- within Wealth Management and Compliance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Healthcare industries

From idea to investment: Understanding the potential of your IP to raise capital

Congratulations on surviving the startup phase. A few years under your belt, some lessons learned along the way and perhaps even some early successes. What comes next?

You may have already launched a technology-driven product or service line and are now looking to expand. Perhaps you are looking to make inroads into new markets, further develop a product, purchase new equipment, hire staff or fend off competitors.

No matter what the next phases of growth looks like for you company, you need to raise capital — fast. IP strategy gives you the edge you need to do just that, opening the door to a universe of government funding programs tailored specifically for SMEs.

If you've overlooked patenting in the race to get your business off the ground, the good news is that it's not too late to get started. Below are some of the key considerations that underpin a winning IP strategy.

Understand the value of your ideas

Many companies make the mistake of approaching patenting in terms of individual products. In fact, it is common for an individual product to contain multiple potential inventions. If you start teasing apart each product or project into separate "new, useful and non-obvious" components, you may well be sitting on a gold mine. The earlier you speak to a patent practitioner the better.

Mine for ideas

Are your product developers already in the habit of documenting their ideas or their progress on a project? If not, this is a great time to start. Many funding programs need dated contemporaneous written records of research and development over time. These records also provide a great foundation for invention disclosures. Invention disclosures can be done concurrently with funding applications too. In fact, listing pending patent applications on a funding application can be a helpful boost to your eligibility.

Mold your ideas

Do you have a set of potentially patentable ideas, but limited funds to get patent applications going? Consider prioritizing the concepts closest to market-ready first before moving on to inventions that are speculative or still in progress. Developing a patent strategy out over a longer time span can help spread out costs into fundable chunks as you build a step ahead of the company's product trajectory.

Manage your ideas

Sophisticated companies not only grab the headlines; they manage tight ships behind the scenes. This is especially critical when it comes to your IP strategy. Do you have employment agreements in place for all key personnel, assignments confirming the company's ownership of inventions and other intangibles, and tracking systems for critical IP due dates? Do you use non-disclosure agreements? Are the signed agreements being managed and in one place? Don't let your smart ideas go walking out the door.

Enforce your ideas

In today's competitive global market, companies can't afford to let their guard down – particularly where IP assets are concerned. Are you tracking competitor activity regularly, and do you have a strategy in place to enforce your IP rights – both at home and abroad? Now is the time to have your plan in place.

Grants, tax incentives and funding programs available to support growing companies across Canada

Canada

|

Program |

Type of Funding |

Funding Available |

Eligibility And Notes |

Jurisdiction |

|---|---|---|---|---|

|

CANADA-WIDE |

||||

|

National Research Council of Canada Industrial Research Assistance Program (IRAP) |

Grant |

Up to $10 million |

Eligible: SMEs1 planning to pursue growth and profit by developing and commercializing innovative, technology-driven, new or improved products, services or processes in Canada. |

Canada |

|

Sustainable Development Technology Canada – Scale Up Funding |

Grant |

Up to 40% of project costs |

Eligible: SMEs with: a defined project that has demonstrated environmental and economic benefits for Canadians, a novel technology that is supported by intellectual property owned by the company, a strategy to enable future growth, a strong end-user value proposition, and the potential to attract a consortia partner to validate the market need. |

Canada |

|

Grant |

Up to 75% of project costs, up to $75k |

Eligible: SMEs who are pursuing collaborative R&D agreements with international partners and investors. Must be registered in Canada, have a CRA business number, own, co-own, or have decision-making authority over the intellectual property (IP) rights for the technology, have a prototype (Technology Readiness Level 4 or higher) and intend to commercially launch the technology within 5 years. |

Canada |

|

|

Scientific Research and Experimental Development Program (SRED) |

Tax credits |

15% to 35% of eligible expenditures |

Eligible: Individuals, corporations and trusts making expenditures in the fields of scientific research or experimental development. |

Canada |

|

Grant and repayable loan |

Up to 50% of eligible costs |

Eligible: Canadian corporations operating in Canada and engaging in business activities within one of the following five funding streams: (1) R&D that will accelerate technology transfer and commercialization of innovative products, processes and services; (2) facilitating the growth and expansion of firms in Canada; (3) attracting and retaining large scale investments to Canada; (4) advancing industrial research, development and technology demonstration through collaboration between academia, non-profit organizations and the private sector; (5) supporting large-scale, national innovation ecosystems through high impact collaborations across Canada. |

Canada |

|

|

Grant |

Up to 85% of project costs |

Eligible: Companies deploying AI to enhance their supply chain. |

Canada |

|

|

Grant |

Up to 50% of project costs, up to $250k |

Eligible: Canadian SMEs2 and start-ups seeking to demonstrate the commercial feasibility of products and technologies. Must have the potential to achieve $10M- $15M in annual revenue within a reasonable period for the market or sector. |

