- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Healthcare and Law Firm industries

As market conditions change, what trends will drive private equity activity in 2025? To help sophisticated investors capitalize on opportunities and generate value, our 9th annual Private Equity Outlook combines a data-driven analysis of the Canadian private equity landscape over the past 12 months, including a detailed breakdown of deal activity and our team's market-leading insights to anticipate what's ahead.

Our On Target: 2025 Private Equity Outlook topics include:

- 2024 in Numbers – Canadian Private Equity Overview

- AI and Private Capital in Canada – Context and Legal Outlook

- Canadian Take-Privates in 2024 and Looking Forward

- The Supply Chains Act and its Application to Private Equity

- The Next Frontier of Fundraising

- The New Era of Competition Enforcement: What it Means for Private Equity

- Major League Gains: Private Equity Investment in the North American Sports Industry

- Canadian Tax Issues for Private Equity Investors

Our national Private Equity & Investment team's full service approach is tailored to deliver a seamless experience to our international clients with their inbound Canadian mandates, and connect Canadian clients to capital and growth opportunities in Canada and globally. Download our 2025 Outlook to learn more about the latest market trends and how we can help you achieve success this year.

Read an excerpt from the publication

2024 in Numbers – Canadian Private Equity Overview

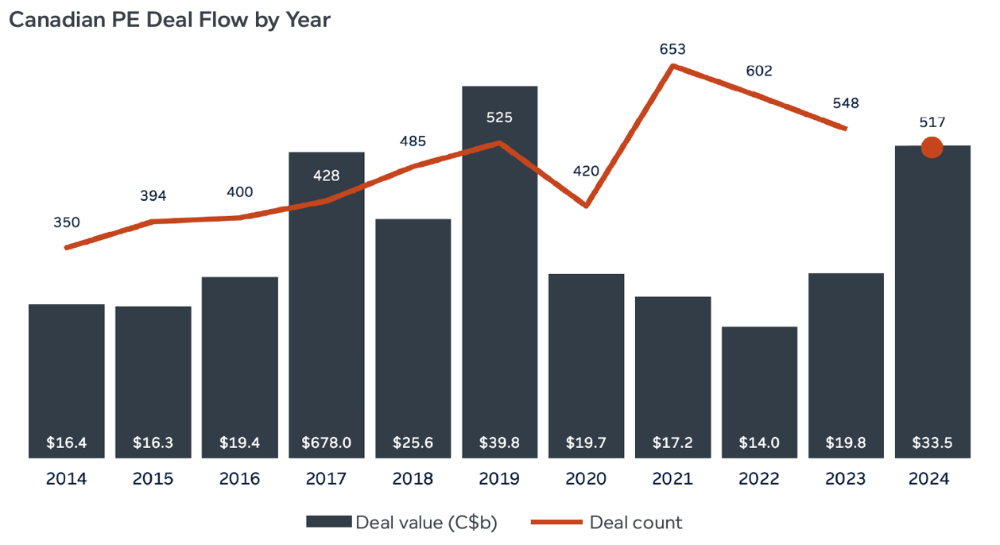

As declining inflation and interest rates confronted ongoing geopolitical unrest and economic uncertainty, the Canadian private equity market showed some contradictory trends in 2024. Although the number of deals declined year-over-year between 2023 and 2024 and fundraising faltered dramatically, aggregate deal value markedly increased, making 2024 a year of contrasts.

This chart compares deal value and deal count between 2014 and December 5, 2024.

In 2023, most higher-value Canadian private equity buyout investment activity took place in the second half of the year, and the momentum from late 2023 continued into the new year, with the aggregate value of deals in Q1 2024 nearly matching that of Q4 2023 and a slight increase in the number of completed M&A transactions, from 141 in Q4 2023 to 149 in Q1 2024. Deal count stayed steady in Q2 2024 with a further 153 completed deals, but the aggregate deal value surged to C$14.4 billion – the highest-performing quarter by aggregate deal value since Q1 2017, and greater than 2.5 times the aggregate deal value seen in the same quarter of 2023.

A significant portion of the deal value in 2024's blockbuster second quarter was represented by its largest deal, the US$6.3 billion take-private of fintech company Nuvei Corporation by Advent International, Philip Fayer, Novacap and CDPQ, with other notable transactions including the acquisition of data storage company eStruxture Data Centers for C$1.8 billion by a consortium led by Toronto-based Fengate Asset Management that included Partners Group Holding AG, Pantheon Ventures and the Laborers' International Union of North America Pension Fund of Central and Eastern Canada and the C$1 billion take-private of decision analytics software provider Copperleaf Technologies by Industrial and Financial Systems (IFS), through its financial sponsors Advent International, Altaroc, EQT, Foresight Group, Hg, Primark Capital and TA Associates.

Overall, the aggregate deal value of private equity transactions closed in Canada in the first half of 2024 showed a dramatic 258% increase over H1 2023, despite a modest 2% year-over-year increase in the number of deals that closed in the first half of the year.

Download the full guide to read more.

To view the original article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.