- within Finance and Banking topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in European Union

- with readers working within the Law Firm industries

ASIC has cancelled two Australian Financial Services Licences ("AFSLs"), for failing to pay industry funding levies. They were more than twelve (12) months overdue.

Licensees must pay the full amount of the levy, including:

- the levy amount;

- any applicable late payment penalties; and

- any shortfall penalties related to the levy.

ASIC has the power to suspend or cancel an AFSL and/or Australian Credit Licence ("ACL") under section 915B(3)(e) of the Corporations Act 2001 (Cth), if an entity fails to pay the levy under the ASIC Supervisory Cost Recovery Levy Act 2017 and has failed to make full payment for at least 12 months after the due date.

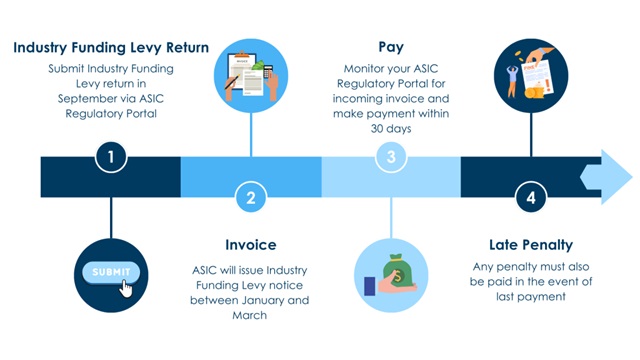

AFSL and ACL holders are required to submit their Industry Funding Return (Business Activity Metrics) via the ASIC Regulatory Portal to receive their levy invoice between January and March in the following year.

Background

The Australian Parliament passed the Financial Services Compensation Scheme of Last Resort Levy Act 2023 (Cth) in 2023, to enhance consumer protection within the financial services industry. The CSLR sets specific eligibility requirements for individuals seeking compensation based on an AFCA determination. It applies only to certain financial products and services.

Further Reading

- ASIC Industry Funding Levy

- ASIC Enforcement Action: Industry Funding Levy (1)

- ASIC Enforcement Action: Industry Funding Levy (2)

- Attention All AFSL and Credit Licence Holders: Have you Submitted your Industry Funding Business Activity Metrics? The Deadline is Approaching!

- ASIC cancels AFS licences of two Australian financial services providers for failure to pay industry funding levies

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.