- within Tax topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Accounting & Consultancy, Banking & Credit and Technology industries

Through Budgets 2022 to 2025, Canada introduced six major clean economy investment tax credits (ITCs):

- the Clean Technology ITC;

- the Clean Hydrogen ITC;

- the Clean Technology Manufacturing ITC;

- the Carbon, Capture, Utilization, and Storage ITC;

- the Clean Electricity ITC; and

- the Electric Vehicle Supply Chain ITC.

The first four of these ITCs listed above are now set out in law following the enactment of Bills C-59 and C-69 in June 2024. Draft legislation for the Clean Electricity ITC was released in August 2024, and in Budget 2025 the Government indicated that legislation may be introduced in Parliament in 2025.

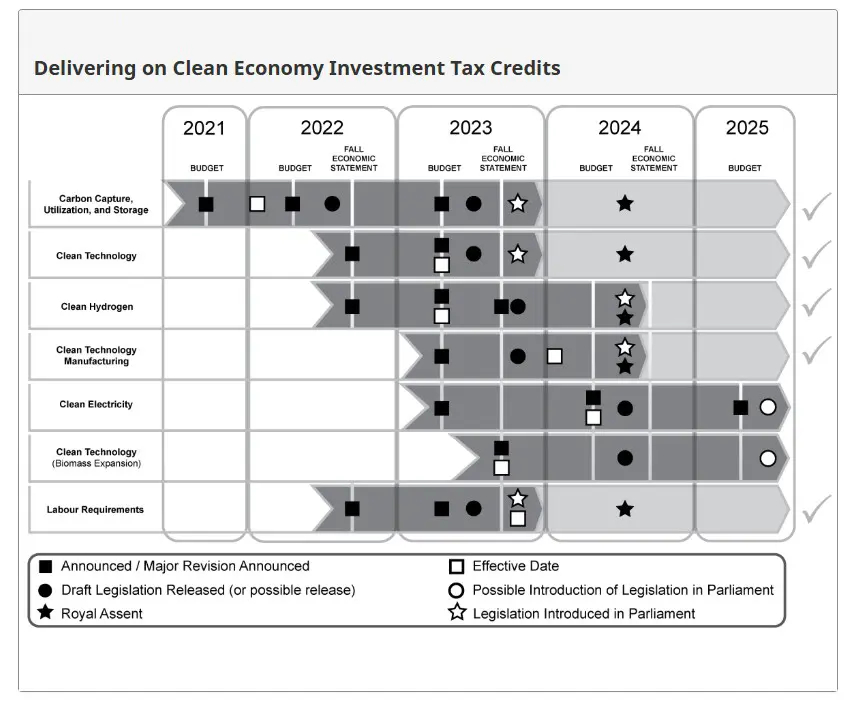

A chart summarizing the legislative status of these ITCs appears below; however, the chart does not include the Electric Vehicle Supply Chain ITC, which the Government announced in Budget 2024 but has not recently addressed. A public consultation on draft legislation for the Electric Vehicle Supply Chain ITC closed on March 14, 2025. The absence of any reference in Budget 2025 may suggest that the measure has been delayed or temporarily deprioritized relative to other clean-economy ITCs that received specific mention in Budget 2025.

Source: Department of Finance Canada, Budget 2025.

The Fall Economic Statement 2024 (FES 2024), released on December 16, 2024, provided significant updates to three of the six major clean economy ITCs as well as to the accelerated depreciation deduction regimes that could affect taxpayers claiming the clean economy ITCs.

Budget 2025, released November 4, 2025, confirmed that the Government intends to proceed with the measures previously announced in the FES 2024 and proposed additional changes to the Clean Electricity ITC, Carbon Capture, Utilization, and Storage ITC, and Clean Technology ITC.

This article summarizes the key developments from the FES 2024 and Budget 2025 that affect the clean economy ITC regime.

