- within Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- with readers working within the Law Firm industries

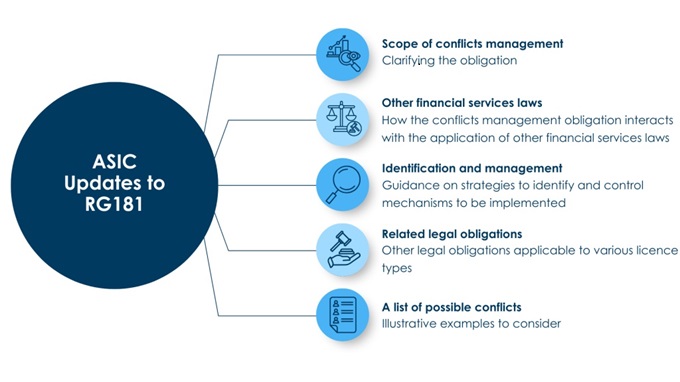

ASIC has updated Regulatory Guide 181 to include further guidance for Australian Financial Services Licensees in relation to managing conflicts of interest. Changes made align RG181 with recent cases, ASIC's policy and changes to the law including to financial adviser obligations, conflicted remuneration and the design and distribution obligations.

Key Changes

The updates relate to:

- The scope of the conflicts management obligation – clarifying that the obligation is broad and applies to all conflicts which relate to the financial services provided by the AFS Licensees.

- Detailing other financial services laws which interact with the conflicts management obligation – including directors' duties, fiduciary duties, the financial adviser standards, registered scheme responsible entity obligations, foreign legislation and industry standards and codes.

- Guidance on the identification and management of conflicts of interest, including examples of control mechanisms that can be implemented and disclosure principles.

- A catalogue of related legal obligations for various AFS Licence types, including personal advice licensees, retail fund operators, securities dealers and claims handling licensees.

ASIC has also included a list of conflicts to which AFS Licensees should have regard. The list is intended to provide illustrative examples to assist AFS Licensees more appropriately identify the specific conflicts that impact their business.

ASIC Commission Kate O'Rourke has stated that licensees must consider conflict management as a cornerstone of the financial services industry and that conflicts of interest "pose real threats that erode trust, tarnish reputations and cause lasting harm to consumers, investors and the entire financial ecosystem."

Next Steps

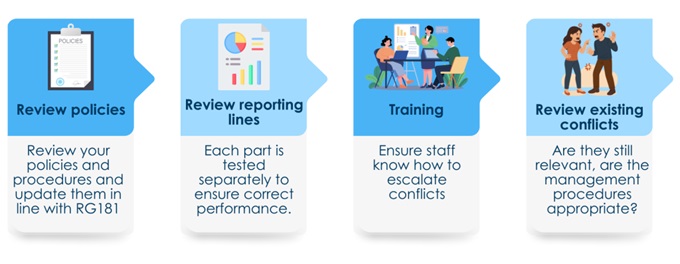

All AFS Licensees should consider their procedures to identify, manage and monitor conflicts of interest that may arise, including:

- Reviewing policies and procedures and updating them in line with ASIC's new guidance;

- Reviewing reporting lines and escalation procedures, including whistleblowing policies;

- Training staff in relation to conflicts of interests, including how to identify conflicts of interest and the procedures to submit a conflict notification;

- Reviewing the existing conflicts of interest which have been identified in the Conflicts of Interest Register and whether the conflicts are still relevant, the management and monitoring procedures are appropriate.

Background

The duty to identify and put in place adequate arrangements to manage conflicts of interest is a fundamental obligation of all AFS licensees under section 912A(1) of the Corporations Act. The management of conflicts of interest was a compliance issue identified in ASIC's Report 820: private credit surveillance report: retail and wholesale surveillance.

Further Reading

Regulatory Guide 181: AFS licensing – managing conflicts of interest

ASIC Media Release: ASIC renews guidance on managing conflicts of interest in financial services

AFSL Conflicts of Interest Policy and Register

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.