- in European Union

- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Law Firm industries

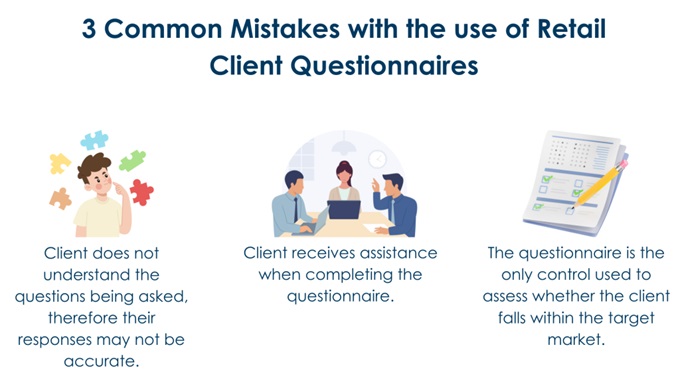

Compliance with the design and distribution obligations ("DDO") by product issuers and distributors remains a key focus of ASIC. ASIC issued three stop orders to AFS Licensees in 2024. Along with the stop orders, ASIC explained how the two Licensees had failed to comply with the DDO, with a particular focus on the retail client questionnaires being used. ASIC subsequently released Report 795 which contains its findings on how Licensees are complying with the DDO, including the use of retail client questionnaires.

Under the DDO regime, retail product issuers and distributors must take reasonable steps that will, or are reasonably likely to, result in distribution conduct relating to retail clients being consistent with the target market determination ("TMD") for the product. A retail client questionnaire is often a critical component of a retail product issuer's compliance system; designed to help the product issuer meet its DDO requirements. The purpose of a retail client questionnaire is to collect information on the prospective client's attributes to allow the product issuer and distributor to assess whether they fall into the target market.

In this article, we walk you through the comments ASIC made in relation to retail client questionnaires and the flaws identified, as well as better practices.

Key Concern 1 – Does your prospective client understand the questions being asked in the retail client questionnaire?

In one of the stop orders, ASIC stated that the retail client questionnaire contained questions and response options that were designed predominantly based on consumer attributes set out in the TMD. ASIC's view is that there was a high risk that the retail client would not understand what was being asked of them in the questionnaire if the questionnaire simply used the same wording as appearing in the TMD.

Questionnaires that are designed in a way which results in a retail client not understanding the questions, and therefore providing inaccurate responses to those questions, may lead to distribution of financial products outside the target market.

Better practices

- designing questions to ask about the characteristics that tend to underly the consumer attributes – for example, the client's income, age, spending habits, debts, use or need of funds for basic living expenses etc.;

- using plain language and avoiding jargon and ambiguity; and

- avoiding mixing different criteria in the same question – double-barrelled questions which ask about two different concepts at once whilst forcing the retail client to give a single answer that may not be fully accurate.

Key Concern 2 - Do you provide assistance to the prospective client in completing the questionnaire?

In all stop orders, ASIC expressed its concern that the effectiveness of a retail client questionnaire was undermined by assistance provided by the product issuer and/or distributor to retail clients when completing the questionnaire.

Examples of assistance include:

- giving prompts disclosing which response option places the retail client outside the target market (such as the use of hard stops);

- using leading, simple or obvious questions (e.g. "yes/no" questions) indicating there is a "preferred" or "correct" answer;

- having warning messages to prompt clients to review their responses and submit alternative responses in order to fall within the target market;

- having follow up telephone communications to provide retail clients with a further opportunity to amend their response to fit within the target market;

- allowing retail clients multiple attempts to pass the questionnaire every 24 hours for an indefinite period; and

- prompting prospective clients with a tick-box acknowledgement that they have certain attributes (self-certification).

Better practices:

- using questions that are open-ended or providing multiple options;

- preventing staff from providing additional explanations – if the client has difficulty understanding the question, it likely means the question has not been designed properly;

- refraining from following up with a client who has failed or been knocked out of the client questionnaire – rejection messages should be short and brief without providing information that would prompt the client as to the reasons why they were rejected;

- implementing lock-out periods to prevent excessive re-attempts in order to pass the questionnaire; and

- requesting the client provide additional documentation to verify a change in responses provided in a re-attempt.

Key Concern 3 – Do you have controls other than the retail client questionnaire in place to comply with DDO?

Lastly, in two of the stop orders, ASIC identified that the retail client questionnaires were the only control the product issuer and distributor used in their onboarding process to assess whether clients were likely to be in the target market. There were no other filters or controls applied during the onboarding process or on an ongoing basis to ensure retail clients fall within the target market identified in the TMD.

Other controls to consider:

- providing regular training to staff (especially consumer-facing staff) on product features, target market and the DDO requirements that are applicable to the business;

- ensuring staff remuneration and incentive structures do not lead to distribution conduct that is inconsistent with the TMD;

- ensuring marketing and promotional materials are consistent with the TMD;

- making use of existing information about a client to assess whether they are likely to fall within the target market;

- monitoring whether clients continue to remain in the target market following distribution; and

- monitoring whether the product remains suitable for the defined target market, such as reviewing the number of complaints or client losses.

If you have any questions regarding your compliance with DDO, please contact us.

Further Reading

- ASIC calls on product issuers to review distribution practices for DDO compliance

- ASIC Report 795 – Design and distribution obligations: Compliance with the reasonable steps obligation

- ASIC Report 762 – Design and distribution obligations: Investment products

- ASIC Report 770 – Design and distribution obligations: Retail OTC derivatives

- ASIC Regulatory Guide 274 – Product design and distribution obligations

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.