- within Corporate/Commercial Law topic(s)

- with Inhouse Counsel

- in India

- with readers working within the Banking & Credit, Retail & Leisure and Law Firm industries

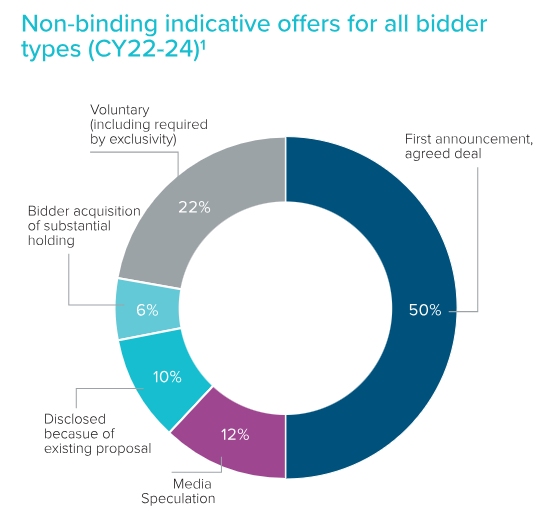

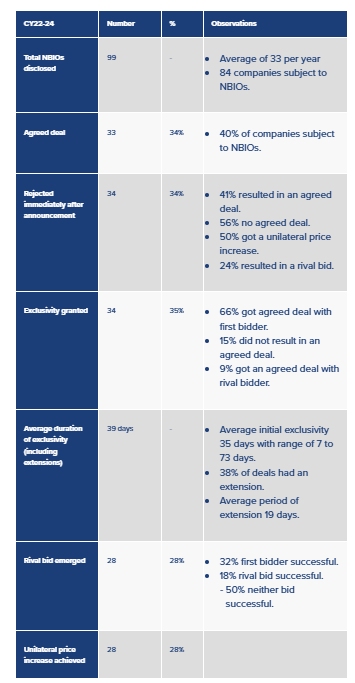

We have analysed non-binding indicative offers (NBIOs) for public companies during calendar years 2022 to 2024. In particular, we have done a deep dive on private equity NBIOs.

The analysis provides insights on success rates of NBIOs and how engagement might unfold. The conclusions from the data provide valuable insights for private equity bidders.

Key Findings

1. First announced on agreed deal:

For all bidder types, the majority of NBIO approaches were not announced until binding transaction documents were agreed. Only 25% of these were private equity bidders, with other private equity NBIOs being disclosed for various reasons before an agreed deal.

2. Leak risk:

Only 12% of NBIOs were leaked, and 46% of these involved private equity bidders, dispelling suggestions that Australia is a leaky market and that private equity NBIOs are more likely to be leaked.

3. Voluntary disclosure by target:

22% of NBIOs were voluntarily disclosed by the target. In 26% of these cases, this led to a rival bid and, in a further 26%, there was a unilateral price increase.

4. Exclusivity at NBIO stage:

Average duration of exclusivity at the NBIO stage was 5 weeks, but this was extended 37% of the time by an average of 19 days.

5. Success rates for NBIOs:

For all bidder types, 40% of targets that received an NBIO ended up with an agreed deal. Private equity bidders were in line with this success rate.

6. Reason for private equity NBIOs failing:

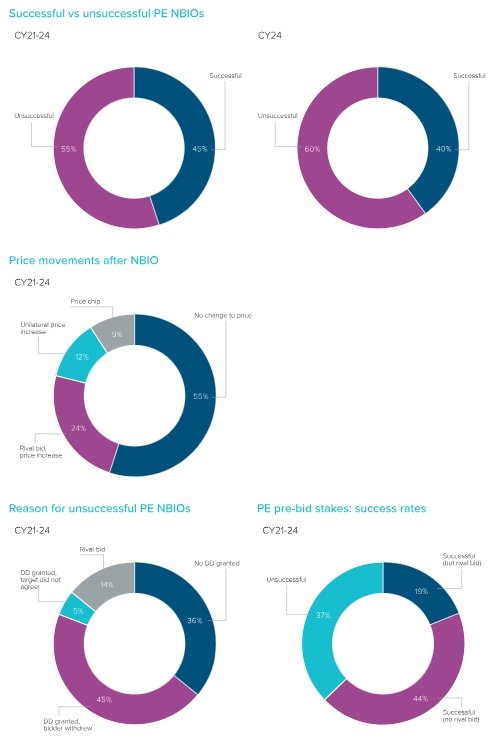

Two thirds of the time, private equity bidders were granted access to due diligence. However, in 45% of cases private equity bidders were granted due diligence, but ultimately withdrew during due diligence. Private equity proceeded with their offer at a lower price in 9% of instances.

