- in United States

- with readers working within the Insurance industries

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Securities & Investment and Law Firm industries

With the number of complaints taken to the Australian Financial Complaints Authority ("AFCA") continuing to rise, AFCA has indicated its disappointment at another record year of complaints and wants financial services and credit licensees to do more.

AFCA has released its annual review report for July 2023 to June 2024, outlining trends in the complaints data collected over the twelve (12) month period. AFCA received a total of 104,861 complaints in the 2023-24 year which was an 8% increase in complaints from the previous year.

All licensees should consider the types of complaints they routinely receive, and take steps to address these via robust IDR processes.

Financial firms should ensure that their IDR process:

- sufficiently equips employees to identify, understand and resolve their customer's complaints internally; and

- sets clear and compliant timeframes for responses being provided to complainants;

- includes appropriate mechanisms for investigation and resolution of systemic issues;

- outlines an appropriate reporting framework and ensures employees are appropriately resourced and empowered to make decisions regarding complaints, particularly in relation to possible resolutions.

We outline two (2) key action items for licensees.

1. AFCA relies on your IDR process during the early stages of an AFCA complaint

The registration and referral stage involves AFCA requesting the financial firm to:

- notify AFCA if they believe that the complaint was lodged incorrectly against them;

- resolve the complaint via IDR;

- provide AFCA and the complainant a final IDR response outlining the firm's position which will help AFCA determine whether to progress the complaint if the response is unlikely to resolve the complaint;

- confirm the resolution with the complainant; or

- request a Rules review if the firm believes that the complaint falls outside of AFCA's jurisdiction.

More than 54% of all closed complaints in 2023-24 involved AFCA returning the complaint back to the firm for some further action. The issue here is twofold:

- AFCA's Annual Review Report identified that, "while financial firms are making progress in resolving complaints early, more work is needed to prevent disputes from escalating to external resolution." See page 45 of AFCA's 2023-24 Annual Review Report; and

- complaints resolved at the registration and referral stage indicate a strong commitment from financial firms to resolve issues early by engaging with the complainant and AFCA.

Key Takeaway

AFCA's findings indicate that financial firms must have a comprehensive IDR process that:

- helps employees identify and understand the root causes of the complaint;

- enables your employees to:

- provide a substantive and definitive answer; and

- clearly address the issues raised by your customers.

Using complaint data, financial firms should also be able to identify systemic issues and processes that require improvement, as highlighted in ASIC Regulatory Guide 271 ("RG 271).

RG 271.117 explains that systemic issues can include:

- inadequacies or misleading information in your disclosure documents;

- system issues that are producing calculation errors; and

- business processes that do not comply with legislations and regulations.

It is important to review your current IDR processes against RG 271 which provides guidance in relation to:

- the definition of complaint;

- timeframes for providing responses to complainants;

- the minimum content requirements for IDR responses;

- the process to identify and escalate systemic issues.

AFCA reported that out of the 104,861 complaints received in the 2023-24 year, 104,203 complaints were closed.

AFCA further categorised the complaints as follows:

- 56,900 closed at the registration and referral stage;

- 32,927 closed at the case management stage;

- 9,609 closed at the rules review stage; and

- 4,767 closed at the decision stage.

2. Most common issues raised by complaints

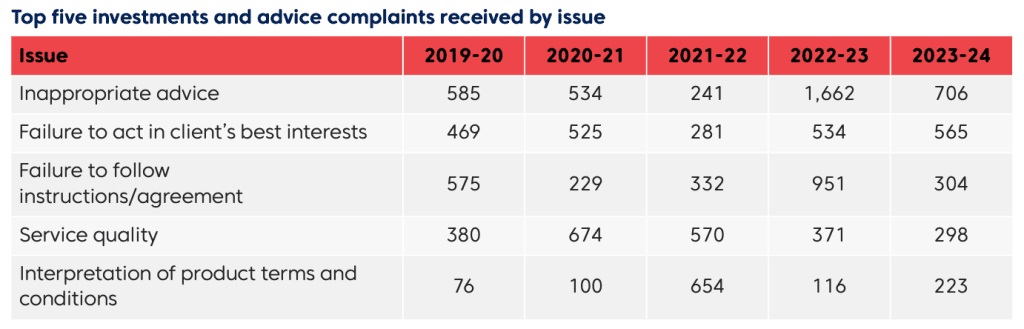

AFCA received 3,559 investments and advice complaints and closed 4,118 in the 2023-24 year. The top five (5) issues raised in the investments and advice complaints were:

- inappropriate advice;

- failure to act in the client's best interests;

- failure to follow instructions/agreements;

- service quality; and

- interpretation of product terms and conditions.

Courtesy of AFCA Annual Review Report 2023-24

Key Takeaway

The average time to close an investments and advice complaint increased from 106 days in 2022-23 to 129 days in 2023-24.

AFCA noted the following trends:

- One of the main issues highlighted in the investments and financial advice complaints was that consumers were receiving inappropriate advice. This can include when consumers were provided with general financial product advice when personal advice was needed;

- Almost forty-four percent (44%) of all investments and financial advice complaints closed in 2023-24 were resolved at the rules review stage. During this stage, financial firms could request AFCA to assess whether they had the jurisdiction to make a decision regarding the complaint. AFCA noted that this may have led to the increase in the average time to close an investments and advice complaint;

- A recurring problem in the 2023-24 year was the misclassification of clients as wholesale clients. AFCA noted that many Contract for Difference providers failed to assess the client's suitability, which resulted in inappropriate risk exposure. AFCA noted that some financial advisers incorrectly applied thresholds of $2.5 million in net assets or $250,000 in income, instead of the $10 million limit specified in the Corporations Act 2001 (Cth) for superannuation products. AFCA noted that this misclassification can expose clients to unsuitable advice;

- While disputes relating to life insurance product advice was comparably smaller to other types of issues, AFCA noted that many disputes related to life insurance, total permanent disability, trauma and income protection policies;

- Disputes relating to investment and financial product advice are commonly influenced by the changing market conditions. AFCA noted that the results from the US elections in November 2024 and the upcoming Australian elections in 2025 may lead to increased market volatility and likely result "in a higher number of complaints in the near future."

Despite these trends, there was a 26% drop in the number of complaints received in the 2023-24 relating to investments and advice. AFCA noted that the decrease in the investment and advice complaints reflect "the positive impact of enhanced education standards and increased professionalism within the industry".

See page 86-88 on the 2023-24 AFCA Annual Review Report for more information.

Further Reading

- AFCA Annual Review 2023-24: https://www.afca.org.au/about-afca/annual-review

- AFCA's EDR Response Guide: https://www.afca.org.au/members/news/new-edr-response-guides-transaction-complaints

- ASIC Regulatory Guide 271: https://asic.gov.au/regulatory-resources/find-a-document/regulatory-guides/rg-271-internal-dispute-resolution/

- Dispute Resolution Policy and Complaint Management Policy Template for AFSL: https://sophiegrace.com.au/product/afsl-internal-dispute-resolution-policy/

- Dispute Resolution Policy and Complaint Management Policy Template for Credit Licences: https://sophiegrace.com.au/product/acl-dispute-resolution-policy/

- Information on Investments and Financial Advice Complaints: https://www.afca.org.au/make-a-complaint/investments-and-financial-advice/investments-and-financial-advice-products-and-issues

- Statement from the AFCA regarding the ASIC Annual Review 2023-24: https://www.afca.org.au/news/media-releases/financial-complaints-rise-further-9-to-record-105000-in-2023-24

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.