- within Corporate/Commercial Law topic(s)

- in United States

- with readers working within the Banking & Credit, Media & Information and Securities & Investment industries

- within Corporate/Commercial Law, Technology and Insurance topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

ASIC has commenced proceedings against RAMS Financial Group in the Federal Court, alleging a range of misconduct in relation to RAMS' activities arranging home loans for consumers.

Credit licensees that provide home loan services to consumers are subject to a range of compliance obligations under the National Consumer Credit Protection Act 2009 (Cth) and the National Credit Code.

In its case against RAMS, ASIC alleges RAMS:

- conducted business with unlicensed persons;

- failed to supervise its representatives appropriately;

- failed to manage conflicts of interest within the business;

- utilised false documentation and information in loan applications; and

- failed to have policies and procedures in place to ensure its representatives complied with the credit legislation.

Key Takeaways for Credit Licensees

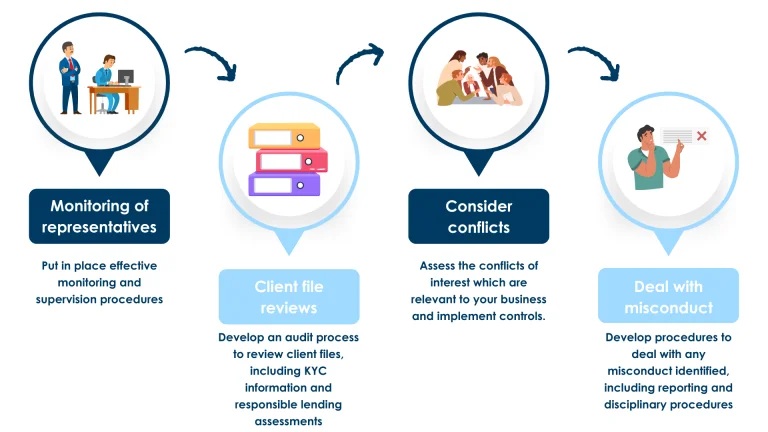

Credit licensees operating with a large number of representatives, or none at all, can take the following action to review and enhance their compliance procedures:

- implement effective monitoring and supervision procedures for

representatives, these can include:

- regular telephone and email contact;

- regular meetings with representatives;

- training;

- asking representatives to complete monthly or quarterly declarations which confirm their understanding of the law and their obligations;

- client file spot checks; and

- marketing reviews;

- establish audit procedures to review client files, including the information collected in relation to Know Your Client procedures, income and expense information and the document utilised to verify a consumer's income and expenses. Any audit procedures should be able to detect misconduct by representatives;

- consider any conflicts of interest which impact your business – including conflicts which may involve unlicensed entities and how these are managed;

- ensure there are robust procedures in place to deal with any misconduct identified, including appropriate reporting arrangements and any disciplinary action which is to be taken.

Background

RAMS operated through a franchise network, where franchisees are independently owned and employ their own staff. RAMS provided credit services to RAMS branded home loans and targeted first home buyers and self-employed borrowers. RAMS has admitted liability for certain contraventions of the law and ASIC is seeking declarations and pecuniary penalties against RAMS.

Further Reading

ASIC sues RAMS for systemic misconduct in arranging home loans

Credit Licensees: General conduct obligations

Shop Products

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.