Our bulletins for Budget 2022, Budget 2023, Fall Economic Statement 2023, Budget 2024, and Budget 2025 contain details regarding the major clean economy ITCs as previously announced. Our summary tables for the four ITCs that were enacted in Bill C-59 and Bill C-69 can be found here.

1. Treatment of government assistance: Some relief

Generally, the clean economy ITCs provide refundable tax credits equal to a portion of the capital cost of eligible investments. The capital cost that is eligible for the clean economy ITCs is typically reduced by government assistance that a taxpayer receives.

Government assistance means assistance from a government, municipality or other public authority whether as a grant, subsidy, forgivable loan, deduction from tax, investment allowance or as any other form of assistance, unless expressly excluded under the Income Tax Act (Canada) ("Act").

In CAE Inc. v. Canada,[1] the Federal Court of Appeal found that low-interest loans from a government constitute "government assistance" and that the entire principal amount of such loans should be deducted from the capital cost for computing ITCs. This is problematic because the economic benefit or assistance that the taxpayer receives via a low-interest loan is arguably only the amount by which a market-rate loan exceeds the low-interest loan. Deducting the entire amount of a low-interest loan would significantly reduce the amount of ITCs available.

In response, the FES 2023 proposed to amend the Act to provide that no-interest or low-interest loans with reasonable repayment terms from public authorities will generally not be considered government assistance. As enacted in Bill C-69, government assistance now excludes non-forgivable loans, directly or indirectly from a public authority in Canada, evidenced in writing and incurred to earn income from a business or property and for which bona fide arrangements were made for repayment of the loan within a reasonable time ("excluded loan exception"). The accompanying Department of Finance explanatory notes noted that an unsecured fifty-year loan would generally not be considered to have bona fide reasonable repayment terms. While the excluded loan exception provides some relief from the problem created by the case law noted above, there remains the potential for interpretative issues.

The FES 2024 proposed to introduce an exception so that any financing provided by the Canada Infrastructure Bank (CIB) would not reduce the cost of eligible property for the purpose of computing the Clean Electricity ITC. Budget 2025 confirmed the Government's intention to proceed with this measure and further proposes to also exclude financing by the Canada Growth Fund (CGF). These are welcome developments, as both the CIB and the CGF provide significant funding to many clean economy projects. This exception would allow taxpayers that receive financing from the Canada Infrastructure Bank or the Canada Growth Fund to claim more of the expenditures as eligible for refundable tax credits.

However, the exception appears to be limited to the Clean Electricity ITC. It also would not cover financings from other government or quasi-government bodies such as Investissement Québec, which would still have to satisfy the excluded loan exception to be carved out from government assistance.

2. Reinstating accelerated depreciation deductions

The suite of measures confirmed or introduced in Budget 2025 includes:

- Reinstatement of the Accelerated Investment, which provides an enhanced first-year write-off for most capital assets;

- Immediate expensing (i.e., 100-per-cent first-year write-off) of manufacturing or processing machinery and equipment;

- Immediate expensing of clean energy generation and energy conservation equipment, and zero-emission vehicles;

- Immediate expending of productivity-enhancing assets, including patents, data network infrastructure, and computers; and

- Immediate expensing of capital expenditures for scientific research and experimental development.

Generally, a taxpayer may elect to deduct the cost of eligible property from income over time by claiming Capital Cost Allowance ("CCA"). The amount of CCA that can be deducted with respect to most assets that are acquired in the year is normally limited to 50 per cent of the amount that could otherwise be deducted, which is often referred to as the half-year rule.

The half-year rule has been temporarily suspended by:

- the accelerated investment incentive (AII), which allows a taxpayer's first-year CCA deduction with respect to eligible property that becomes available for use in the year to be increased by 50 per cent; and

- the immediate expensing measures for manufacturing or processing machinery and equipment under CCA Class 53, clean energy equipment under Classes 43.1 and 43.2, and zero-emission vehicles under Classes 54, 55 and 56, which provide for a 100-per-cent deduction.

