Welcome to the February issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- The Bureau completes nine merger reviews in January 2023, the same number as it completed in January 2022 (nine) and 40% fewer than the number completed in January 2021 (15).

- The Federal Court of Appeal dismisses the Competition Bureau's appeal to block the Rogers-Shaw merger.

- 2023 transaction review thresholds under the Competition Act and Investment Canada Act are announced.

Merger Monitor

January 2023 Highlights

- Nine merger reviews completed

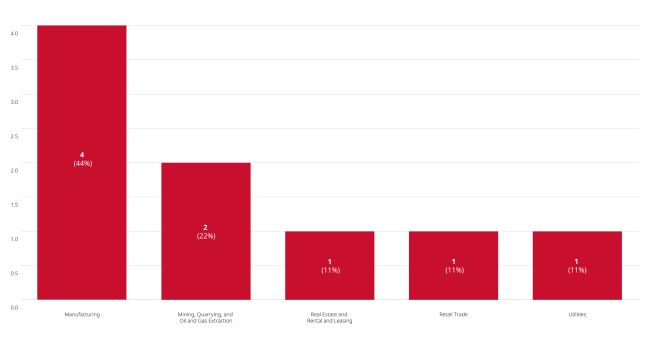

- Primary industries: manufacturing (44%); mining, quarrying, and oil and gas extraction (22%); real estate and rental and leasing (11%); retail trade (11%); utilities (11%)

- Zero consent agreements (remedies) filed

- Zero judicial decisions filed

- Four transactions received an Advance Ruling Certificate (44%); five transactions received a No Action Letter (56%)

Merger Reviews Completed in 2023 by Primary Industry

Merger Enforcement Activity

The Federal Court of Appeal dismisses Bureau's appeal to block the Rogers-Shaw merger

- On January 24, 2023, the Federal Court of Appeal (FCA) dismissed the Commissioner of Competition's (Commissioner) appeal from the Competition Tribunal's (Tribunal) decision dismissing the Commissioner's application to block the merger of Rogers Communications Inc. and Shaw Communications Inc. including Shaw's divestiture of Freedom Mobile Inc. to Vidéotron Ltd. The FCA found that the Tribunal did not commit any legal errors. The Commissioner's primary argument on appeal concerned the Tribunal's decision to consider the divestiture of Freedom Mobile as part of the Rogers-Shaw merger, rather than as a proposed remedy. Had the Tribunal adopted the Bureau's approach, Rogers and Shaw, rather than the Commissioner, would have held the burden of proof with respect to establishing the impacts of the divestiture. The FCA rejected the appeal, holding that the Tribunal is not beholden to the transaction as pleaded by the Commissioner, except where a change to the transaction results in procedural unfairness (which the Bureau admitted was not present in this case). The FCA held that even if the Tribunal had erred on these legal issues, there would have been no impact on the outcome of the case, given the Tribunal's finding that the merger and divestiture were not likely to substantially prevent or lessen competition, and were actually pro-competitive in some respects.

Non-Enforcement Activity

Minister Champagne will not change merger notification thresholds in 2023; extends the deadline for an ongoing public consultation regarding the Competition Act

- On February 2, 2023, François-Philippe Champagne, the Minister of Innovation, Science, and Industry (Minister) announced that the transaction-size threshold for the advance notification of mergers under the Competition Act will remain set at C$93-million in 2023; the transaction-size threshold has remained unchanged since it was reduced from C$96-million to C$93-million in 2021.

- The Minister also announced that the deadline for Canadians to submit comments in connection with the ongoing review of the Competition Act has been extended to March 31, 2023. For more information regarding the review, see the November 2022 edition of Competitive Edge.

Investment Canada Act

Non-Cultural Investments

October 2022 Highlights

- Zero reviewable investment approvals and 64 notifications filed (41 for acquisitions and 23 for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (48%); Netherlands (6%); France (6%); India (6%)

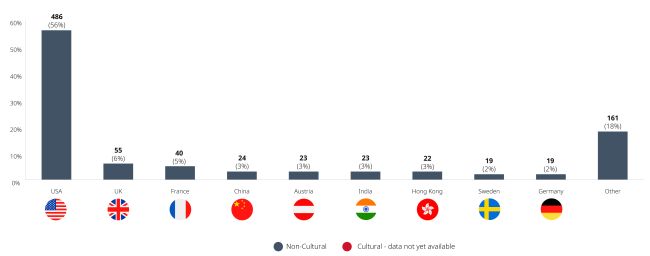

January – October 2022 Highlights

- One reviewable investment approval and 871 notifications filed (645 for acquisitions and 226 for the establishment of a new Canadian business)

- Country of origin of investor: U.S. (56%); U.K. (6%); France (5%); China (3%); Austria (3%); India (3%)

Government of Canada publishes updated thresholds for Investment Canada Act reviews

- The Government of Canada has released the 2023 thresholds that will determine whether investments by foreign investors will be subject to a pre-closing "net benefit" review, subject to publication in the Canada Gazette:

- The threshold for investors that are not state-owned

enterprises based in countries party to a trade agreement with

Canada increased to C$1.931-billion in enterprise value (from

C$1.711-billion). This threshold applies to investors based in

countries party to the following trade agreements:

- Canada-United States-Mexico Agreement (CUSMA)

- Canada-UK Trade Continuity Agreement (Canada-UK TCA)

- Canada-European Union: Comprehensive Economic and Trade Agreement (CETA)

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP)

- Canada-Chile Free Trade Agreement

- Canada-Peru Free Trade Agreement

- Canada-Colombia Free Trade Agreement

- Canada–Panama Free Trade Agreement

- Canada-Honduras Free Trade Agreement

- Canada-Korea Free Trade Agreement (CKFTA)

- The threshold for investors that are not state-owned enterprises based in other World Trade Organization countries increased to C$1.287-billion in enterprise value (from C$1.141-billion).

- The threshold for state-owned enterprise investors from World Trade Organization countries increased to C$512-million in book value of assets of the Canadian business being acquired (C$454-million).

- The threshold for all investors in a cultural business and all investors that are not World Trade Organization countries remained at C$5-million in book value of assets of the Canadian business being acquired.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

For permission to reprint articles, please contact the bulletin@blakes.com Marketing Department.

© 2025 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.