- within Privacy, Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

AUSTRAC has recently published new lists of suspicious activity indicators that are sector-specific to assist reporting entities to identify potential money laundering ("ML"), terrorism financing ("TF") and other serious and organised criminal activity.

This article provides a summary of the new indicators for non-bank lenders and financiers.

Are you captured as a non-bank lender or financier?

If you provide one or more designated services as prescribed in the AML/CTF Act, you must enrol with AUSTRAC as a reporting entity and there are a range of obligations imposed by the AML/CTF Act along with the AML/CTF Regulations that you must comply with.

Item 6 and Item 7 of Section 6 of the AML/CTF Act prescribe the following designated services:

- Item 6 – making a loan, where the loan is made in the course of carrying on a loans business;

- Item 7 – in the capacity of either lender for a loan or assignee of the lender for a loan, allowing the borrower to conduct a transaction in relation to the loan, where the loan was made in the course of carrying on a loans business.

The above definitions capture non-bank lenders and financiers for both loans issued under the National Consumer Credit Protection Act 2009 ("NCCP Act") and loans that are not captured by the NCCP Act such as commercial loans. It's a common misconception that only consumer loans are caught by the AML/CTF Act, however it is clear from section 6 of the AML/CTF Act that this is not the case. If you are carrying on a loans business and are unsure if the AML/CTF Act is applicable to you, the obligations you must comply or what you need to do if you have operated without the appropriate enrolment with AUSTRAC, please contact us.

What do you need to do?

We have included below a summary of the suspicious activity indicators that non-bank lenders and financiers should be alert to. If any of these indicators are identified by your entity, you must consider lodging a suspicious matter report with AUSTRAC within the appropriate timeframe:

- In relation to terrorism financing, within 24 hours; or

- In relation to money laundering or other matters, within 3 business days.

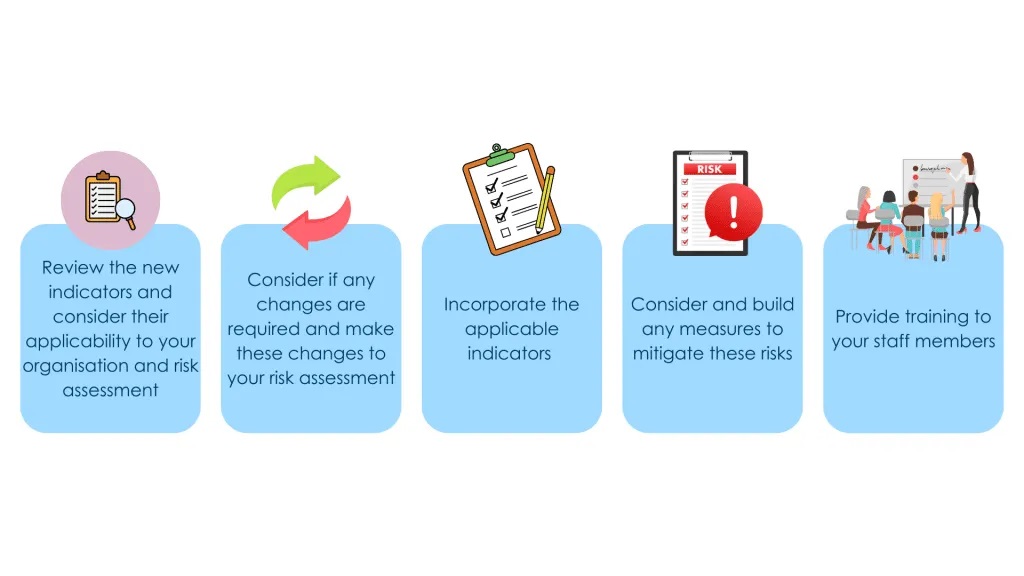

For any reporting entities that provide designated services as a non-bank lender or a financier, we encourage you to:

- Review the new indicators above and consider their applicability to your organisation and risk assessment;

- Consider if any changes are required and make these changes to your risk assessment;

- Incorporate the applicable indicators into your red flag indicator sheet or any other manuals forming part of the AML/CTF Compliance Program;

- Consider and build any measures to mitigate these risks; and

- Provide training to your staff members in relation to the indicators, as well as any other updates made to your AML/CTF Program, to ensure your front, middle and back office staff members are able to identify the presence of any of these indicators in their day to day role.

If you would like to seek compliance or legal advice in relation to the incorporation of these indicators into your existing AML/CTF Compliance Program, please contact us.

| Customer Identification and Behaviour Indicators | |

|---|---|

| Customer Identification (ID) Indicators | Customer Behaviour Indicators |

A customer:

|

A customer:

|

| Money Laundering Inidcators | |

A customer:

|

|

| Tax Crime, Fraud and Scams | |

| Tax Evasion Indicators | Identity and Loan Fraud Indicators |

A customer:

|

A customer:

|

| Welfare Fraud Indicators | Scam Indicators |

A customer:

|

A customer:

|

| Terrorism, National Security and International Crime Indicators | |

| Terrorism Financing Indicators | Proliferation Financing Indicators |

A customer:

Open Source information:

|

A customer:

Corporations:

|

Further Reading

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.