- with readers working within the Retail & Leisure industries

- within Accounting and Audit topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

One shot, one chance

Businesses only get one shot at undertaking a Small Business Restructure (SBR). If that proposal is rejected by creditors, you're unable to try again for seven years. That's a long time to carry the weight of unmanageable debts.

At Worrells, we understand the stakes. That's why we're proud to share that we have done the most SBRs of any firm in Australia at 593 (between 1 July 2021 and 31 March 2025), with an SBR success rate that exceeds the industry average. However, the stark reality is that the numbers don't lie; as of January 2025, the acceptance rates of SBRs have plummeted, with approximately 20% less being accepted by creditors.

In this article, I'll explore the changing landscape of SBRs, why SBR acceptance rates are decreasing and what Worrells does differently to help clients achieve better outcomes.

What is an SBR, and why are the stakes so high

The SBR regime was implemented on 1 January 2021 as a streamlined alternative to traditional voluntary administration aimed specifically at small businesses.

It allows eligible companies (not sole traders or partnerships) to propose a restructuring plan to their creditors, usually offering a reduced payout over time in exchange for compromising the rest of their unsecured liabilities.

But here is the catch: if the creditors reject the plan, that company can't try again for another seven years. There is effectively no second shot and no room to negotiate.

Many directors mistakenly believe an SBR is a guaranteed way to eliminate debt or that every business can use one. They also assume there's a guaranteed discount of 70% to 80%, but this is simply not true.

Why does the system have a trust problem

Some firms may treat SBRs like a "ticket-punching" exercise, offering cheap plans with minimal engagement and poor results. These plans may:

- Be lodged without properly understanding the business

- Contain unrealistic forecasts

- Not address key concerns such as insolvent trading or director loans

- Fail to consult with key creditors, like the ATO, to understand the decision criteria they apply when considering a Plan.

This results in distrust from creditors. They may receive vague reports, unclear reasoning and sometimes see signs of financial mismanagement. Creditor votes reflect that distrust.

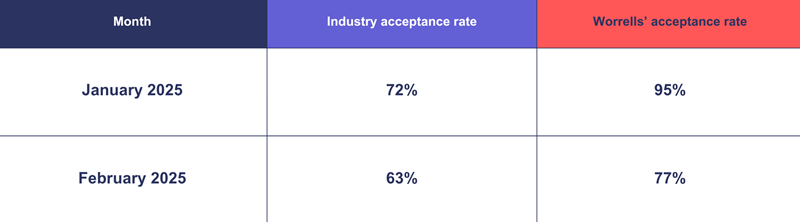

I don't make such a claim lightly. In my review of success rates for the top 5 SBR firms in Australia (by number of appointments) for the period 1 July 2024 to 31 March 2025 financial year, two firms had an SBR success rate of 60%, and one firm had an SBR success rate of 68%. Over the same period, our success rate was 77%.

SBRs - A white Knight for Small Businesses

SBRs provided a new tool for insolvency practitioners to assist businesses. The brutal reality is that the majority of liquidations do not return any money to unsecured creditors, particularly in the hospitality industry (something I have written about previously: Gift certificates and what you can do if the business goes into liquidation | Worrells).

SBRs provided a way for small businesses to alleviate cash flow pressures and continue trading without shutting their doors. Between 1 July 2021 and 31 March 2025, 3,349 restructuring proposals were accepted by creditors. Each is a business that was insolvent but was given a second chance by their creditors and (hopefully) provided a better return to creditors than if those companies went into liquidation. A rare win-win scenario in the insolvency industry.

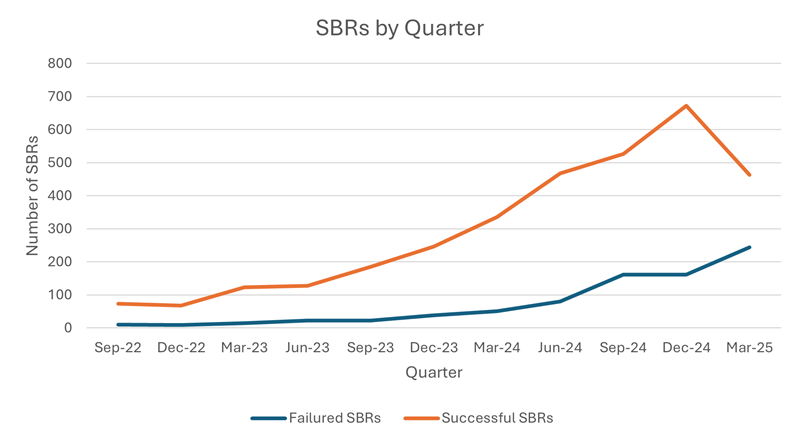

The increased use of SBRs is reflected in the following graph:

Readers will observe that as the insolvency industry, business advisors and businesses became more comfortable with the SBR process, there was increased use of SBRs over time. The number of successful and failed 1 SBRs remained relatively stable until December 2024, when the acceptance rates of restructuring proposals began to drop.