Canada |

|

|

Grant |

Up to $99k |

Eligible: Indigenous individuals, communities, governments, organizations, associations and businesses. |

Canada |

|

|

Grant |

Up to $4k |

Eligible: Canadian SMEs and start-ups seeking to travel abroad to grow their customer base, open a satellite office, develop distribution channels or partnerships, or secure investment. Funding offsets costs of travel and accommodation. |

Canada |

|

|

WESTERN CANADA |

||||

|

Western Economic Diversification Canada Business Scale-up and Productivity Program |

Interest-free repayable loan |

Up to 50% of project costs from $200k, up to $5 million |

Eligible: High growth companies3 incorporated in Canada producing innovative goods, services or technologies in one of the following areas: advanced manufacturing, clean resources, clean tech, digital industries, health/bio sciences, natural resource value-added processing or value-added agriculture. Eligible projects include one or more of the following activities: productivity improvement, business scale-up or technology commercialization. |

Western Canada4 |

View the checklist on IP best practices for Canadian scale-ups »

Disclaimer: The resources listed are compiled from a wide range of government websites, and do not represent a complete list of funding options available to Canadian SMEs. The resources provided are aimed at for-profit SMEs, and does not include those tailored specifically for non-profits, educational institutions or non-profit research institutions. In order to learn more about each funding option, and to confirm eligibility criteria, please visit each individual website.

Footnotes

1. Small and Medium sized Enterprises. Defined by IRAP as having no more than 500 employees.

2. Small and Medium Sized Enterprises

3. Typically this means increases in revenue of at least 20%, year over year. Must also have fewer than 500 employees, have been in business in Canada for at least 2 years and have staffed operating facilities in Western Canada.

4. Western Canada includes BC, AB, SK and MB

British Columbia

|

Program |

Type of Funding |

Funding Available |

Eligibility And Notes |

Jurisdiction |

|---|---|---|---|---|

|

BRITISH COLUMBIA |

||||

|

BC Scientific Research & Experimental Development Tax Credit |

Tax Credit |

10% of eligible costs, up to $300k |

Eligible: Corporations that qualify for the federal SRED program and that have a permanent establishment in BC and carry on scientific research and experimental development in BC. |

BC |

|

Grant |

Up to 50% of project costs, up to $50k |

Eligible: SMEs1 and non-profits engaged in applied research and development, developing new or improved products and services, or the testing of innovative equipment or technologies to support capital investment decisions. |

BC (Northern Development Trust Region) |

|

|

Grant |

Up to $200k |

Eligible: SMEs in BC who have developed a prototype and are ready to take their technology and demonstrate it at a prospective customer site. Applicants should have an early adopter or a potential customer identified. |

BC |

|

|

Tax Credit |

Up to 75% corporate income tax, up to $8 million |

Eligible: Corporations operating an international patent business through a fixed place of business in BC, involving selling, assigning or licensing a patent to a non-resident person, or selling to a non-resident person a good or service in respect of which the sales revenue is principally derived from an invention for which a patent is owned by the corporation. Eligible classes of patents include life sciences, clean power generation, waste water treatment and fuel cell technology. |

|

|

View the checklist on IP best practices for Canadian scale-ups »

Disclaimer: The resources listed are compiled from a wide range of government websites, and do not represent a complete list of funding options available to Canadian SMEs. The resources provided are aimed at for-profit SMEs, and does not include those tailored specifically for non-profits, educational institutions or non-profit research institutions. In order to learn more about each funding option, and to confirm eligibility criteria, please visit each individual website.

Footnote

1. Defined in this program as have fewer than 500 employees with less that $100 million in revenue.

Alberta

|

Program |

Type of Funding |

Funding Available |

Eligibility And Notes |

Jurisdiction |

|---|---|---|---|---|

|

ALBERTA |

||||

|

Grant |

Up to 20% of eligible expenses, up to $800k |

Eligible: Corporations that undertake R&D in Alberta, that have less that $50 million in capital assets, and that are eligible for the federal SRED program. |

Alberta |

|

|

Grant |

$200k to $5 million |

Eligible: Businesses that have "shovel-ready" projects that will accelerate innovation in support of GHG emissions reduction, increase long-term economic competitiveness and stimulate growth in critically important sectors of Alberta's economy. |

Alberta |

|

|

Alberta Innovates Voucher and Micro Voucher Programs |

Grant |

Up to $100k or up to $10k |

Eligible: High potential, high growth, technology and knowledge-based SMEs with technologies in the mid-to-late developmental stages (may include some early developmental stages). Vouchers are available up to $100k and micro vouchers up to $10k. |

