- within Government, Public Sector, Privacy and Immigration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Law Firm industries

Reforms to Australia's AML/CTF regime have been passed and are set to commence in 2026. The concept of "value transfer" has been introduced and has associated reporting implications for reporting entities (financial institutions, remittance providers and virtual asset services providers – current digital currency exchanges).

Further details are to come in the new AML/CTF Rules (currently in draft). While these changes do not start until 31 March 2026, reporting entities should become familiar with these changes by reviewing the draft rules so that they are on track to implement them when they are finalised. This will help ensure they continue to stay compliant with the AML/CTF regime in its next iteration.

What is a value transfer chain?

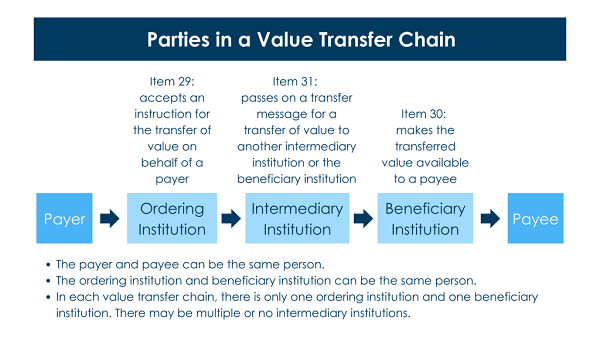

A transfer of value means a transfer that involves money, virtual assets or property (except physical currency and other tangible property). In a value transfer chain, the transfer is facilitated from an ordering institution (on behalf of the payer) to the beneficiary institution (on behalf of the payee). One or more intermediary institutions may also be involved to connect the ordering institution to the beneficiary institution. The payer and payee may be the same person. The ordering institution and the beneficiary institution may also be the same.

| Who may be part of a value transfer chain? | Who is NOT part of a value transfer chain? |

|---|---|

|

|

If you are part of a value transfer chain, what do you need to do?

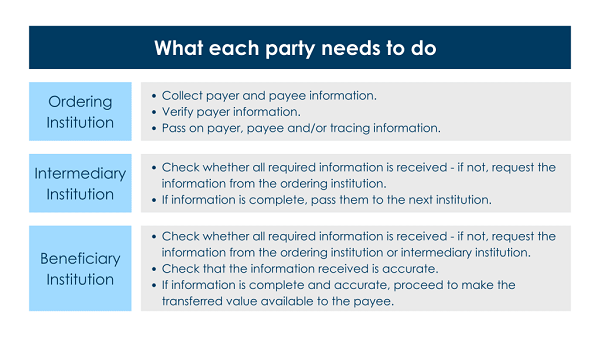

Generally, the ordering institution will need to collect information about the payer and payee, verify payer information and then pass them on to the next institution (either the beneficiary institution or an intermediary institution). The next institution (either the beneficiary institution or an intermediary institution) will then check that it has all the required information and that the information received is accurate, before it proceeds to complete its part in the value transfer chain. The specific information that an institution needs to collect, verify and/or pass on depends on the circumstances of the transfer, which will be detailed in the new AML/CTF Rules.

If the value transfer chain involves a transfer of a virtual asset, in addition to the above, the ordering institution and beneficiary institution must conduct additional due diligence before giving effect to the transfer.

- The ordering institution must check that:

- The virtual asset wallet to which the virtual asset is being transferred is either a custodial wallet controlled by a person who is appropriately licensed to do so (if required to) under a law that gives effect to the FATF Recommendations (i.e. a law that aligns with the global standards for combatting money laundering and terrorism financing), or a self-hosted wallet controlled by the payee; and

- The beneficiary institution is appropriately licensed (if required to) under a law that gives effect to the FATF Recommendations (i.e. a law that aligns with the global standards for combatting money laundering and terrorism financing).

- The beneficiary institution must check that:

- The virtual asset wallet from which the virtual asset has been transferred is either a custodial wallet controlled by a person who is appropriately licensed to do so (if required to) under a law that gives effect to the FATF Recommendations (i.e. a law that aligns with the global standards for combatting money laundering and terrorism financing), or a self-hosted wallet controlled by the payer.

If an ordering institution receives virtual assets transferred from a self-hosted virtual asset wallet, or if a beneficiary institution transfers virtual assets into a self-hosted virtual asset wallet, and the ordering/beneficiary institution has not verified the person who controls the self-hosted virtual asset wallet, then the ordering/beneficiary institution (the reporting entity) must submit a report to AUSTRAC within 10 business days about the provision of this service.

International value transfer services (IVTS) reporting

An IVTS report must be submitted to AUSTRAC by a reporting entity which:

- Operates at or through a permanent establishment in Australia; and

- Is an ordering institution or beneficiary institution in a value transfer chain for a transfer of value into or out of Australia; and

- Within 10 business days after passing on (in the case of an ordering institution) or receiving (in the case of a beneficiary institution) a transfer message for the transfer of value;

unless the reporting entity reasonably determines that the transfer of value will not occur and takes reasonable steps to ensure that the transfer of value will not occur.

If an intermediary institution has been involved in the value transfer chain, the intermediary institution may submit an IVTS report in place of the reporting entity (the ordering institution or the beneficiary institution) if there is a written agreement between the intermediary institution and the reporting entity that enables the intermediary institution to submit the IVTS report instead.

Note: the IVTS reporting obligation will replace the existing International Funds Transfer Instruction (IFTI) reporting obligation. However, there will be a transition period (to be determined by rules) for reporting entities to adjust to the new IVTS reporting obligation (expected to commence post-2026).

Further Reading

More details can be found in the AML/CTF Amendment Act 2024, as well as the upcoming new AML/CTF Rules and AUSTRAC's core guidance – to be released in the second half of 2025.

- AUSTRAC's AML/CTF Reform Hub

- AML/CTF Amendment Act 2024

- Explanatory Memorandum and Supplementary Explanatory Memorandum

- Future Law Compilation of the AML/CTF Act

- Draft AML/CTF Rules 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.