- within Government and Public Sector topic(s)

- in United States

- in United States

- within Corporate/Commercial Law topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Banking & Credit, Business & Consumer Services and Retail & Leisure industries

The Rise and Fall of International Enrolments

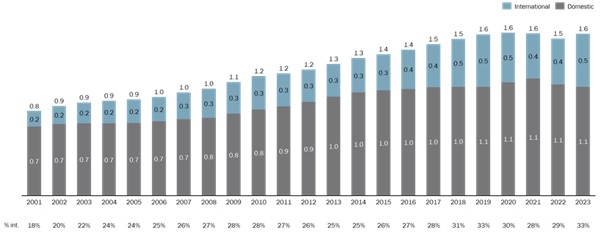

For the 20 years before COVID, international student enrolments in Australian universities climbed dramatically both in absolute numbers and as a proportion of total enrolments (see Diagram 1). International students became a prominent feature of life on and around university campuses, as well as an increasingly important source of revenue for the university sector.

COVID threw that trend into reverse, as borders closed and international students were prevented from entering the country; and those that were here were told to 'return to their home countries'. Numbers have recovered since COVID, and 2024 saw a universal increase in international student revenue across the sector.

Diagram 1: Domestic and international enrolments across

Australian Universities (2001-2023), in millions

However, beneath the surface, government policy settings were changing dramatically in 2024. After decades of supporting international education through favourable visa policies, the government has decided to throttle back the rate at which visas are processed for international students as part of its effort to reduce the overall net overseas migration numbers.

Policy Whiplash: MD 107 to MD 111

The most tangible manifestation of this was Ministerial Directive (MD) 107. Issued on 14 December 2023, MD 107 introduced a system of prioritisation for international student visa processing that put 'low risk' universities at the front of the queue while demoting higher risk institutions to the back. The effects of MD 107 began to be felt in early 2024, as some universities saw a dramatic surge in visa approvals while others saw a sharp decline against expectations (and budget forecasts).

During 2024, the government changed tack and moved to a system of numeric caps for each institution. After attempts to legislate caps failed, the government replaced MD 107 with MD 111, which slows visa processing once a university's visa approvals reach 80% of its notional cap. While a fairer system for the sector overall, the new regime will also have very different effects across the sector.

To try to make sense of this, we have analysed the 2024 position of the majority of universities (i.e. those whose 2024 financial statements have been released by the end of June 2025) according to three criteria (see Table 1):

- The increase in international student revenue in 2024 compared to 2023;

- The institutional cap for 2025 under MD 111 compared to estimated enrolments in 2024; and

- The level of exposure of each university to international student revenue.

NB: All data is based on publicly available data sources,

which we believe to be accurate to the best of our

knowledge.

Winners, Losers, and the Golden Ticket

From this, we have identified three discrete groups in the sector:

Group 1: The 2024 Winners

Universities who benefitted from MD 107 in 2024 but who will see a sharp reduction in international numbers in 2025 under MD 111. These universities, mostly GO8s and inner city ATNs, are typically also the most exposed to international student revenue;

Group 2: The 2024 Losers

Universities who were adversely affected by MD 107 but who appear to have significant room to grow international volumes based on their MD 111 cap going into 2025. These universities, mostly outer suburban and regional universities, have capacity to increase their international student revenue under current settings; and

Group 3: The Golden Ticket Group

The 'golden ticket' group who did well in 2024 compared to 2023, have room to continue their growth in 2025 under MD 111 and who have low exposure to international revenue. This mixed group consists of Southern Cross, University of Sunshine Coast, VU, Swinburne, Edith Cowan, CQU and JCU.

Table 1: Change in international student revenue for

2023-24, and "cap" for key universities for 2025 onwards

1

Strategic Implications for 2025

Universities must act decisively to protect their share of international enrolments. Looking ahead, the strategies for each group begin to look very different.

For the first group, in addition to planning for reduced revenue in the short to medium term, the focus will need to be on improving retention of existing students, reviewing pricing strategies and exploring opportunities for uncapped revenue growth (e.g., TNE).

For the second and third groups, the priority is to close the gap to the institutional cap as fast as possible while managing visa risk; and to ensure that any unfilled 'gap to the cap' is not reallocated to other universities that can demonstrate stronger demand. The caps are not an entitlement that is guaranteed to remain in place if places are unfilled.

This analysis prompts a few observations.

Revenue risk is no longer theoretical - it's policy-driven and immediate. The scale of international student recruitment into higher education, supported over many years by both sides of politics, means that visa policy is no longer a side issue in higher education funding.

The second is the vastly differing effects of government policy on different universities. Our analysis shows at least three distinct groups, each facing different circumstances and priorities. Each university will need to take stock of where it sits in the sector and act accordingly, in ways we have suggested above.

The third is that international student caps are not an

entitlement for each institution. The twists in government policy

over the course of 2024 alone suggest that it would be unwise to

assume that policy will remain unchanged for long. For this reason,

universities with a 'gap to the cap' (i.e., universities in

our second and third categories) need to close that gap quickly or

risk government or its agencies (e.g., ATEC) deciding to allocate

unfilled places to universities with unmet demand (i.e.,

universities in our first category).

What should university leaders do now?

- Understand your position in the new segmentation.

- Act swiftly to close any gap to your institutional cap.

- Prepare for further policy shifts - flexibility is now a strategic imperative.

KordaMentha's upcoming Annual Higher Education Report will provide

deeper insights and tailored strategies for navigating this new

landscape. Follow us for updates and reach out to explore how we

can support your institution's performance improvement journey

.

Footnote

1 Only universities whose financial statements have been released by the end of June 2025 have been included. The 2025 "soft cap" relative to estimated 2024 NOSC figures are based on data tabled in Parliament, relevant to Motion No 622 and 624.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.