- within Intellectual Property topic(s)

- with Inhouse Counsel

- in United States

- with readers working within the Healthcare, Pharmaceuticals & BioTech and Law Firm industries

- within Intellectual Property topic(s)

- in United States

- with readers working within the Advertising & Public Relations, Pharmaceuticals & BioTech and Retail & Leisure industries

- within Intellectual Property topic(s)

- with Finance and Tax Executives

Semaglutide, the blockbuster GLP-1 receptor agonist marketed under names like Ozempic® (type 2 diabetes) and Wegovy® (weight loss), has rapidly become one of the most consequential drugs in modern healthcare. As countries grapple with rising obesity and diabetes burdens, semaglutide has captured global headlines—not only for its clinical efficacy but also for how Novo Nordisk has handled its market exclusivity in Canada through patent portfolio management and regulatory data exclusivity.

In early 2026, Canada may become the first major Western jurisdiction to allow generic semaglutide, ahead of the United States and Europe. This shift will cause a pricing reset throughout North America and potentially worldwide. Accordingly, the semaglutide story is a case study in the intersection of patent strategy, regulatory processes, and public policy.

🔍 1. Understanding the Canadian Patent Protection and Regulatory Landscape

The compound patent for semaglutide CA 2,601,784 was filed on March 20, 2006. If all maintenance fees had been paid, the patent would have expired March 20, 2026. However, in 2017 the maintenance fee was paid, refunded, then paid again with a late fee. In 2018, the maintenance fee was paid late, with an additional fee. The patent ultimately lapsed permanently due to non-payment of the 2019 maintenance fee. It is not clear why Novo Nordisk had so many misgivings about maintaining this very important patent, as the 2019 maintenance fee was only $450.

Canada operates a Notice of Compliance (NOC) linkage regime, aligning regulatory approval from Health Canada with patent enforcement. If a generic company files for Health Canada approval of a drug with patents listed on the Canadian Patent Register, they must "serve" the brand company with a Notice of Allegation that typically challenges the validity of the patent. That Notice can then trigger a 24-month automatic stay of the generic launch unless the case is resolved earlier. For more details, see Health Canada's NOC guidance.

Interestingly, none of the semaglutide patents are listed on the Canadian Patent Register, meaning that enforcement through the linkage regime is unavailable. This also makes it hard to predict which patent(s), if any, Novo Nordisk will enforce through the courts to prevent generics from competing on the market. Despite the lapse of CA 2,601,784, a generic entrant may still have to address patents related to formulation, injection device and/or dosing regimen which could further extend protection of Novo Nordisk's semaglutide products in Canada.

As the manufacturer of an innovative new drug, Novo Nordisk also enjoys data exclusivity for its clinical and manufacturing data through Canada's Food and Drug Regulations until January 4, 2026. This poses a final barrier to the entry of a generic drug competitor to the Canadian market that is soon to expire.

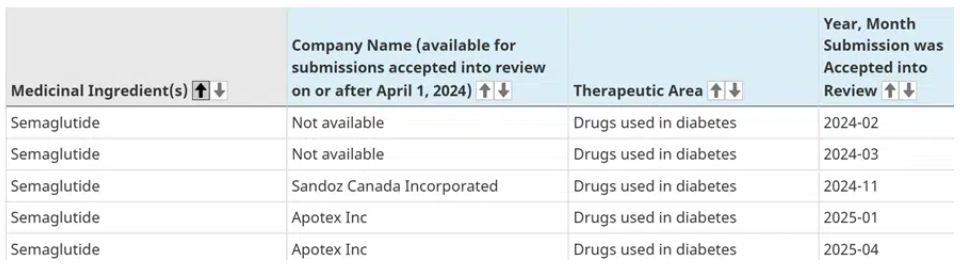

Currently, there are 5 generic submissions under review as listed below:

🧬 2. The Market Readiness of Generic Manufacturers

As can be seen from the above table, multiple companies are positioning themselves for an early Canadian launch of a generic version of semaglutide:

– Sandoz, Apotex, Hikma, and others have publicly

announced interest.

– Sandoz, in particular, is

actively investing in GLP-1 biosimilars and has signaled a

first-wave generic strategy in Canada post-2026.

