- within Consumer Protection topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Transport industries

Steven Pettigrove, Jake Huang, Luke Higgins and Luke Misthos of the Piper Alderman Blockchain Group bring you the latest legal, regulatory and project updates in Blockchain and Digital Law.

Stripe's $1.1B acquisition: What it means for stables and crypto VC

Financial services and software as a service company Stripe has acquired Bridge, a stablecoin platform for USD $1.1 billion. As one of the largest crypto deals in history, it reignites the conversation around stablecoins as a potentially revolutionary use case for blockchain technology outside of Bitcoin's "store of value" narrative. The acquisition hints at larger implications for stablecoins and the wider crypto venture capital landscape.

According to one of its founders, Bridge aims to build a global stablecoin payments network to "enable companies to use a stablecoin rail without thinking about it". The company enables businesses to accept fast and low-cost payments without needing to deal in stablecoins directly. Bridge was founded by Coinbase and Square alumni, and raised $40 million in August in a round led by Sequoia.

Stripe recently re-enacted stablecoin payments in the US via Solana, Ethereum and Polygon. Solana's recent push to integrate stablecoins into its ecosystem has been notable, with efforts like attracting PayPal's stablecoin and supporting Solana-native stablecoin-focused startups like Perena, Sphere, and Lulo. The Stripe acquisition signals that the demand for faster, cheaper stablecoin infrastructure is growing.

Stripe's move bolsters confidence in the future of stablecoins, showing that major fintech players believe in their potential to transform payments and financial services. Just last week, A16Z's State of Crypto report observed that stablecoins have product-market fit with USD $8.5 trillion worth of transaction volume across 1.1 billion transactions in the second quarter of 2024 ending 30 June alone.

One of the enduring challenges in crypto venture capital has been the limited exit opportunities for startups. With traditional IPOs being rare in the space, VCs often rely on token launches and airdrops to generate returns, which can lead to short-term thinking and market volatility. Stripe's acquisition of Bridge represents a more traditional pathway for VCs to exit through equity-based deals.

The deal suggests a potential dual-path exit strategy for crypto investments. The upside might be longer term thinking, with a renewed emphasis on product development and user growth, and away from short term token speculation.

Stripe's acquisition signals that stablecoins might be the next big frontier in crypto. It also represents a broader vote of confidence in public blockchains as emerging payment rails.

Bricks and blocks: US startups target tokenised real estate

Tokenisation of real world assets (RWA) – the process of representing physical and financial assets as digital tokens on a distributed ledger such as a blockchain – is often cited as an exciting real world use case for blockchain technology. Advocates say it has the potential to unlock and diversify economic opportunity by creating greater liquidity in and access to private assets.

The Financial Times has reported that US investors are testing the waters in real property tokenisation, which slides a house or hotel into digital tokens that represent ownership, and gives would-be buyers the ability to hold a digital sliver of a bricks-and-mortar building.

It is gaining popularity among crypto fans seeking new areas in which to invest their funds and use blockchain technology — and as high house prices in large cities like London and New York make investing in property outright increasingly unaffordable for many. Real estate tokenisation offers a lower threshold to invest, and investors can benefit from the potential to rise in property value and incoming rents.

US Property tokenisation companies such as Lofty, RealT and HouseBit offer a range of buildings to invest in, using either cryptocurrency or standard bank deposits.

Founded in 2018 in Miami, Lofty is backed by the Silicon Valley start-up incubator that spawned companies including Airbnb and the crypto exchange Coinbase. Property sellers list their buildings on the website and Lofty creates a company registered in Wyoming for each one, making tokens representing the ownership, each valued at $50. Each token will also hold information such as the asset's ownership history, trading and regulatory details, and the tokens live on a blockchain, which essentially acts as a digital record keeper. Calling itself the "NASDAQ For Real Estate", Lofty has tokenised more than 181 properties to date.

Compared to more established investment products like real estate investment trusts (REITs) which typically own or finance large groups of commercial and residential buildings, some argue tokenised real estate promises a more tangible way to invest small amounts in individual properties. Jerry Chu, founder of Lofty says,

Real estate is a very emotional asset class... REITs exist and funds exist [but] people seem to be a lot happier about ownership when they can say, 'It's this address, I own it because of these reasons.'

In Australia alone, Digital Economy Council of Australia (DECA) reported that RWA tokensiation can unlock up to AUD $12 billion per year in potential economic gains. Globally, McKinsey and Boston Consulting Group estimated that tokenising illiquid assets could create a market worth between $2tn and $16tn by 2030 – tokenised home equity alone could be worth $3.2tn, and allow investors from around the world to hold slices of illiquid assets that are otherwise difficult to own.

