Canada's Competition Act provides that certain types of transactions (Notifiable Transactions) exceeding monetary and other thresholds - referred to as "party- size" and "transaction-size" thresholds - must be notified to the Commissioner of Competition (Commissioner), who is the head of the Competition Bureau (Bureau), prior to closing. In the absence of an exemption or a waiver, parties to Notifiable Transactions must provide the Commissioner with prescribed information and comply with a specified waiting period before completing the transaction.

Parties that have completed a Notifiable Transaction without complying with these provisions may have committed a criminal offence and be liable for significant fines and court-ordered remedies, including dissolution of the transaction.

It is important to note that, irrespective of size, all acquisitions of control or of a significant interest in the business of another entity with a real and substantial connection to Canada may be subject to review and possible challenge by the Commissioner for up to one year after closing if the Commissioner finds that the merger is likely to prevent or lessen competition substantially. Only the Commissioner can challenge a merger under the Act. Applications by the Commissioner are heard by the Competition Tribunal, which is a quasi-judicial body comprising lay and judicial members. Recent years have seen an uptick in the Commissioner's review of non- notifiable mergers; therefore parties to these proposed acquisitions should consult competition law experts early in the process to minimize the risk of unforeseen consequences.

This step-by-step guide is designed to assist with determining whether a proposed transaction is subject to mandatory pre-merger notification in Canada. All amounts are expressed in Canadian dollars and are based on audited financial statements for the most recent fiscal year - for example, asset values refer to book value reported in audited financial statements, not fair market value. (Monetary amounts referenced in this guide are current as of April 1, 2021.)

Determining Whether a Transaction Is Notifiable

Step 1: Assess the Transaction-Size Threshold

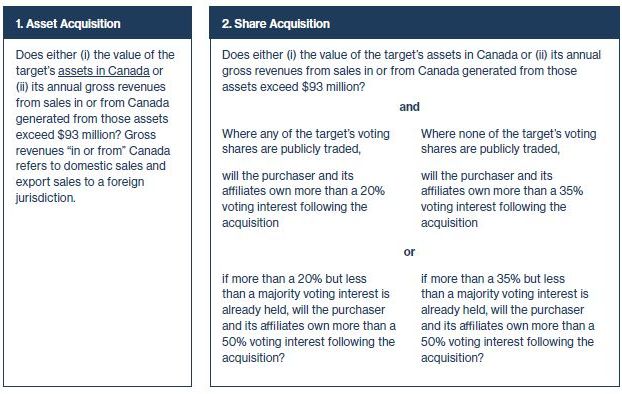

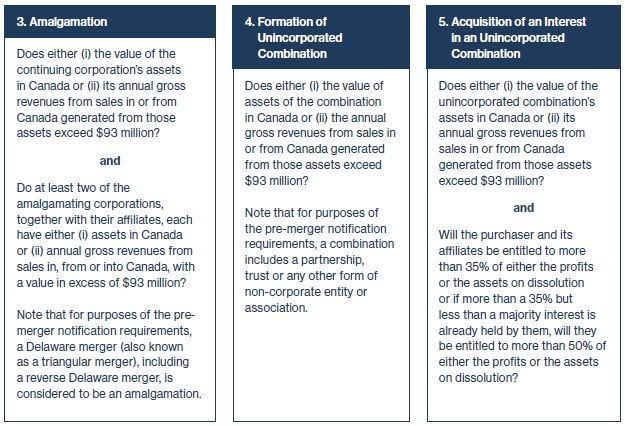

The Act contemplates five broad categories of transactions that are subject to pre-merger notification (listed below). Each category requires that the target has an "operating business" in Canada, defined as a business undertaking in Canada to which employees employed in connection with the undertaking ordinarily report for work.

If there is an "operating business" in Canada, does the proposed transaction exceed the applicable transaction-size threshold on the basis of the relevant transaction type below?

If yes, proceed to Step 2 to assess the party-size threshold.

If the applicable transaction-size threshold is not exceeded, pre-merger notification is not mandatory, even if the parties meet the party-size threshold.

Step 2: Assess the Party-Size Threshold

Do the parties to the transaction together with their affiliates collectively have either

- assets in Canada

or - gross revenues from sales in, from or into Canada

in excess of $400 million? Gross revenues "in, from or into" Canada refers to domestic sales, export sales to a foreign jurisdiction, and import sales from a foreign jurisdiction.

If the proposed transaction exceeds the party-size threshold, it is notifiable subject to any exemption or waiver that may apply. Proceed to Step 3.

If not, pre-merger notification is not mandatory.

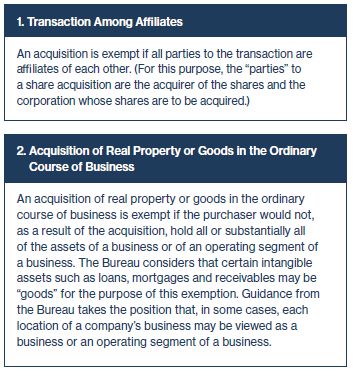

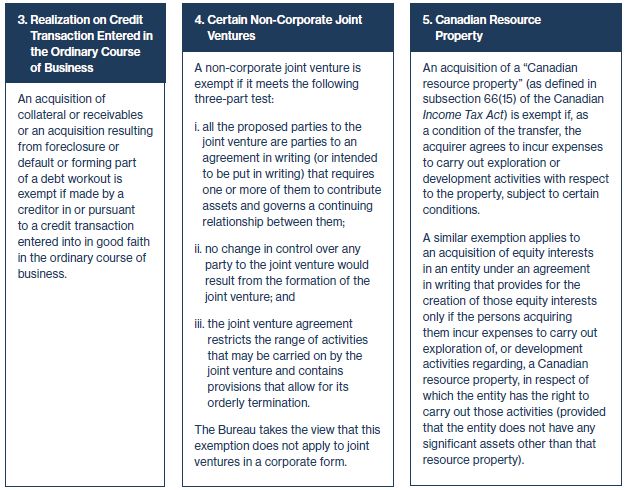

Step 3: Evaluate Possible Exemptions

A transaction that satisfies both of the above thresholds may not be subject to pre-merger notification if it falls within a statutory exemption.

Do any of the exemptions below apply in respect of the proposed transaction? This is not an exhaustive list and other exemptions may be available. The Commissioner may also waive the requirement to pre-notify where satisfied that the proposed transaction is not likely to prevent or lessen competition substantially.

If no exemption applies, the proposed transaction is subject to mandatory pre-notification. Proceed to the following section for guidance on notification and clearance.

If any of the exemptions above apply, pre-merger notification is not mandatory.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.