The challenge for these firms isn't only legal—it's technical. Semaglutide is a peptide-based drug delivered via injection pens. Creating a high-quality, stable biosimilar (or in this case, a complex small molecule peptide) and a device that passes Health Canada's scrutiny is no small feat.

Device-related IP and manufacturing barriers could delay market entry, even after expiry of the compound patent, unless generics invest in the development of alternative approaches.

🧠 3. Evergreening in Action: Strategic Patent Filing

Evergreening is not new. Big pharma often extends product monopolies through secondary patents—covering delivery mechanisms, isomers, dosage regimens, or combinations.

In semaglutide's case:

– Novo Nordisk has filed over 100 patents globally related

to semaglutide.

– Canadian filings mirror this strategy, creating a patent

thicket that generic challengers must navigate.

– Some of the injection-pen-related patents in Canada run

until at least 2033, potentially delaying Wegovy® generics

despite the core molecule being unprotected.

Canada also has safeguards to counteract evergreening:

– Section 5 of the PM(NOC)

Regulations allows generics to challenge

"unjustified" patents listed on the Patent Register to

gain early access to the Canadian market.

– The Canadian Competition Bureau has previously intervened

in cases involving abuse of IP to block competition.

While evergreening practices are a legitimate strategy to protect innovation, critics argue that they are frequently used to delay competition rather than advance science. This is why, as a matter of public policy, pathways are provided for generic companies to enter the market to create competition and reduce prices for in-demand drugs.

💰 4. Economic and Public Health Impacts

Cost Implications

Currently, Ozempic® and Wegovy® retail for $200–$300

CAD/month, depending on coverage. Generic entry could reduce these

prices by 80–90%, saving millions in public healthcare

spending. Given semaglutide's wide adoption, Canada could

see:

– Annual system-wide savings in the hundreds of

millions

– Increased patient access, especially among uninsured

populations

Cross-Border Impact

If generics are approved in Canada before the U.S. (where

semaglutide's patents expire in 2032), they could be imported

into the U.S. under Section 804 of the U.S. Food, Drug,

and Cosmetic Act. Florida has already obtained federal approval to import

cheaper Canadian drugs.

Therefore, Canada could become a regional hub for lower-cost GLP-1 therapies, influencing pricing across North America and potentially around the world.

🌍 5. The Global Context: Generic Outlook in Key Jurisdictions

| Country | Core Patent Expiry | Generic Outlook |

| Canada | lapsed through non-payment of maintenance fees | Early generic entry expected in January, 2026 |

| China | 2026 (but revoked) | Patents invalidated, pending appeals |

| Brazil | 2026 | Generics likely soon |

| Europe | 2031 | Stronger device and method patents |

| U.S.A | 2032 (plus extensions) | Market entry delayed, high evergreening |

Canada is likely to be the first OECD country to approve a generic version of semaglutide. Once manufacturing is established, it will become easier for generic companies to enter the market in other countries, leading to increased competition and lower prices worldwide.

🧩 6. Strategic Considerations for Stakeholders

For Innovators (Novo Nordisk):

– Focus will shift to next-generation GLP-1 analogs

(e.g., CagriSema, amycretin).

Explore Novo Nordisk's pipeline here: Novo Nordisk R&D Pipeline

– Continued success of the currently approved product will likely rely on combination therapies and new indications.

Generics:

– Legal preparedness is essential.

– Investment in delivery device technology and peptide

manufacturing will be key to competing effectively.

Policymakers:

– Consider frameworks to speed up device approvals for

competing delivery models.

– Anticipate U.S. pressure around cross-border pricing

arbitrage.

Payers and Insurers:

– Update approved drug lists and budget impact models.

🔮 7. Final Thought: A Canadian Case Study in Market Exclusivity for Innovative Drugs

This case study highlights the importance of securing a patent portfolio in Canada to utilize the patent linkage system, and other regulatory tools, to delay entry of generic competitors, which inevitably affects pricing across North America.

Canada's semaglutide story is more than a tale of patent expiry. It highlights the need for comprehensive life cycle management of innovative therapies using layered strategies and illustrates the weaknesses that can be exploited by generic competitors to gain early market access. This case will also influence future regulatory thinking on how to manage high-cost therapies and ensure equitable access to life-changing medications.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.