Crunching the numbers - Dropping acceptance rates

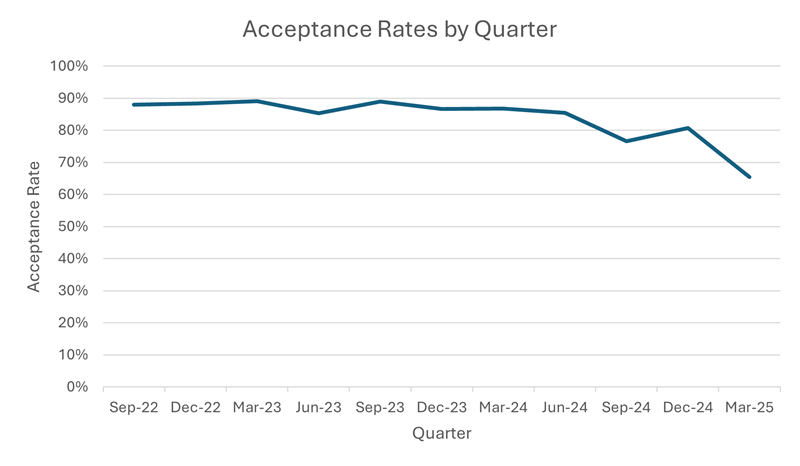

On my review of the small business restructure acceptance rates, there was an average acceptance rate of 88% and 87% for the 2023 and 2024 financial years, respectively. In the 2025 financial year, the acceptance rate began to reduce as creditors became more critical of the plans being proposed or the underlying business:

In January 2025, a switch was metaphorically flipped, with acceptance rates plummeting:

The lower acceptance rates mean that businesses have less certainty about the outcome of a small business restructure. This means spending money on a less certain outcome.

What creditors consider

Creditors vote based on whether they believe the proposal is fair and achievable. In our experience, the most successful proposals demonstrate:

- A reasonable return, representing what the Company can afford to pay. This is a judgment call: creditors do not want to see a massive profit at the end of the plan (that they don't get access to), but businesses also need to make sure they can afford the contributions.

- Credible and clear restructuring reports

- When it comes to the ATO, good lodgement and compliance history are important factors

- Communication with creditors prior to the SBR - a great way to burn goodwill with anyone is ignoring them.

- Whether there are related party loan accounts on the balance sheet. These represent funds that are taken out of the Company and given to a related party. If this is the case, creditors will want to know why they should take a haircut while those funds are not returned!

- Positive changes made within the business that address the reasons for financial difficulty. Creditors need to know what strategies have been put in place so that the Company does not end up in the same position or default on its obligations under the proposed plan.

A poor restructuring report, or failure to explain the reasons behind a business's decline and turnaround strategy, can sink a proposal, regardless of the numbers.

Who will be impacted?

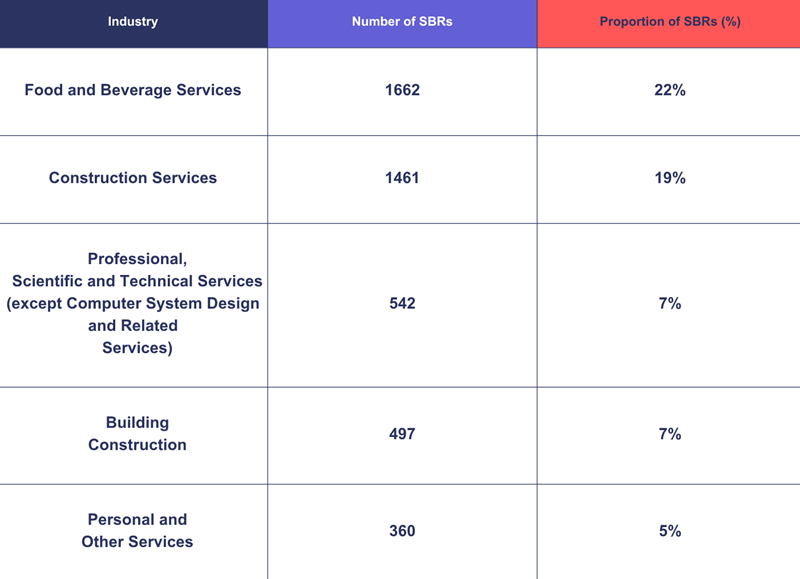

It will come as no surprise that the Hospitality and Construction sectors will be most impacted by a downturn in SBR acceptance rates. Between 1 July 2021 and 31 March 2025, the top 5 industry types that have utilised a small business restructure are:

What Worrells does differently

At Worrells, we don't take on every SBR opportunity that comes through the door. We carefully consider the company's circumstances before recommending the SBR path.

We:

- Assess eligibility criteria in detail

- Work with the business's directors, accountants and advisers to ensure the cash flow can support the restructure

- Provide clear, honest, and upfront advice — even if that means saying no

- Equip clients with comprehensive guidance on the process

In short, we don't try to fit a square peg into a round hole.

Conclusion: Get the Right Advice

Being the premium provider of SBRs and insolvency services means holding ourselves to a higher standard. This means providing the right advice and making sure that business owners know all of the facts. Great decisions are made based on great information.

If your business is considering an SBR, don't gamble on your one shot. Choose the firm with a proven record of success.

Footnote

1 Failure is defined in this article as the restructuring process not successfully moving to the restructuring plan phase.