- within Corporate/Commercial Law topic(s)

- within Antitrust/Competition Law, Technology and Real Estate and Construction topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- with readers working within the Law Firm industries

While the past couple of years have been a target-friendly environment, with multiple bidders vying for target assets in a competitive market, 2023 promises to bring more uncertainty for target boards which will have to guard against opportunistic bids in a falling market. Additionally, even where target boards are eager to close a deal, market uncertainty and regulatory approvals may prolong completion timeframes, which exposes the target to ongoing material adverse change (MAC) and termination risks.

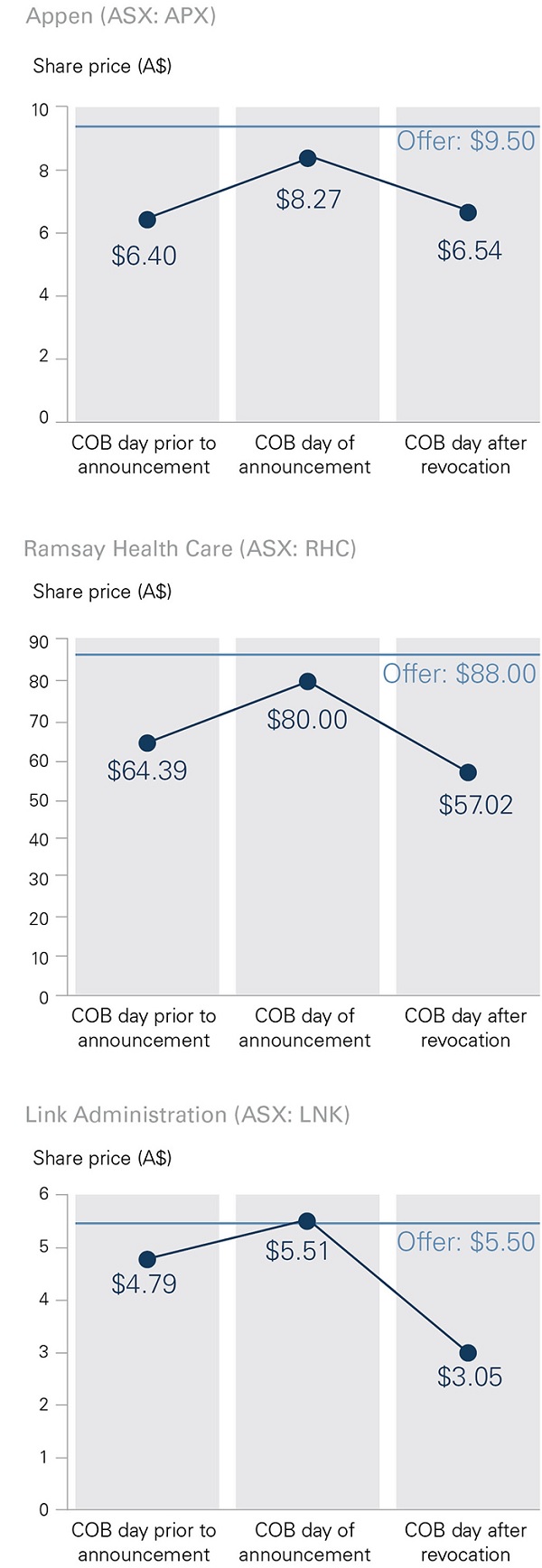

A number of deals this year have underlined the importance of managing MAC and regulatory risk well. Among them, the bid for Link Group by Dye & Durham, which ultimately did not proceed due to a fine being imposed by a foreign regulator that allowed the bidder to terminate the deal under a MAC condition.

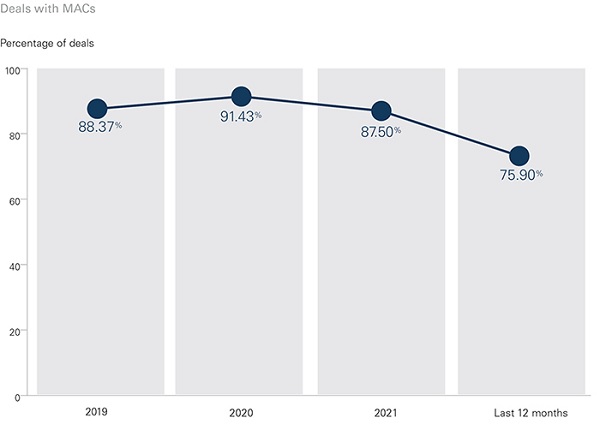

Our statistics this year showed a marked drop in MAC conditions - this is consistent with our view that target boards will need to carefully consider whether to allow MAC conditions in the current environment.

Source: M&A 2023 Outlook

If a MAC is agreed, it is important to ensure the triggers are appropriate, having regard to the market conditions and the specific risks to the business. Targets should test bidders' assumptions that a MAC trigger should automatically allow a termination of the deal. If a particular issue is foreseeable, query whether shareholders' interests would be better served by instead repricing the transaction based on pre-agreed metrics.

In the past year, regulators (in particular, antitrust regulators in the US and Europe) have been particularly rigorous in their review of transactions. This has resulted in lengthy and extended delays in completion timeframes. Reverse break fees for a bidder's failure to obtain regulatory approvals and 'hell or high water' obligations are some of the devices that target boards can employ to mitigate risk in these situations.

In some jurisdictions, the ability of a bidder to terminate a transaction in particular circumstances typically only lasts until a shareholder vote. Whereas in Australia, the termination right in the case of a scheme usually extends until the second court hearing, when all the conditions precedent have been satisfied. This extends the exposure period for targets, in addition to being highly disruptive for the business due to the prolonged operation of pre-completion conduct of business covenants and employee uncertainty.

However, in a number of recent transactions (including Verra Mobility Corporation's acquisition of Redflex and Square's bid for Afterpay), the courts agreed to grant approval for the scheme even while a regulatory approval has remained outstanding as a condition subsequent. In both cases, the condition subsequent had to be satisfied by a specific date, otherwise the scheme would not proceed.

While this strategy may also have benefits for the bidder, target boards may wish to consider whether it is preferable overall to push for a shareholder vote and court approval of a scheme, even where regulatory conditions remain outstanding. To do so might effectively 'lock the scheme in' and provide certainty for shareholders and the parties.

Finally, target boards also need to consider what fall-back positions are available to the company, if a transaction becomes public and does not proceed for any reason. The inevitable share price drop - see graphs below - (as evidenced by Link Group, Appen and Ramsay, amongst others) will need to be countered.

This can be achieved either by a clear vision and strategy for the target business as a standalone ongoing business or by implementing alternative fall-back transactions which continue to provide shareholder value.

Examples of the latter include Ramsay's potential sale of its stake in its French business, Ramsay Sante, and Link Group's potential distribution of its PEXA shareholding to shareholders.

This article first appeared in Corrs' M&A 2023 Outlook. Find the full report here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

|

|

| Lawyers Weekly Law firm of the year

2021 |

Employer of Choice for Gender Equality

(WGEA) |