7. Pre-bid stakes indicate success:

In 63% of cases where a private equity bidder took a pre-bid stake, they ended up succeeding with control, including overcoming a rival bidder in 19% of instances. This is in line with the statistic that 83% of cases where a bidder (of any type) took a pre-bid stake they succeeded.

Charts

The charts and tables below summarise our analysis of the data and we dissect the findings below.

Private equity NBIO statistics (CY21-24)1

1. Analysis restricted to control transactions involving an ASX-listed target that have been completed. Live deals excluded (not to skew agreed deal statistic) being: Bigtincan Holdings Limited, Vonex Limited, SelfWealth Ltd, SG Fleet Group Limited, AVJennings and Insignia Financial Ltd.

NBIO Statistics for All Bidder Types

From the charts, we can see 50% of all approaches were first announced at the time transaction agreements were signed. This seems high relative to the high number of newspaper headlines we read about indicative approaches having been made. An example of this is the recently announced A$2.4 billion combination of Ramelius Resources and Spartan Resources.

This highlights that bidders and targets generally prefer deal confidentiality, and are still successfully able to deal behind closed doors, in most cases. For bidders, confidentiality is prized because it reduces the risk of a rival bid by not advertising that the target may be "in play". For targets, confidentiality avoids unnecessary share price volatility and criticism if a deal does not eventuate.

The data shows that about 40% of targets that receive an approach that is disclosed ultimately reach an agreed deal. That is a reasonable success rate, but shows that the majority of NBIOs fail. Disclosure of an approach can set a target's share price on a volatile ride, which when combined with the low success rate, makes the decision to disclose a delicate one.

The Australian market gets criticised from time-to-time for being a leaky market. But only 12% of approaches had to be disclosed because of media speculation (notwithstanding the best efforts of hard-working journalists to sniff out a deal). This is much lower than we expected. It shows that the large number of people often involved in a deal can generally be trusted to protect confidentiality.

Exclusivity was granted in ~35% of the disclosed approaches (before an agreed deal) on average across the three years (after a price was acceptable). The average initial period of exclusivity granted was 35 days, while the total average period of exclusivity was 39 days. This is consistent with our expectation of exclusivity being required for about 5-6 weeks to complete due diligence and agree transaction documents. On average, an extension to the initial exclusivity period was granted in 37% of cases, with the average extension in those cases being for 19 days.

Deep Dive on Private Equity NBIOs

Private equity NBIOs for public companies often receive a great deal of scrutiny. A private equity bidder usually does not have access to synergies (unlike a strategic bidder), which raises the question: why can the bidder offer to pay more than the fundamental value assessed by the target? As a consequence, there can sometimes be scepticism from a target over whether these offers will materialise to an agreed deal. With that lens, let's get into the data.

How likely is a private equity NBIO to be successful?

Our data suggests that a private equity NBIO is just as likely to be successful as an approach from a strategic bidder, which is about 40% of the time. This statistic does ebb and flow, for the 2.5 years to June 2023, the success rate was closer to 25%, but that captured a period of severe dislocation in share prices following anticipated interest rate rises (where share prices declined rapidly against target views on fundamental value). Of course, these statistics do not cover approaches that were rejected and never made public – which would reduce the success rate (which would also apply for other bidder types, though anecdotally confidential rejections that never see the light of day are less common for strategics).

Of the NBIOs that were disclosed due to a 'leak' (i.e. media speculation), 46% involved private equity bidders. We conclude that, overall, the risk of a leak is not heightened where the approach is from private equity, quelling suggestions that, as a general rule, private equity are more likely to leak an approach to put pressure on a target to engage.

Only 14% of deals that were first announced on an agreed deal involved a private equity bidder. This compares to 31% for non-private equity bidders. We conclude that private equity bidders are half as likely to remain confidential all the way until transaction documents, relative to non-private equity bidders. This was primarily driven by private equity bidders being over-represented in disclosures caused by the bidder acquiring a pre-bid stake above 5%, with private equity bidders representing 75% of the forced disclosures in this category. This supports the conventional wisdom that private equity bidders are more likely than strategic bidders to take a pre-bid stake before an agreed deal.

Where are private equity approaches falling over?