Both measures apply to eligible property that was acquired after November 20, 2018, and becomes available for use before 2028 and were intended to be phased out for property that became available for use after 2023. The FES 2024 fully reinstated both measures for qualifying property acquired on or after January 1, 2025, and that becomes available for use before 2030. They would be phased out starting in 2030 and fully eliminated for property that becomes available for use after 2033.

Budget 2025 confirmed the Government's intention to proceed with these previously announced measures.

In addition, Budget 2025 proposed several new targeted measures:

- Immediate expensing for manufacturing or processing buildings acquired on or after Budget Day (November 4, 2025) and used for manufacturing or processing before 2030. This measure would phase out gradually between 2030 and 2033; and

- Reinstatement of accelerated CCA for liquefied natural gas (LNG) equipment and related buildings, but only for low-carbon LNG facilities.

To be eligible for accelerated CCA, an LNG facility must meet new high standards for emissions performance. Two levels of support would apply based on emissions intensity:

- Facilities that are in the top 25 per cent in terms of emissions performance would be eligible for accelerated CCA at the same rates as previous measures (30 per cent for liquefaction equipment and 10 per cent for non-residential buildings used in LNG facilities); and

- Facilities that are in the top 10 per cent in terms of emissions performance would be eligible for an accelerated CCA rate of 50 per cent for liquefaction equipment and 10 per cent for non-residential buildings used in LNG facilities.

These measures are expected to apply to property acquired on or after Budget Day (November 4, 2025) and before 2035.

While the reinstatement and expansion of accelerated depreciation deductions may be favourable to taxpayers who desire increased deductions from their income, such measures can also create potential recapture issues in later years. The following example from a recent CRA technical interpretation[2] is illustrative:

- The taxpayer acquires a Class 43.2 (50 per cent) property in 2024 with a capital cost of $10 million;

- The property becomes available for use in 2024;

- For the 2024 taxation year:

- The property qualifies for the AII and therefore the taxpayer may deduct up to $7.5 million as CAA in respect of the property from its business income for 2024. The following assumes that the taxpayer elects to deduct the maximum amount of $7.5 million as CCA;

- The taxpayer qualifies for the Nova Scotia Capital Investment Tax Credit ("NS CITC") and claims $2.5 million of NS CITC in 2024;

- The taxpayer qualifies for the Atlantic ITC ("AITC") and claims $0.75 million of AITC in 2024; and

- The taxpayer is also entitled to the Clean Technology ITC in 2024. The capital cost of the property for purposes of the Clean Technology ITC is reduced by government assistance received by the taxpayer. Government assistance, as defined under the Act, excludes the AITC and other federal clean economy ITCs but includes the NS CITC. Therefore, the adjusted capital cost of the property for purposes of the Clean Technology ITC is $7.5 million, resulting in $7.5 million of Clean Technology ITC.

- For the 2025 taxation year:

- The capital cost of the property will be reduced by the amount of the NS CITC, the AITC and the Clean Technology ITC that the taxpayer claims for 2024, resulting in an adjusted capital cost of $4.5 million; and

- The $7.5 million of CCA deduction that the taxpayer took in 2024 will reduce the undepreciated capital cost ("UCC") of the class to negative and give rise to a recapture of $3 million being included in income for 2025.

- For the 2026 taxation year:

- The $3 million recapture in 2025 will be added to the UCC of Class 43.2, resulting in a nil UCC.

- The $3 million recapture could have been avoided if the taxpayer chose to deduct $4.5 million of CCA in computing its 2024 income, instead of the maximum amount of CCA of $7.5 million as allowed by the AII regime.

Accordingly, careful planning is advisable when combining accelerated depreciation with clean economy ITCs or other credits that affect the UCC of a class. Strategic coordination of these measures can optimize tax efficiency and prevent unexpected recapture in future taxation years.