Alberta |

|

Grant |

Up to $150k

|

Eligible: High potential, high growth, technology SMEs in Alberta seeking to enter into a partnership with a potential client to conduct a pilot demonstration to trial and prove the technical and business merits of their product. |

Alberta |

|

|

Grant |

Up to $25k |

Eligible: SMEs in Alberta promoting sales of products and services in a new international export market. Funding offsets cost of travel and accommodation. |

Alberta |

|

View the checklist on IP best practices for Canadian scale-ups »

Disclaimer: The resources listed are compiled from a wide range of government websites, and do not represent a complete list of funding options available to Canadian SMEs. The resources provided are aimed at for-profit SMEs, and does not include those tailored specifically for non-profits, educational institutions or non-profit research institutions. In order to learn more about each funding option, and to confirm eligibility criteria, please visit each individual website.

Ontario

|

Program |

Type of Funding |

Funding Available |

Eligibility And Notes |

Jurisdiction |

|---|---|---|---|---|

|

ONTARIO |

||||

|

Grant or Loan |

Up to 15% of project costs, funding caps vary by project type |

Eligible: Businesses in Eastern or Southern Ontario with at least 3 years of operations/financial statements, employing at least 10 people (5 if in rural Ontario), who are committed to creating at least 5 new jobs (or 30% increase for companies with fewer than 15 employees) and who have invested at least $500,000 in their project ($200,000 if in rural Ontario). |

Ontario (Eastern and Southern) |

|

|

Tax Credit |

8% to 10% of eligible expenses |

Eligible: Corporations with a permanent establishment in Ontario who conduct scientific research and experimental development in Ontario. |

Ontario |

|

|

Tax Credit |

3.5% to 4.5% of eligible expenses |

Eligible: Corporations with a permanent establishment in Ontario who conduct scientific research and experimental development in Ontario. |

Ontario |

|

|

Grant |

50% of project costs |

Eligible: a wide range of business located in northern Ontario. There are separate streams, with separate funding caps, for R&D and commercialization of new technologies, launching new businesses, and growing or expanding existing businesses. |

Ontario (Northern) |

|

View the checklist on IP best practices for Canadian scale-ups »

Disclaimer: The resources listed are compiled from a wide range of government websites, and do not represent a complete list of funding options available to Canadian SMEs. The resources provided are aimed at for-profit SMEs, and does not include those tailored specifically for non-profits, educational institutions or non-profit research institutions. In order to learn more about each funding option, and to confirm eligibility criteria, please visit each individual website.

Quebec

|

Program |

Type of Funding |

Funding Available |

Eligibility And Notes |

Jurisdiction |

|---|---|---|---|---|

|

QUEBEC |

||||

|

Grant |

Up to $99k |

Eligible: First Nations, the Native Alliance of Quebec, or corporations owned by First Nations or the Native Alliance of Quebec or one of their members. Must have experience in the field of the activities proposed and must have full-time involvement with the business. |

Quebec |

|

|

Programme Innovation - Volet Soutien aux Projets d'Innovation |

Grant |

30% to 75% of project costs, up to $50k to $500k |

Eligible: Canadian or Quebec SMEs with a permanent establishment in Quebec, and who are developing innovative products or processes, from the planning stage up to the pre-commercialization stage. |

Quebec |

|

Grant |

40% of eligible costs, up to $80k |

Eligible: Companies incorporated in Quebec or with a permanent establishment in Quebec seeking to increase their capacity to export, or to consolidate or diversify markets outside of Quebec. Must be engaged in on of the following industries: manufacturing, retail and wholesale, information technology. |

Quebec |

|

|

Grant |

Up to 50% of project costs, up to $3 million |

Eligible: Companies with a permanent establishment in Quebec who are developing innovative, green technology that is either at the pre-commercial stage or testing stage. |

Quebec |

|

|

Grant |

Up to 75% of project costs, up to $500k |

Eligible: Companies with a permanent establishment in Quebec who are seeking to test the technical or commercial viability of innovative energy-saving or power demand optimization measures. |

Quebec |

|

|

Incentive Deduction for the Commercialization of Innovations in Québec |

Tax Credit |

2% on eligible taxable income

|

Eligible: Most corporations that: have an establishment in Quebec, carry on a business in Quebec and which derive income from the commercialization of a patent, certificate of supplementary protection, a plant breeder's rights or a copyrighted software that resulted from R&D activities carried on at least in part in Quebec. |