In36% of situations the target Board did not grant due diligence at the offered price – presumably the bidder did not reach the Board's view on fundamental value. For example, in June 2024, Bapcor was subject to an NBIO from Bain Capital for $5.40 a share which was leaked and the target ultimately rejected the proposal for not representing fair value. Bapcor's share price had declined from about $5.70 to a low of $4.20 in the lead-up to the NBIO, following management instability caused by an announced candidate for CEO deciding not to join the company. Since the rejection, Bapcor's share price has predominantly traded below the offer price in the range of $4.27 to $5.36.

In 64% of cases, the Board was willing to grant due diligence. We conclude that, unsurprisingly, where the offer clears fundamental value, target Boards are open to engaging with private equity bidders.

45% of the time the bidder was granted due diligence but then withdrew the offer during due diligence. This statistic raises an age-old debate. Targets use it to argue that private equity offers are unreliable. Bidders may rebut this by arguing it indicates inadequate continuous disclosure rules or practices, meaning it is difficult to accurately formulate a view on price from an 'outside-in' analysis alone. We think the truth lies in the middle, being that underwriting debt and equity in a leveraged buyout at fair value is very challenging, given there are no (or minimal) synergies or business strategy justifications to rely on for completing the deal. This makes private equity bids more sensitive to findings during due diligence that undermine price assumptions. While this is not reason alone for a target not to engage with a private equity bidder that clears the Board's view on fundamental value, bidders and targets should be attuned to this heightened risk. It supports a general conclusion that retaining confidentiality is best in order to avoid unwanted price instability and the risk of unwanted attention over a failed bid.

Are private equity bidders likely to price chip?

Targets are often concerned that private equity will offer a price to gain access to due diligence and then seek to renegotiate downwards during due diligence. However, the data does not support that scepticism. In only 9% of private equity NBIOs was the price reduced downwards. In a majority of instances (55%), private equity bidders stood by their initial offer and in more than a third of the cases, they had to increase their price either due to a rival bid (24% of cases) or a unilateral price increase (12% of cases). We conclude that private equity is overall quite reliable in sticking to their offer to gain access to due diligence.

An example of a rare price reduction during due diligence was TPG Capital's bid for InvoCare. TPG initially approached at $12.65 a share in March 2023 and having amassed an ~18% pre-bid stake (later increased to 19.9%). While InvoCare did not consider the proposal to represent fair value, the company was willing to grant limited due diligence to allow TPG to reach an acceptable price level. By late-April 2023, TPG and InvoCare could not agree the terms of confidentiality, presumably because the terms of the standstill were not acceptable to TPG, and TPG withdrew its proposal. The parties re-engaged and in mid-May 2023, InvoCare secured a revised proposal from TPG at $13.00 a share (reduced by a special dividend of up to $0.60 to release franking credits) and granted due diligence. After months of exclusive due diligence, an implementation agreement was entered into at a reduced price of $12.70 (reduced by a special dividend of up to $0.60 to release franking credits). During this time, InvoCare's financial performance had continued to deteriorate. While there was ultimately a price reduction during due diligence in this case, target shareholders received superior value to TPG's initial approach, notwithstanding TPG's strong pre-bid position with a 19.9% stake.

What is a good indicator that a private equity bidder will be successful?

In short, where the private equity bidder takes a pre-bid stake. A private equity bidder that took a pre-bid stake ultimately acquired control in two thirds of the cases over the last three years. This statistic supports the conclusion that taking a pre-bid stake shows conviction that the private equity bidder wants control and will go through with the offer.

While the pre-bid stake is a powerful tool to dissuade or overcome a rival bid, in ~19% of instances the private equity bidder with a pre-bid stake was ultimately successful only after overcoming a rival bid. Again, this shows the conviction of a private bidder that takes a pre-bid stake.

The most compelling example of this conviction was BGH Capital's acquisition of a 19.9% stake as part of its $7.10 a share NBIO for Virtus Health. A rival bidder, CapVest, emerged and was granted due diligence at $7.60 a share (scheme) or $7.50 a share (takeover bid with a 50.1% minimum acceptance condition). The dual scheme-takeover structure was designed to apply pressure to BGH to vote in favour of the scheme or risk being stuck in a minority position. However, this did not dissuade BGH. BGH was willing to proceed with an off-market takeover bid and was ultimately successful in acquiring control, without gaining access to due diligence from the target. This example highlights the high level of conviction of a private equity bidder that acquired a pre-bid stake and their resolve to acquire control.

Conclusion

The statistics in this review of NBIOs and pre-bid stakes provide useful insights into how an approach from a bidder might unfold. We consider that these findings are useful for private equity bidders contemplating an approach. If you have any queries regarding the data or specific situations, please do not hesitate to contact us.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]