholders over the next several months to ensure that the province is supporting the exploration and production of minerals while receiving a fair return on its resources.

Closing Tax Loopholes

The Ontario and federal governments have negotiated a new agreement for enhanced compliance activities focused on aggressive international tax planning. This agreement builds on an existing agreement that has generated an additional $500 million in revenue for Ontario over the past several years, including more than $200 million in 2012-13.

The 2013 Budget further proposes legislation to introduce new disclosure rules for aggressive tax avoidance transactions similar to the rules introduced by the federal government in November 2012. This new measure will require taxpayers to report aggressive tax avoidance transactions that attempt to avoid Ontario tax. Initiatives related to closing tax loopholes are expected to generate more than $300 million in incremental tax revenues over the next four years.

Underground Economy

The Ontario and federal governments recently negotiated an agreement to enhance compliance activities that will improve the integrity of the tax system and generate incremental tax revenues from individuals and corporations who are not complying. These measures are consistent with the 2012 Budget commitment and a recommendation by the Commission on the Reform of Ontario's Public Services.

Despite the measures implemented to date, Ontario is calling on the federal government to do more to combat the underground economy, including the release of its strategy on the underground economy as soon as possible.

Enhancing Audit

Ontario will expand the use of its automated risk assessment system to identify tax accounts that pose the highest risk of tax loss. This initiative will generate an additional $65 million annually.

Clearance Certificates

All businesses are required to obtain a clearance certificate from the Minister of Finance under the Retail Sales Tax Act (RSTA) for sales to which the Bulk Sales Act applies. To enhance the effectiveness of clearance certificates, the 2011 Budget amended the RSTA to allow the minister to withhold clearance certificates until tax debts under other statutes (Alcohol and Gaming Regulation and Public Protection Act, 1996; Fuel Tax Act; Gasoline Tax Act, Race Tracks Tax Act and Tobacco Tax Act) were paid or secured. These amendments were made effective until June 30, 2013. The 2013 Budget is now proposing to repeal this sunset date.

Accelerated Capital Cost Allowance (CCA) for Manufacturing and Processing Machinery and Equipment

Capital Cost Allowance (CCA) is the tax depreciation expense in respect of a capital asset that is used in a business. Ontario and the federal government currently provide a temporary 50% accelerated CCA for manufacturing and processing machinery and equipment acquired after March 18, 2007, and before 2014.

Ontario will parallel the 2013 federal budget proposal to extend the accelerated CCA for manufacturing and processing machinery and equipment acquired in 2014 or 2015. The assets qualifying for this accelerated CCA will be subject to the half-year rule in the year they are acquired.

PERSONAL TAX MEASURES

Ontario Trillium Benefit (OTB)

The 2011 Ontario Budget introduced the Ontario Trillium Benefit (OTB), which combined the Ontario Sales Tax Credit, Ontario Energy and Property Tax Credit and Northern Ontario Energy Credit into one payment. The OTB is currently paid in monthly instalments. The 2013 Budget proposes to modify the OTB so that, beginning in 2014, each recipient will have the choice to receive their benefit in one of two ways:

1. In a single payment at the end of the benefit year, or

2. In monthly payments throughout the year.

Specifically, taxpayers will have the choice to receive their 2014 OTB benefit in monthly instalments or in one single payment. If a taxpayer chooses the monthly payments, he/she will start to receive his/her OTB payments in July 2014. If, instead, the taxpayer chooses the single payment, he/she will receive the full amount in June 2015. In the latter case, the taxpayer would not receive any OTB payments from July 2014 to May 2015.

If the total OTB for the year is $360 or less, the taxpayer will receive the total amount in the first payment month, i.e., July 2014.

Dividend Tax Credit

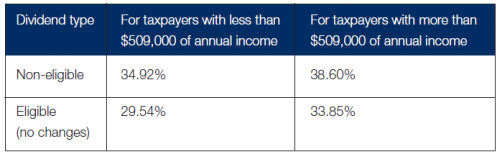

The 2013 Federal Budget proposed changes to the tax treatment of dividends distributed from corporate income taxed at less than the general corporate tax rate (i.e., income taxed at the small business rate), starting in 2014. Ontario will mirror this measure, subject to federal implementation.

After factoring these dividend tax measures, the combined federal and Ontario dividend tax rates applicable to an Ontario taxpayer, who is already taxed at the highest marginal tax rate, are summarized as follows. These rates are applicable to dividends received in calendar year 2014 and beyond.

Pooled Registered Pension Plans (PRPPs)

In response to calls for new, more flexible retirement savings plans, the federal government recently implemented legislative changes to support the introduction of pooled registered pension plans (PRPPs). These plans are intended to make it easier to save for retirement by providing employees and self-employed individuals with a new low-cost savings vehicle that is professionally managed and portable. The Ontario government announced that it will be consulting with interested parties to determine how PRPPs should be implemented before introducing legislation.

FEDERAL TAX MEASURES

The 2013 Federal Budget, which was tabled in March 2013, proposed several other tax measures that, under the terms of the Canada-Ontario Tax Collection Agreement, will be adopted by the Ontario government. These include proposals relating to:

- Lifetime capital gains exemption increase from $750,000 to $800,000;

- Restriction on claiming farm losses;

- Elimination of the deduction for safety deposit boxes;

- Corporate and trust loss trading;

- Mining expenses;

- Accelerated CCA for clean energy generation equipment; and

- Character conversion transactions and leveraged life insurance arrangements.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.