Quebec |

|

Tax Credit |

7.8% on eligible taxable income, up to 50% of net income |

Eligible: corporations that have an establishment in Quebec, who are selling or renting qualified products that integrate patented inventions developed in the province, who carry out 50% or more of their manufacturing and processing activities in Quebec, and who's paid-up capital calculated at the end of its previous tax year, including that of the companies with which it is associated, is equal to or greater than $ 15 million. The underlying R&D of the patent must have been carried out in part in Quebec. In addition, the corporation must have paid at least $500,000 of eligible R&D expenditures in the five years prior to the patent application, which gave rise to refundable Quebec R&D tax credits. |

Quebec |

|

View the checklist on IP best practices for Canadian scale-ups »

Disclaimer: The resources listed are compiled from a wide range of government websites, and do not represent a complete list of funding options available to Canadian SMEs. The resources provided are aimed at for-profit SMEs, and does not include those tailored specifically for non-profits, educational institutions or non-profit research institutions. In order to learn more about each funding option, and to confirm eligibility criteria, please visit each individual website.

Notes

- This list is targeted at for-profit companies, and does not

include non-profits, educational institutions or non-profit

research institutions.

- We have focused on funding that is provided by government and

that is available to tech companies in a range of industries, and

which can be applied to a range of uses. There are a plethora of

funding sources that a narrowly targeted at specific industries, of

for which the application of funding is relatively constrained. We

excluded the following categories of funding:

- Funding available through private organizations;

- Funding narrowly aimed at technology used in a single specific industry, such as pharmaceuticals, fisheries, forestry, agriculture, digital media and visual art;

- Funding, the application of which is tightly constrained (the majority of these were wage subsidies, provided for hiring specific types of professionals or service providers);

- Funding from supercluster organizations (typically requiring membership to qualify);

- Funding that is only available to individuals (not businesses);

- Funding that requires participation in a program of some sort (e.g. accelerator programs);

- Funding that requires collaboration with academic researches or institutions;

- Funding from competitions or challenges;

- Funding available to companies partnering with businesses in a single specific country;

- Funding for which projects must be completed by a particular date (within 2 years);

- Funding not available in 2021; and

- COVID-specific funding.

- The below eligibility information is presented with the caveat

that most sources of funding have more eligibility requirements

than is listed in the chart; We selected what we thought were the

most important requirements for each source of funding. we are

concerned that we may be representing an incomplete picture of

eligibility criteria, but on the other hand, including all

eligibility requirements would significantly expand the size of the

chart and make it much less user-friendly. There are often

eligibility criteria presented on the landing pages for the various

grants, and then additional criteria contained in more detailed

application guidance documents; we generally included the former

and omitted the latter.

- The Business Benefit Finder is an excellent tool for identifying potential sources of funding based on company and project characteristics. It is widely used by government program administrators, such as Innovation Canada. Mentorworks is an excellent tool for identifying potential sources of funding for Ontario SMEs.

IP Best Practices for Canadian scale-ups

Understand your IP:

- Instead of blue-sky brainstorming, break down the ideas you already have into separate inventions. Think about the problem the invention is trying to solve and what makes it better or different.

- Identify how your inventions are "new, useful and non-obvious" and therefore eligible for patent protection.

Protect your inventions:

- Convert written development records into invention disclosures. This is a valuable exercise as an invention disclosure can be used to jumpstart the process of filing a patent application.

- Ensure invention disclosures are drafted as inventions are created. With each new invention, a invention disclosure should be drafted to capture new IP as it is created.

Plan ahead:

- Understand the various options when it comes to IP protection: patents, trade secrets, trademarks and copyrights. Choose the right form of IP protection for each invention, based on your overall business strategy, to stop competitors from copying your inventions.

- Ensure you have an IP strategy in place to protect your IP assets. IP rights are business assets and will help you secure financing, or can be leveraged to increase your valuation. It's essential that you own and protect your IP if you are looking to secure funding.

Stay organized:

- Work with leadership to ensure you have well-organized agreements; this will bring clarity and future-proof against changes or disputes.

- Keep organized records of competitor activity and consider enforcement options before you have to use them.

What next?

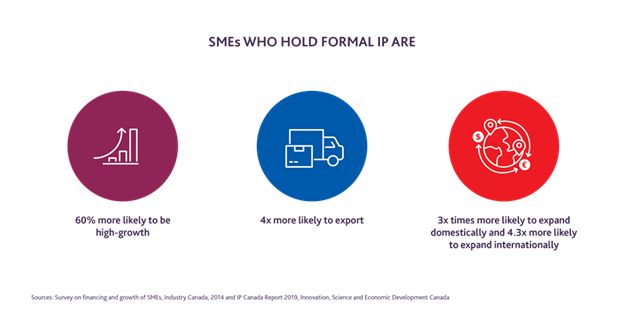

Canadian SMEs with formal IP are more likely to experience high growth, expand into new markets, and receive various types of financing. Contact our IP practitioners to discuss how to take your IP protection and exploitation strategy to the next level.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.