- within Finance and Banking topic(s)

- with Finance and Tax Executives

- with readers working within the Securities & Investment industries

AFCA has reported that for the 2024-25 year, it received more than 100,000 complaints from consumers. Whilst this is a 4% decline overall, AFCA's Chief Executive Officer, David Locke, considers this number is still far too high.

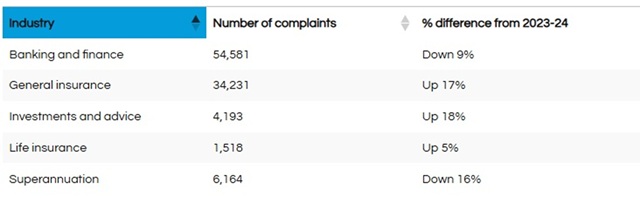

The complaint numbers by industry sector are below:

Mr Locke has detailed that Credit Licensees and AFS Licensees that provide services to retail clients still have work to do to help reduce the number of complaints that end up at AFCA, particularly those in the insurance, investments and advice sectors.

What can licensees do?

Licensees are required to have internal dispute resolution (IDR) procedures which meet the standards outlined in ASIC Regulatory Guide 271. Effective IDR procedures should be designed to enable complaints to be resolved between the licensee and the consumer.

Given the high number of AFCA complaints, licensees should:

- Review their IDR procedures, including:

- how complaints are handled;

- reporting lines;

- templates used to provide responses to consumers;

- timeframes and methods for contacting consumer throughout the complaint; and

- frameworks for remediation;

- Ensure consumers are aware of complaint handling procedures,

including:

- how to make a complaint;

- where to go for further information;

- the contact details of the person responsible for their complaint;

- their right to complain to AFCA;

- Train employees to ensure they understand:

- the IDR process;

- how to deal with consumers during the complaint, this may also include training in relation to how to deal with vulnerable consumers;

- Review record keeping procedures to ensure that records are maintained appropriately if the complaint does proceed to AFCA.

Proactively dealing with complaints and ensuring IDR procedures are compliant with Regulatory Guide 271 will ensure licensees meet their obligations and will help to lower the number of complaints which proceed to AFCA.

If you are unsure whether your IDR procedures meet the requirements of Regulatory Guide 271, pleasecontact usfor assistance.

Further Reading

- AFSL Internal Dispute Resolution and Complaints Management Package

- ACL Internal Dispute Resolution and Complaints Management Package

- ASIC Regulatory Guide 271: Internal Dispute Resolution

- AFCA Media Release: AFCA receives more than 100,000 financial complaints in 2024-25

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.