Meanwhile, tokenisation is also taking off on Wall Street — BlackRock and Fidelity International are among the asset managers exploring tokenising funds in order to make it cheaper and easier to move assets, though these are largely only available to institutional investors only.

However, RWA tokensation remains a legal grey zone in many countries including Australia. Australia's current regulatory regime premised on paper or centralised ledgers and centralised intermediaries presents an obstacle to unlocking the ownership economy and allowing access to concentrated private markets.

DECA argues that a primary barrier to realizing this potential Australia's current regulatory framework. Without reform, Australia risks falling behind other nations in the global tokenisation market. Key recommendations include establishing a clear taxonomy for digital assets, reforming the licensing regime, and the introduction of regulatory sandboxes.

By adopting these reforms, the nation can position itself as a leader in the digital transformation of financial markets and allow a new generation to access markets currently dominated by institutions and high new worth investors.

A future perfect: DAOs as adaptive governance engines

The Royal Melbourne Institute of Technology (RMIT) Blockchain Innovation Hub, a leading research institute that studies blockchain technology and its applications, has published a paper exploring the innovative governance structures of Decentralised Autonomous Organisations (DAOs). The authors offer a fresh perspective on the capabilities of DAOs. Calling DAOs "adaptive governance engines", the paper says their true benefits are enabling low cost and fast change in governance structure in order to adapt to dynamic regulatory, competitive and financial environments.

What are DAOs?

The paper states that:,

a DAO is an organization whose essential operations are automated, agreeing to rules and principles assigned in code without human involvement. A DAO is a novel, scalable, self-organizing coordination on the blockchain, controlled by smart contracts.

In the fast-evolving world of blockchain and decentralised technologies, DAOs are emerging as a revolutionary model of governance.

Why DAOs Matter

The paper explains that traditional economic theories, particularly Ronald Coase's theory of the firm, argue that firms exist to reduce the transaction costs associated with market activities. Firms, as Coase explained, take over certain functions – like production and coordination – because they can do so more efficiently than relying purely on market mechanisms. DAOs, on the surface, seem to extend this logic by using blockchain technology to automate contracts and reduce costs further.

However, the authors argue that DAOs are much more than just cost-saving mechanisms that distribute and minimise agency costs through token governed smart contracts. The true value of DAOs lies in their ability to enable rapid, low-cost governance changes. In today's complex and rapidly shifting economic, regulatory and technological landscapes, organisations need to be adaptable. DAOs offer a flexible governance model that allows organisations to evolve and respond to these external changes more quickly than traditional firms.

This adaptability is key to their value. Traditional organisations often struggle to change their governance structures quickly, but DAOs make it possible to adjust governance in real-time through smart contracts and community voting mechanisms.

Case Studies

The paper considers three DAO case studies – Shapeshift, Uniswap and Optimism – to illustrate how DAOs can evolve and adapt to external pressures.

- Shapeshift, a cryptocurrency exchange, started as a centralised company but transitioned to a DAO in response to increasing regulatory pressures. This shift allowed Shapeshift to decentralise control, creating a wider community of stakeholders and seek to mitigate regulatory risks.

- Uniswap, a decentralised trading protocol, provides a different example. While initially centralised, it gradually transitioned to a DAO by introducing governance tokens. Although developers continue to lead protocol development, governance decisions, like protocol upgrades and treasury management, are ultimately decided by token-holders through voting. This gradual shift of control demonstrates the frameworks' ability to empower token-holders while the protocol continues to benefit from developer expertise.

- Optimism, a Layer 2 blockchain network, also transitioned from a centralised structure to a DAO. Optimism has embraced an experimental approach to governance, iterating on its structures and adapting based on feedback from its community. This iterative model showcases the potential of DAOs to experiment with new forms of governance and adapt to changing needs over time.

Conclusion

The paper provides a forward-thinking analysis of the potential for DAOs to redefine governance in the digital age. By positioning DAOs as adaptable and innovative governance tools, it opens the door for further exploration into how decentralised models can meet the needs of modern organisations in the digital economy.

Key takeaways from a16z's State of Crypto report

Andreessen Horowitz (a16z) recently released its 2024 report on the state of crypto, highlighting the continued growth and impact of blockchain technology. The report provides an overview of the significant trends in the space, from surging crypto usage to the convergence of artificial intelligence (AI) and blockchain. Below are the key takeaways from the report, which paint a picture of an industry poised for further innovation and adoption.

