Welcome to the July issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity continues to be strong, with the number of completed merger reviews through the end of May (107) being 11 per cent higher than the number of completed reviews through the same period two years ago in 2019 (96). When compared to 2020, which saw a reduction in merger activity resulting from the pandemic, completed merger reviews through the first half of 2021 are 45 per cent higher than the number of completed reviews through the same period in 2020 (74).

- Competition Bureau investigates marketing practices regarding pandemic benefit programs.

- Competition Bureau reaches agreement with Federated Co-operatives Limited and Blair's on their proposed joint venture.

- Investment Canada Act 2019-2020 Annual Report released.

Merger Monitor

June 2021 Highlights

- 15 merger reviews completed

- Primary industries: real estate and rental and leasing (27 per cent); mining, quarrying and oil and gas extraction (20 per cent); and manufacturing (13 per cent)

- Zero consent agreements (remedies) filed

- 12 transactions received an Advance Ruling Certificate (80 per cent), while three transactions received a No Action Letter (20 per cent)

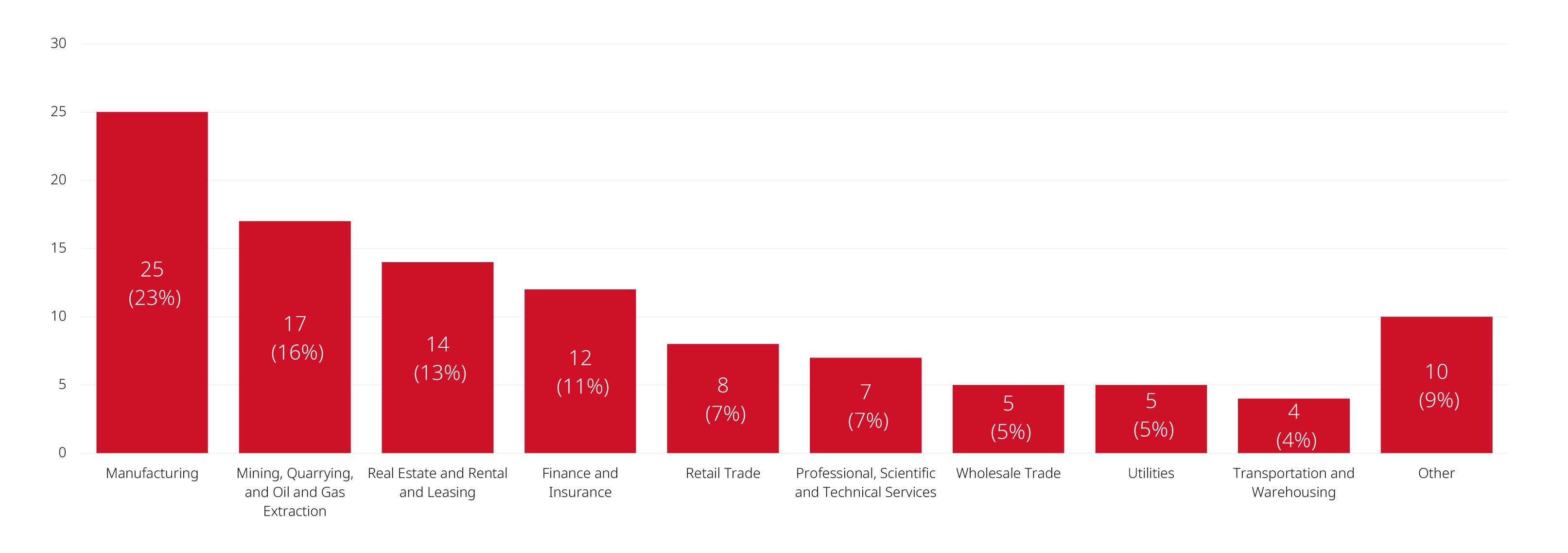

January – June 2021 Highlights

- 107 merger reviews completed

- Primary industries: manufacturing (23 per cent); mining, quarrying and oil and gas extraction (16 per cent); real estate and rental and leasing (13 per cent); and finance and insurance (11 per cent)

- Zero consent agreements (remedies) filed

- 76 transactions received an Advance Ruling Certificate (71 per cent), while 31 transactions received a No Action Letter (29 per cent)

Misleading Advertising Enforcement

Multiple criminal charges laid in online business directories case

- On June 14, 2021, the Competition Bureau announced that they have laid charges under the deceptive marketing provisions of the Competition Act, against an individual from Ontario, for making false or misleading statements to promote business listings, including failure to disclose applicable pricing, terms and conditions for services. The Bureau also brought charges against this individual on multiple grounds under the Criminal Code.

