- within Law Practice Management, Antitrust/Competition Law and Energy and Natural Resources topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Business & Consumer Services, Consumer Industries and Insurance industries

On 10 December 2023, the Australian Treasurer unveiled important revisions to the current foreign investment framework aimed at bolstering Australia's housing stock and providing more homes for Australians. These changes include:

- tripling the application fees for foreign investment in established dwellings

- doubling vacancy fees for all foreign-owned dwellings acquired on or after 7.30pm on 9 May 2017, resulting in a six-fold increase in vacancy fees for future purchases of established dwellings

- strengthening the ATO's compliance regime to ensure foreign investors comply with the rules, including selling their residence when required

- implementing the commercial fee schedule for foreign investment in eligible build-to-rent projects

(together, Framework Changes).

On 7 February 2024, a Bill proposing to amend the current Foreign investment framework (including several pieces of legislation and regulation) was introduced to the House of Representatives to implement the Framework Changes listed above.

In addition to the above, the Bill also proposes to increase the maximum fee payable for a proposed investment or as vacancy fees for foreign acquisition of residential land from $1,045,000 to $7,000,000.

The Bill commences either on 1 April 2024 or the day after that Bill receives Royal Assent, whichever occurs later.

Current regime

Under the current foreign investment regime, foreign persons are generally prohibited from purchasing established dwellings. Exceptions includes:

- temporary residents may apply to acquire one established dwelling to live in

- foreign investors may apply to acquire established dwellings for the purpose of redevelopment to increase Australia's housing stock

- in limited circumstances, foreign companies may apply to acquire an established dwelling to house their Australian-based staff.

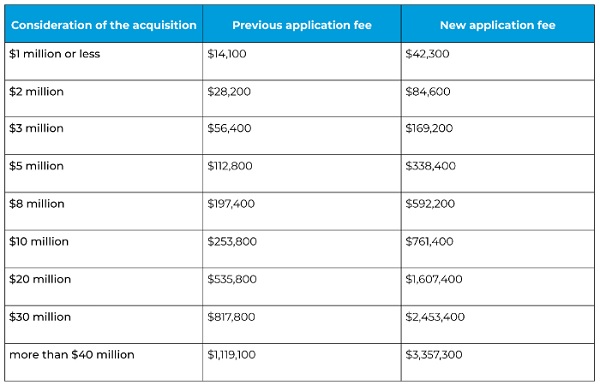

Foreign individuals may purchase a new dwelling with the prior approval from the Foreign Investment Review Board (FIRB). As with all FIRB approvals, there is an application fee which is dependent on the purchase price – the higher the price, the higher the fee, with residential land incurring the highest fee bracket.

Tripling application fees for established dwellings

The Foreign Acquisitions and Takeovers Act (Cth) 1975 (Act) defines 'established dwelling' as "a dwelling (except commercial residential premises) on residential land that is not a new dwelling".

The Bill proposes to amend the Act and its related regulation by updating the relevant indexation provisions for FIRB application fees. These amounts, set in the Regulation, are to be indexed from July 1 each year, starting on or after 1 July 2024. The Bill also proposes to triple the FIRB application fees payable by a foreign investor in acquiring an interest in residential land on which there is at least one established dwelling.

We list some examples of application fees below:

Doubling vacancy fees for foreign-owned dwellings

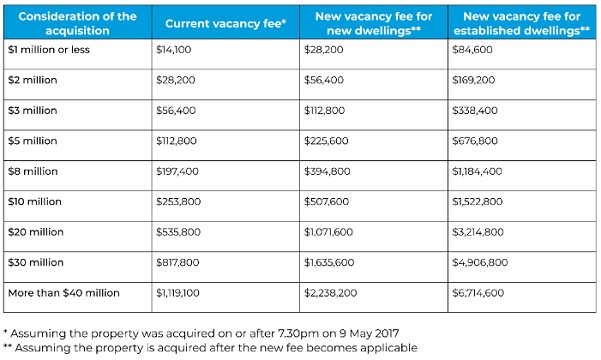

Foreign residential property owners face an annual vacancy fee if their property is acquired on or after 9 May 2017 and is not residentially occupied or genuinely available on the rental market for at least 183 days (approximately six months) in a 12-month period.

The vacancy fee is generally equivalent to the residential land application fee that was paid by the foreign person at the time the application for foreign investment approval to purchase the property was made. It serves as an incentive for foreign investors to make their unused properties available for rental. The proposed doubling of this fee aims to reinforce this measure, potentially resulting in a six-fold increase in vacancy fees for investors acquiring established dwellings.

We list some examples of the vacancy fees below:

Incentive for build-to-rent projects

Under the previous foreign investment regime, the application fees for build-to-rent projects varied depending on the property type, with residential land fees substantially higher than those for commercial land. An encouraging change to the current foreign investment framework entails applying the lower commercial land application fee to build-to-rent project applications, regardless of the land category. For example, for the acquisition of any type of land for a build-to-rent project with a consideration of up to $50 million will attract a FIRB fee of $14,100.

This aspect of the proposed amendments was announced to take effect on 14 December 2023 and the relevant fee will be indexed on 1 July 2024. However, it remains uncertain whether the change will be reflected through fee regulation revisions or administrative means such as upfront partial fee waivers.

Impact on foreign investors and developers

It is commonly seen that foreign property developers acquire residential land, typically with prior FIRB approval, that includes established dwellings. These acquisitions are often made with the intention of redeveloping the land into various types of housing which contribute to the expansion of housing stock and accommodation options. Whether the proposed increase in fees will apply to these property developers remains unclear.

What should you do?

Considering the substantial changes, foreign investors, including developers, face critical decisions in their acquisition endeavours. As all foreign investment circumstances are unique, foreign investors should plan early for whether their proposed actions may require FIRB approval and budget for the increased cost of seeking approval.

Investors should conduct comprehensive evaluations and weigh the financial implications carefully before committing to acquisitions of established dwellings.

How can we help?

We understand that the FIRB rules can be complex to navigate. However, it is essential that investors identify the correct fee payable at the time of lodgement of their FIRB applications.

We are trusted advisors to many foreign clients investing and operating in Australia.

This publication does not deal with every important topic or change in law and is not intended to be relied upon as a substitute for legal or other advice that may be relevant to the reader's specific circumstances. If you have found this publication of interest and would like to know more or wish to obtain legal advice relevant to your circumstances please contact one of the named individuals listed.

[View Source]