3. Updates on specific Clean Economy ITCs

(a) Clean Electricity ITC: Canada Infrastructure Bank (CIB) and Canada Growth Fund (CGF)

The Clean Electricity ITC is a refundable credit equal to 15 per cent of the capital cost of eligible investments in equipment related to low-emitting electricity generation, electricity storage, and the transmission of electricity between provinces and territories.

The Clean Electricity ITC, as announced previously, is available to Canadian corporations that are:

- taxable Canadian corporations;

- provincial or territorial Crown corporations, only for investments in designated provinces and territories (see discussions below);

- corporations owned by municipalities;

- corporations owned by Indigenous communities; and

- pension investment corporations.

The FES 2024 proposed to include the CIB as an eligible entity (we expect this means "qualifying entity") for the Clean Electricity ITC. Budget 2025 confirms the Government's intention to move forward with this measure and further proposes to include the CGF as an eligible entity for the same credit.

These developments are significant, as both the CIB and the CGF are key federal entities that provide financing and investment support to large-scale clean economy projects. Allowing these entities to qualify for the Clean Electricity ITC ensures that projects financed through them, and usually structured as limited partnerships, can still benefit fully from refundable tax credits, thereby enhancing the overall financial feasibility of clean electricity infrastructure.

(b) Clean Electricity ITC: Provincial and territorial Crown corporations

As noted above, the Clean Electricity ITC would be available to provincial and territorial Crown corporations only for investments made in eligible property situated in eligible jurisdictions. It was also previously announced that:

- the federal Minister of Finance would designate a province or a territory as an eligible jurisdiction if the Minister was satisfied that the provincial or territorial government has publicly committed to (i) achieve a net-zero electricity grid by 2035, and (ii) cause the Crown corporation to reduce the electricity bills of ratepayers by an amount equivalent to the amount of the ITC;

- the Crown corporation must report annually to the federal government on how it reduces ratepayers' bills or risk a penalty; and

- the Department of Finance was to consult with the provinces and territories on the details of these conditions.

The FES 2024 announced the results of the relevant consultation, including details of the final conditions that provincial and territorial governments would need to satisfy to be considered for designation as an eligible jurisdiction and the annual reporting requirements that would apply to any designated provincial and territorial Crown corporations claiming the Clean Electricity ITC.

Budget 2025 confirms the Government's intention to proceed with the implementation of the Clean Electricity ITC and to introduce legislation to deliver the credit. It also states that the Government will remove the two conditions imposed on provincial and territorial governments for their Crown corporations to qualify. The removal of these conditions would also appear to render the related designation and annual reporting requirements described in the FES 2024 unnecessary or subject to modification, although Budget 2025 does not explicitly address these elements. According to Budget 2025, eliminating these requirements will allow Crown corporations to access the credit more efficiently, better support clean electricity investment, and reduce administrative burden.

(c) EV Supply Chain ITC

Budget 2024 announced a refundable EV Supply Chain ITC equal to 10 per cent of the capital cost of eligible building property used in qualifying EV supply chain segments: (i) EV assembly, (ii) EV battery production, and (ii) cathode active material ("CAM") production.

The FES 2024 provided detailed design and implementation parameters for the EV Supply Chain ITC, including the scope of eligible corporations, property, and investment thresholds. Budget 2025 does not speak to or otherwise address this ITC, and therefore the following design features remain as previously set out in the FES 2024:

- Eligible corporations: The EV Supply Chain ITC would be available only to taxable Canadian corporations that invest directly in eligible property. It would not be available to partnerships or trusts.

