- within Finance and Banking topic(s)

- with Finance and Tax Executives and Inhouse Counsel

- in Africa

- with readers working within the Banking & Credit, Retail & Leisure and Securities & Investment industries

ASIC releases its Corporate Plan for 2025-26

On 26 August 2025, ASIC released its Corporate Plan for 2025-26 (the Plan) setting out its strategic direction through to 2029. The Plan sets out the following five strategic priorities:

- driving better outcomes for consumers and small businesses;

- strengthening market disclosure foundations and conduct by ASIC-regulated professionals;

- driving better outcomes for Australians planning for, and in retirement;

- strengthening operational, digital and data resilience and safety; and

- driving integrity and transparency across markets.

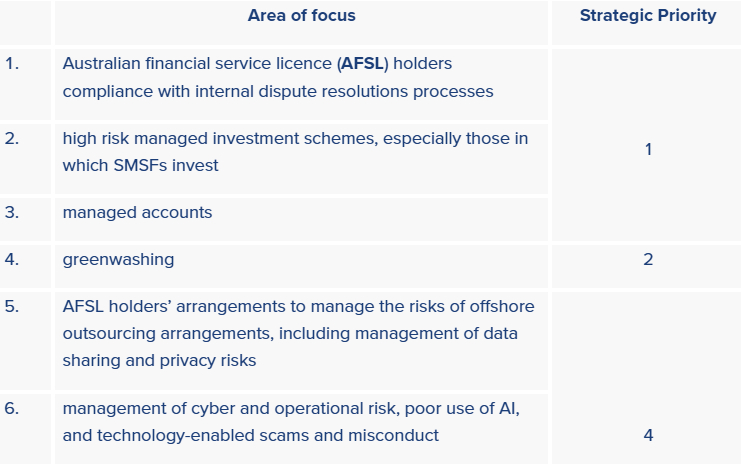

Each strategic priority is supported by descriptions of specific areas on which ASIC will focus, including:

The Plan evidences ASIC's enforcement focus. It repeats ASIC's enduring enforcement priorities (which include, systemic compliance failures by large financial institutions and misconduct involving a high risk of significant consumer harm, particularly conduct targeting financial vulnerable consumers).

New performance measures and targets set out in the Plan include:

- average days between acceptance of a referral by the enforcement team and the commencement of a formal investigation;

- the number of people or companies referred to the Commonwealth Director of Public Prosecutions for criminal prosecution, with a target of at least 30 per year; and

- the number of civil proceedings commenced with a target of at least 35 per year.

The Plan also reaffirms ASIC's commitment to simplifying the regulatory regime. ASIC will issue a regulatory simplification report and continue working with external stakeholders to reduce complexity and improve regulatory guidance

Report on ASIC's 2025 enforcement and regulatory progress

On 21 August 2025, ASIC released Report 812 ASIC enforcement and regulatory update: January to June 2025, summarising its key enforcement and other activities from the first half of 2025.

The report outlines a proactive enforcement agenda, with a focus on consumer protection, regulatory compliance and market integrity.

It records an increase in investigations commenced, civil penalty proceedings filed and civil penalties imposed by courts compared to the first half of 2024.

The report highlights several enforcement actions taken against AFSL holders for:

- breaching consumer protection laws;

- making false or misleading statements; and

- failing to comply with design and distribution obligations.

Data on consumer and retail investor protections

On 21 August 2025, ASIC released data on 7,561 reports of misconduct received between 1 January 2025 to 30 June 2025. Key findings from the data show that:

- 78% of reports (5,909) related to financial services and retail investors, covering a range of matters;

- of those, 40% concerned operating an unregistered managed investment scheme or providing financial services without an AFSL; and

- 36% related to general licence (including AFSL) obligation failures.

Extension of financial hardship withdrawals relief instruments

On 27 August 2025, ASIC extended the relief in ASIC Corporations (Hardship Withdrawals Relief) Instrument 2020/778 for a further 18 months and is now seeking industry feedback on whether this instrument should lapse or be remade via CS 28 Proposed remake of hardship withdrawals relief.

Feedback on the consultation closes on 31 October 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.