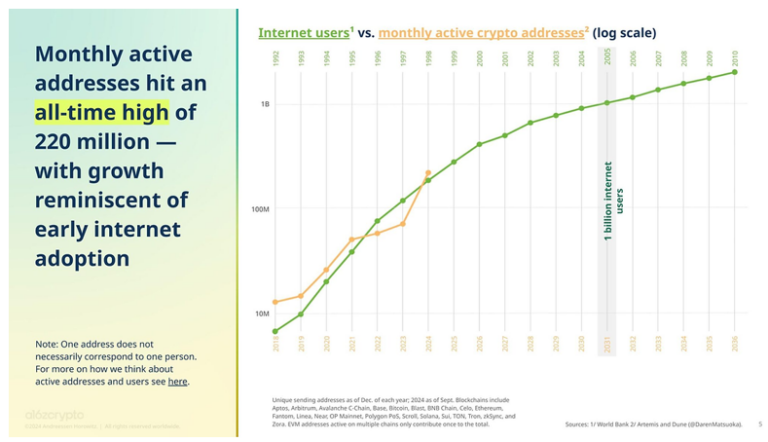

- Crypto Activity and Usage Reach All-Time Highs

2024 has seen unprecedented levels of crypto activity, driven by a surge in user engagement and transaction volume. The growth is fuelled by the increasing use of stablecoins, decentralised finance (DeFi), and blockchain applications in various sectors. Crypto's widespread appeal is evidenced by more consumers and businesses using blockchain technology for financial transactions, smart contracts, and digital assets.

Ethereum's Layer 2 (L2) networks and other scalable blockchains have also contributed to this expansion by significantly increasing transaction capacity and reducing fees. As more users tap into crypto's potential, usage is expected to continue its upward trajectory.

Source: Andreesen Horowitz

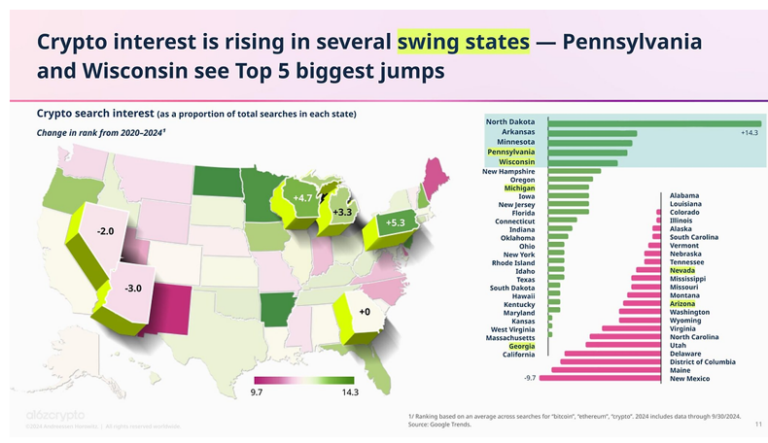

- Crypto Takes Center Stage in U.S. Politics

As the 2024 U.S. elections approach, crypto has emerged as a key political issue. Lawmakers and regulators are increasingly focusing on crypto's role in the financial system, and the topic is generating considerable debate across both political parties. With major legislative milestones in the past year, such as the approval of Bitcoin and Ethereum exchange-traded products (ETPs) and the passage of bipartisan crypto regulations, the industry is now firmly in the spotlight.

The regulatory landscape remains a focal point, and the outcome of the U.S. election could have far-reaching implications for the future of blockchain technology and digital assets.

Source: Andreesen Horowitz

- Stablecoins Secure Their Place in the Market

Stablecoins, a class of cryptocurrencies pegged to traditional assets like the U.S. dollar, have found solid product-market fit. Their popularity is soaring due to their ability to facilitate low-cost, nigh-instantaneous transactions without the volatility typically associated with other cryptocurrencies like Bitcoin. Stablecoins amounted to an eye-watering USD $8.5 trillion worth of transaction volume across 1.1 billion transactions in the second quarter of 2024 ending 30 June alone.

The ease of use and practicality of stablecoins make them an appealing solution for global remittances, cross-border payments, and everyday transactions. They're increasingly being adopted by businesses and consumers as a viable alternative to traditional payment systems.