- Eligible property: The EV Supply Chain ITC

would be available for buildings and structures, including their

component parts, that are described in paragraph (q) of CCA Class

1. Further, all or substantially all of the use of property must be

in one or more of the three qualifying EV supply chain segments:

- EV assembly, which would comprise the final assembly of a motor vehicle that is either fully electric or a plug-in hybrid that has a battery capacity of at least 7kWh;

- EV battery production, which would comprise the manufacturing of battery cells used in the powertrains of fully electric or plug-in hybrid vehicles, or battery modules used in the powertrains of fully electric or plug-in hybrid vehicles; and

- CAM production, which would include the production of CAM that is used as inputs to the manufacturing of battery cells used in the powertrains of fully electric or plug-in hybrid vehicles; but exclude preliminary processing activities, such as activities that could generally allow property to qualify for the Clean Technology Manufacturing ITC.

- Machinery and equipment investment

requirement: To be eligible for the EV Supply Chain ITC, a

corporation (either by itself or as part of a related group, such

as with a Canadian parent company) must invest at least $100

million in each of the three qualifying EV supply chain segments,

by either:

- acquiring at least $100 million of property eligible for the Clean Technology Manufacturing ITC that has become available for use in each of the three segments; or

- acquiring at least $100 million of property eligible for the Clean Technology Manufacturing ITC that has become available for use in each of two segments and hold a qualifying minority interest (i.e., at least 10 per cent of the voting shares and 10 per cent of the value of the shares) in another corporation that acquires at least $100 million of property eligible for the Clean Technology Manufacturing ITC that has become available for use in the remaining segment.

- Recapture rules: The recapture rules would be similar to the existing recapture rules for the Clean Technology Manufacturing ITC. The recapture period is 10 years from the date of acquiring a particular eligible property.

- Timing: The EV Supply Chain ITC would apply to property that is acquired and becomes available for use on or after January 1, 2024.

- Phase-out: The EV Supply Chain ITC would be

reduced to

- five per cent for property that becomes available for use in 2033 or 2034; and

- onil for property that becomes available for use after 2034.

In early 2025, the Department of Finance launched a public consultation on draft legislative proposals to implement the EV Supply Chain ITC. The consultation ran from February 21 to March 14, 2025, seeking feedback from stakeholders on the proposed framework for the credit, including eligibility, qualifying segments, and administrative requirements. The consultation has now closed, and the Department has indicated that feedback will be considered in preparing final legislative proposals.

Other design elements would generally mirror the Clean Technology Manufacturing ITC.

(d) Clean Hydrogen ITC: Extension to methane pyrolysis

The Clean Hydrogen ITC is a refundable credit available to taxable Canadian corporations (including via partnerships) of up to 40 per cent of the cost of eligible equipment used in clean hydrogen production. The rate of the credit depends on the hydrogen's assessed carbon intensity ("CI").

Eligible pathways for clean hydrogen production currently include hydrogen produced from:

- the electrolysis of water (including methods such as Proton Exchange Membrane Electrolysis, Alkaline Electrolysis, and Anion Exchange Membrane Electrolysis); or

- the reforming or partial oxidation of eligible hydrocarbon (e.g., natural gas, eligible renewable hydrocarbon) coupled with carbon dioxide ("CO 2 ") captured using a carbon capture, utilization, and storage ("CCUS") process (including methods such as Steam Methane Reforming and Autothermal Reforming).

The FES 2024 proposed to expand the eligible pathways to include methane pyrolysis, i.e., hydrogen produced from the pyrolysis of natural gas and other eligible hydrocarbons. The existing design features of the Clean Hydrogen ITC would generally apply, with the following pathway-specific design details:

- Eligible projects: Unlike the reforming and partial oxidation production pathways, the pyrolysis process would not be required to capture CO 2 emissions using a CCUS process (except dual-use heat and power equipment).

- Eligible equipment: Eligible equipment would also include property that is used to produce all or substantially all hydrogen from methane pyrolysis, determined without reference to any solid carbon that is produced (such as pyrolysis reactors; heat exchangers; separation equipment and purifiers; and compression and on-site storage equipment.)

- Limit on coverage of pyrolysis reactor system costs: The Clean Hydrogen ITC would only be available to support the capital costs of the pyrolysis reactor system up to $3,000 per tonne of annual hydrogen production capacity.

