- within Corporate/Commercial Law topic(s)

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- in Asia

- with readers working within the Metals & Mining, Retail & Leisure and Construction & Engineering industries

- within Insolvency/Bankruptcy/Re-Structuring and Law Department Performance topic(s)

GENERATING VALUE FROM ESG - A GUIDE FOR BOARDS AND ORGANISATIONS

Company boards are under increasing pressure to address material Environmental, Social, and Governance (ESG) challenges, with a particular focus on decarbonising their operations.

This article delves into the challenges in governing the balance between commerciality versus compliance obligations; including the main challenges boards face, to ensure pragmatism triumphs over perfection and, how boards can come to terms with the degree of control they can exercise when effecting change and setting strategy

Boards need to become comfortable looking to several other markets for 'best practice' in response to the decarbonisation challenge.

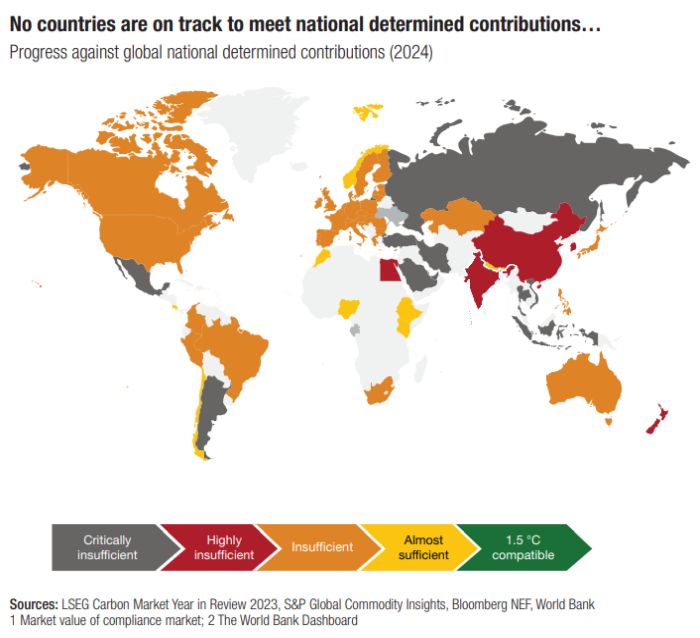

No countries are on track to meet national determined contributions...

Progress against global national determined contributions (2024)

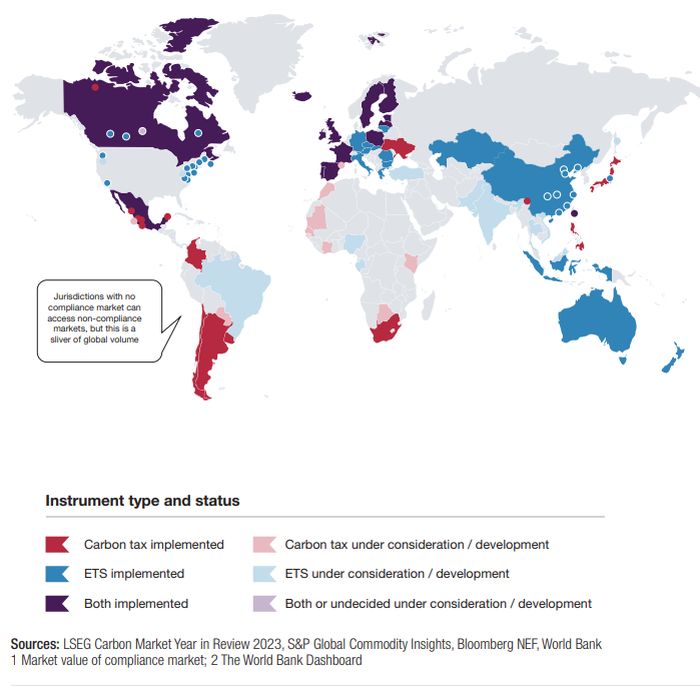

...despite increasing adoption of ETS and carbon tax schemes (ETS markets equate to ~US$950 Bn in annual trades1 )

ETS / carbon tax schemes - Implemented, scheduled, and under consideration (2024)2

While Australia is not a significant emitter compared to global peers, our exported resources contribute to a large portion of emissions within some of our largest companies' value chains.

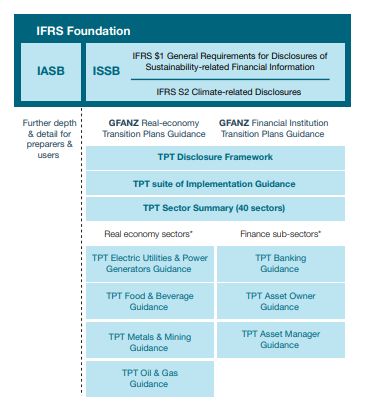

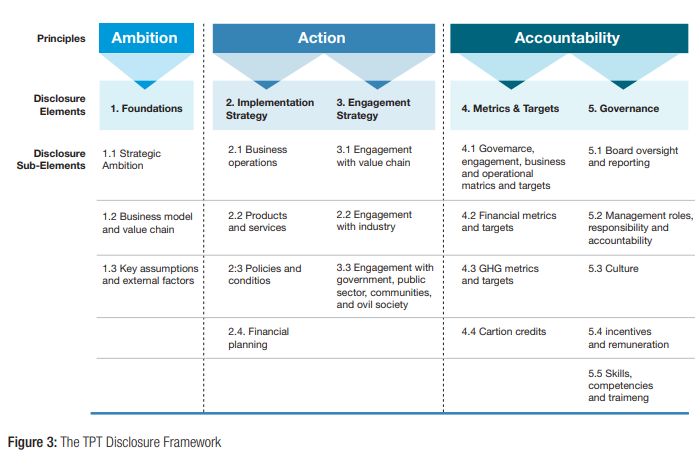

The UK Transition Planning Task-Force is recognised as the gold standard for companies to adopt decarbonisation planning and supported by IFRS/ISSB.

Consideration of data quality in decision making is obvious, which is why a lack of alignment on clear Scope 3 emissions reporting is frequently used as an excuse.

However, if and when Scope 3 begins posing an existential threat to customer bases this can create the impetus for change. These are the types of long-term challenges that boards should be contemplating and addressing in the near term, preserving value and seeking new opportunities.

Boards are challenged to weigh the costs of decarbonisation (and any ESG action) against potential long-term benefits, risk mitigation, enhanced reputation, and future profitability. ESG factors more broadly, can be critical components (not siloed pursuits) to financial health and should be actively integrated into management's strategy.

To view the full article click here

Originally Published 5 October 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]