Competition Bureau investigates marketing practices regarding pandemic benefit programs

- On July 9, 2021, the Competition Bureau announced that it had obtained a section 11 court order (on July 2, 2021) compelling Canada Tax Reviews Inc. (Canada Tax) to produce relevant records and written returns in relation to the Competition Bureau's inquiry into Canada Tax's potentially deceptive marketing practices. In particular, the Bureau's inquiry concerns potentially false or misleading claims made by Canada Tax when promoting services to Canadians wanting to apply for government benefit programs implemented in response to COVID-19.

Bid-Rigging

Fifth engineering executive charged in Gatineau bid-rigging case

- On June 29, 2021, the Competition Bureau announced that they had brought charges under the Criminal Code against a fifth individual, in connection with a bid-rigging conspiracy for City of Gatineau infrastructure contracts. The Bureau's charges included fraud over C$5,000, conspiracy to commit fraud, and conspiracy to rig bids. All four individuals previously charged in June 2018 have now pled guilty and received conditional sentences for their respective roles in the Gatineau bid-rigging scheme.

Merger Enforcement

Competition Tribunal and Federal Court of Appeal dismiss bid to block closing of merger

- On July 1, 2021, the Competition Tribunal released a decision denying the Commissioner of Competition's application to block closing of the merger between SECURE Energy Services Inc. (SECURE) and Tervita Corporation (Tervita). The Commissioner then launched an urgent appeal of this decision before the Federal Court of Appeal (FCA). The FCA found, applying the standard test for injunctions, that there was no irreparable harm and that the balance of convenience militated in favour of allowing closing to occur and dismissed the application. On July 2, 2021, SECURE announced the closing of its merger with Tervita, to form one entity, continuing under the name SECURE Energy Services Inc.

Competition Bureau reaches agreement with Federated Co-operatives Limited and Blair's on their proposed joint venture

- On July 7, 2021, the Competition Bureau released a statement announcing that it had entered into a registered consent agreement with Federated Co-operatives Limited (FCL) and Blair's Family of Companies (Blair's) that will preserve competition for the sale of crop inputs in Lipton, Saskatchewan. To resolve the Bureau's concerns over the competitive impact of their proposed joint venture, Blair's and FCL have agreed to sell Blair's retail location in Lipton, and two nearby anhydrous ammonia facilities.

Non-Enforcement Activity

Competition Bureau Performance Measurement & Statistics

Report 2020-2021

The Competition Bureau released their Performance Measurement & Statistics

Report (PMSR) for the 2020-2021 fiscal year (April 1, 2020

– March 31, 2021). Highlights of the PMSR include:

- 179 Pre-Merger Notification Filings pursuant to section 114(1) of the Competition Act and Advance Ruling Certificate requests pursuant to section 102 of the Competition Act. This represents a decrease of 51 filings from the 2019-2020 fiscal year.

- 11 Supplementary Information Requests were issued for concluded matters, pursuant to section 114(2) of the Competition Act. This is relatively consistent with previous years (nine issued in 2019-20; 13 in each of 2018-19 and 2017-18).

- 97.5 per cent of the 125 Non-Complex Merger Reviews were completed within the Bureau's service standard, consistent with 2019-20 (98.5 per cent), with the average duration of non-complex merger reviews being 10.21 days in 2020-21 (down from 10.97 days in 2019-20).

- 84 per cent of the 50 Complex Merger Reviews were completed within the Bureau's service standard, a decline from 93 per cent in 2019-20, with the average duration of a complex merger review being 46.06 days, an increase from 36.09 days in 2019-2020.

Speeches

Closing remarks – ICPEN Conference 2021

- On June 24, 2021, Deputy Commissioner Josephine Palumbo provided remarks to attendees of the virtual International Consumer Protection Enforcement Network Conference (ICPEN). Deputy Commissioner Palumbo stated that Canada's Presidency will leave certain values behind on the ICPEN's framework, including inclusivity, transparency, diversity of voice and collaboration. Deputy Commissioner Palumbo also emphasized the need for ICPEN to keep pace with a rapidly evolving digital economy, continue their efforts toward fostering coordinated enforcement action among international organizations and cultivate deeper protection strategies for consumers.

Investment Canada Act

April 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 106 notifications filed (80 for acquisitions and 26 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (58 per cent), Germany (five per cent) and Austria (four per cent)