- CI: The CI of methane pyrolysis projects would also depend on the end use of the produced solid carbon.

- Carbon End-Use Plan: The taxpayer must track the end use of their solid carbon through an "End-Use Plan," the compliance to which must be set out in the terms of contracts with their solid carbon offtakers prior to the beginning of the compliance period for the Clean Hydrogen ITC.

- Venting and flaring: Methane pyrolysis projects would be restricted from venting or flaring the hydrogen produced by the project (other than venting/flaring for system integrity and safety).

- Timing: The methane pyrolysis pathway would apply in respect of property that is acquired and becomes available for use in an eligible project on or after December 16, 2024.

The FES 2024 also indicated that other low-carbon hydrogen production pathways may be added.

Budget 2025 confirms the Government's intention to proceed with the inclusion of methane pyrolysis as an eligible pathway under the Clean Hydrogen ITC.

(e) Carbon Capture, Utilization, and Storage ITC

The Carbon Capture, Utilization, and Storage ITC is a refundable credit available to taxable Canadian corporations for eligible expenditures related to carbon capture, utilization, and storage activities.

There are three different credit rates, depending on the purpose of the eligible equipment. Under the current framework, the following rates apply to eligible expenditures incurred from the beginning of 2022 to the end of 2030, with reduced rates scheduled to apply for expenditures incurred from 2031 to 2040:

- 60 per cent for eligible capture equipment used in a direct air capture project (reduced to 30 per cent for expenditures from 2031 to 2040);

- 50 per cent for all other eligible capture equipment (reduced to 25 per cent for expenditures from 2031 to 2040); and

- 37.5 per cent for eligible transportation, storage and use equipment (reduced to 18.75 per cent for expenditures from 2031 to 2040).

The extent to which the tax credit is available depends on the end use of the carbon dioxide being captured. Eligible uses include dedicated geological storage and storage in concrete. Enhanced oil recovery remains ineligible.

Budget 2025 proposes to extend the availability of the full Carbon Capture, Utilization, and Storage ITC rates by five years, so that the full credit rates will apply to eligible expenditures incurred from the start of 2022 to the end of 2035. Expenditures incurred from the beginning of 2036 to the end of 2040 will remain subject to the lower credit rates described above.

In addition, Budget 2025 announces that the government will postpone the previously planned review of the ITC rates (which was originally to occur before 2030). The next review will now take place before 2035. This extension provides greater certainty for long-term carbon capture projects that often require multi-year development and construction periods.

(f) Clean Technology Manufacturing ITC: Expansion of critical minerals

The Clean Technology Manufacturing ITC is a refundable credit equal to 30 per cent of the cost of investments in new machinery and equipment used to manufacture or process key clean technologies, or to extract, process, or recycle critical minerals essential for clean technology supply chains (i.e., lithium, cobalt, nickel, graphite, copper, and rare earth elements).

When first introduced, the credit applied to activities related to critical minerals such as lithium, cobalt, nickel, graphite, copper, and rare earth elements. These minerals are foundational inputs for clean technology manufacturing, including batteries, electric motors, and renewable energy infrastructure.

Budget 2025 proposes to expand the list of critical minerals eligible for the Clean Technology Manufacturing ITC to include antimony, indium, gallium, germanium, and scandium. As outlined in the Budget, this expansion builds on the Government's ongoing efforts to maintain Canada's clean economy investment tax credits as competitive, targeted, and effective tools for attracting new projects and creating high-quality jobs. By broadening the range of eligible minerals, the Government aims to enhance the investment environment for clean technology manufacturing, encourage greater participation in domestic supply chains, and support sustained growth across Canada's clean economy.

This measure would apply to property that is acquired and becomes available for use on or after Budget Day (November 4, 2025).

Footnotes

1 2022 FCA 178.

2 CRA Views 2024-1027501E5, "Stacking of investment tax credits and CCA", October 21, 2024.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.