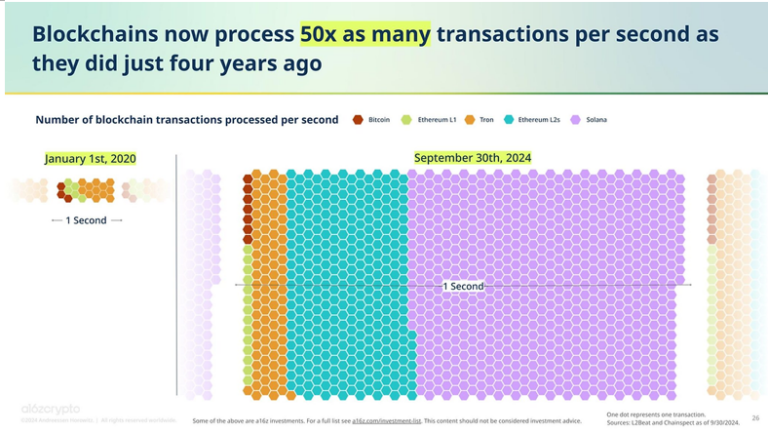

- Infrastructure Upgrades Reduce Costs and Boost Efficiency

Blockchain infrastructure has undergone significant improvements, increasing capacity and drastically reducing transaction costs. Ethereum's 2024 "Dencun" upgrade, also known as EIP-4844 or protodanksharding, has been a game-changer. By enhancing Layer 2 networks, this upgrade has lowered fees, making Ethereum transactions more accessible while maintaining high throughput.

In addition to Ethereum, zero-knowledge (ZK) proofs are playing an essential role in scaling and enhancing privacy on blockchains. As ZK proofs become more cost-effective and widely adopted, they are unlocking new possibilities for blockchain interoperability and application development.

Source: Andreesen Horowitz

- DeFi Continues to Grow

With more than USD $169 billion locked up in various protocols, DeFi remains one of the most important sectors in the crypto space. Since DeFi's rise in 2020, decentralised exchanges (DEXs) have grown to account for 10% of global spot crypto trading, a notable shift from centralised exchanges' dominance just four years ago.

Ethereum's transition to proof-of-stake in 2022 has further boosted DeFi's growth by reducing energy consumption and increasing network security. The percentage of staked Ether has nearly tripled in two years, further solidifying DeFi's presence in the crypto ecosystem.

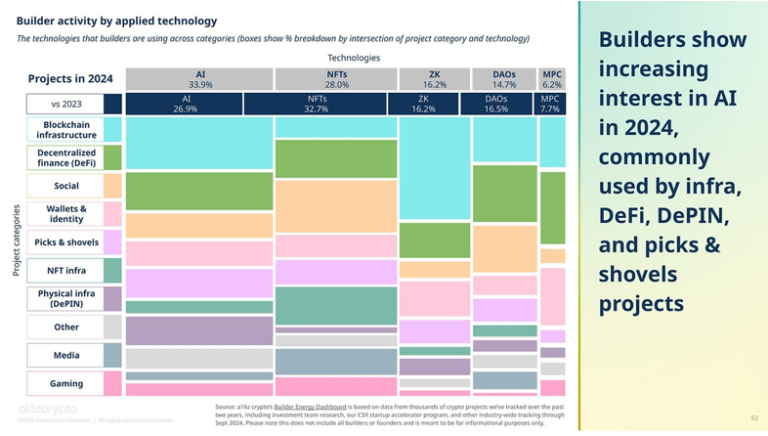

- Crypto Tackles AI's Centralisation Challenges

Artificial intelligence has been a hot topic in 2024, and crypto is seen as a solution to some of AI's biggest challenges, particularly around centralisation. As the cost of training advanced AI models skyrockets, only a few large tech companies have the resources to develop cutting-edge AI systems. Blockchain, with its decentralised nature, offers a potential solution to this issue.

Crypto projects like Gensyn and Story are already leveraging blockchain to democratise AI resources and track intellectual property. By combining the decentralisation of blockchain with AI's capabilities, these projects aim to create a more equitable and transparent technological landscape.

- Scalable Infrastructure Unlocks New Onchain Applications

As transaction fees decrease and blockchain networks become more scalable, new on-chain applications are emerging. One notable shift is in the non-fungible token (NFT) market. While NFTs were once known for high-value sales, the lower transaction costs have led to a rise in affordable, community-driven NFT collections on platforms like Zora and Rodeo.

Source: Andreesen Horowitz

Additionally, social networks and prediction markets are gaining traction on the blockchain. Social-related projects make up over 10% of new crypto developments in 2024, while crypto-based prediction markets, despite facing regulatory challenges in the U.S., are becoming more popular in other parts of the world.

Conclusion

a16z's report makes it clear that crypto has experienced significant growth in terms of scale and usage. The continued rise of stablecoins, DeFi, and scalable blockchain technology, combined with crypto's potential to address AI's challenges, sets the stage for further innovation.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.