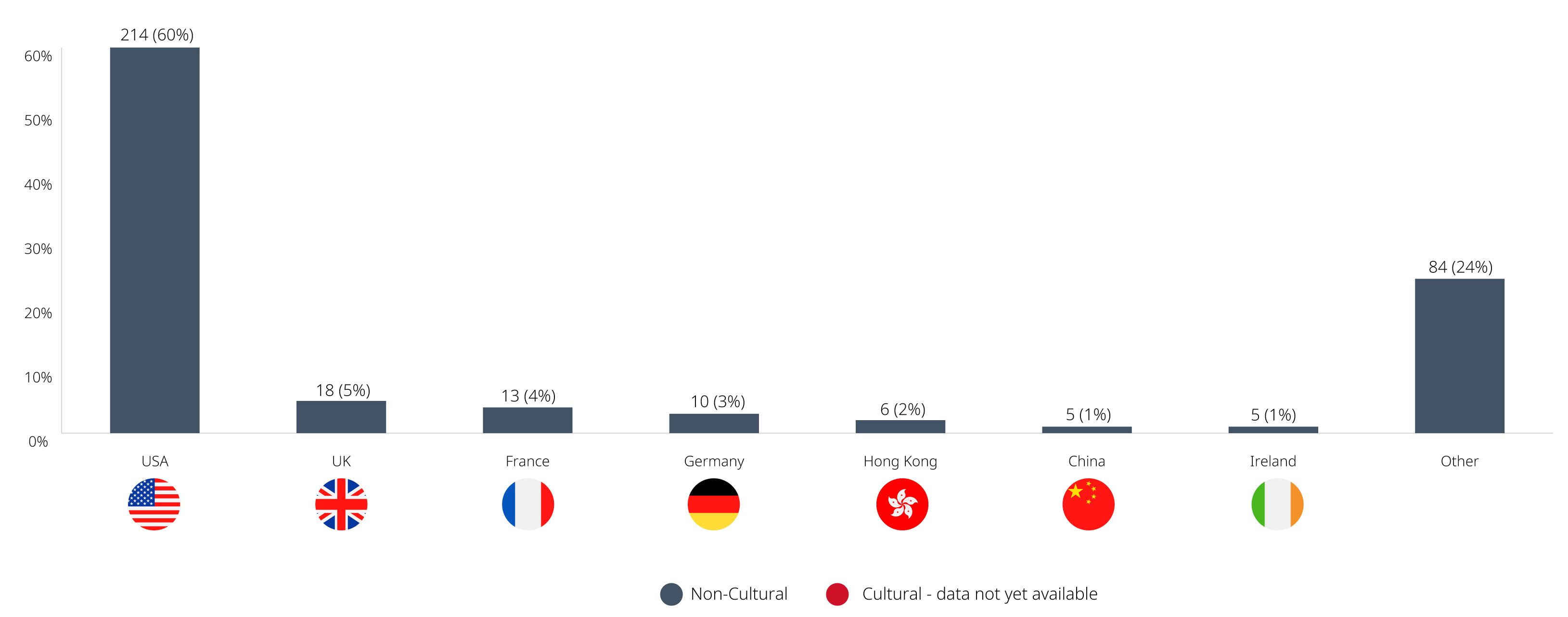

January – April 2021 Highlights

- For non-cultural investments: zero reviewable investment approvals and 355 notifications filed (271 for acquisitions and 84 for the establishment of a new Canadian business)

- Country of origin of investor (non-cultural): U.S. (60 per cent), UK (five per cent), France (four per cent) and Germany (three per cent)

Investment Canada Act 2019-2020 Annual Report now available

The Investment Canada Act 2019-2020 Annual Report was released on July 8, 2021, providing information and statistics on the administration of the Investment Canada Act (ICA) during the government's 2019-2020 fiscal year (from April 1, 2019 to March 31, 2020). Highlights include:

- For a second straight year, a new, all-time high of investment filings (1,032) under the ICA was achieved, including nine applications for review and 1,023 notifications (768 notifications for the acquisition of control of an existing Canadian business and 255 notifications for the establishment of a new Canadian business).

- The United States (47.0 per cent), the United Kingdom (17.8 per cent), and the European Union (15.9 per cent) were the most common countries of origin for investors, accounting for 833 of the 1,032 filings (80.7 per cent) and representing more than 90 per cent of the total enterprise value of investments.

- The leading sector in terms of number of investments was Business and Services Industries (457 investments), followed by Other Services (203) and Manufacturing (193) while the top sectors by enterprise value were Business and Services Industries (C$34,825-million), Resources (C$27,099-million) and Other Services (C$22,489-million).

- With respect to the ICA national security regime, ten notices were issued under section 25.2 of the ICA that an order for a formal national security review of the investment may be made (this is a slight increase in the number of 25.2 notices issued in 2018-19 (nine), but more than double the number of notices issued in each of 2017-18 and 2016-17 (four in each fiscal year)). Seven of these investments were subsequently ordered to undergo a formal national security review, of which one was found to require no further action, three were withdrawn by the investors and three resulted in an order for divestiture of the Canadian business.

Blakes Notes

- To read more thought leadership insights from the Competition, Antitrust & Foreign Investment group, please click here.

- For the latest legal and business updates regarding COVID-19, visit our Resource Centre.

For permission to reprint articles, please contact the bulletin@blakes.com Marketing Department.

© 2025 Blake, Cassels & Graydon LLP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.