- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit, Basic Industries and Insurance industries

Between 1 January to 30 June 2024, ASIC recorded 63 commenced and 140 ongoing investigations. Throughout that period, 4 outcomes have been reached in relation to credit misconduct, and a further 22 have enforcement litigation in process. Given the scale of ASIC's enforcement this year, credit licensees are reminded of the importance of ensuring they have in place robust compliance procedures.

ASIC's Enforcement Power

ASIC has the power to cancel or suspend credit licences if a licensee is likely to contravene general conduct obligations under section 55(b) of the National Consumer Credit Protection Act 2009 ("NCCP Act").

For example, Melbourne credit licensee John Adicho had his credit licence suspended in July 2024 after ASIC found that he had failed to, and could not be relied upon to, discharge his duties and obligations under the NCCP Act. Mr Adicho was also expelled from the Australian Financial Complaints Authority ("AFCA"). His non-compliance included:

- non-payment of fees;

- failure to lodge numerous annual compliance certificates; and

- non-payment of industry funding levies.

What are General Conduct Obligations and what is the consequence of breaching these obligations

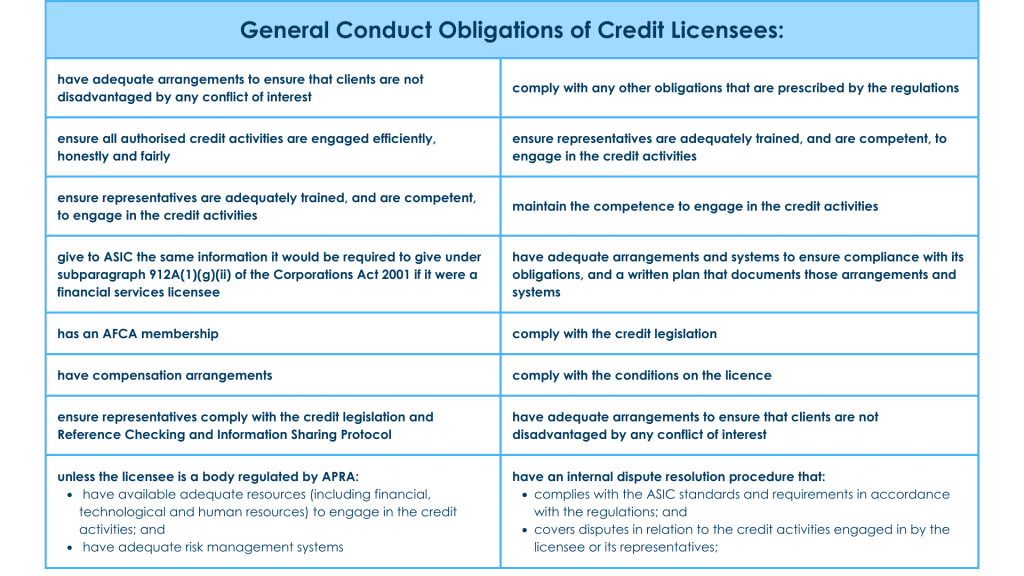

Being a member of AFCA is one of the general conduct obligations imposed on credit licensees by the NCCP Act. The other general conduct obligations credit licensees must comply with under section 47 of the NCCP Act include:

- ensuring your authorised credit activities are engaged in efficiently, honestly and fairly;

- managing any conflicts of interest;

- ensuring that your representatives are adequately trained and competent to comply with the credit legislation;

- maintaining competence to engage in the authorised credit activities;

- having an internal dispute resolution procedure;

- ensuring professional indemnity insurance (or other compensation arrangements) are in place;

- implementing a written plan and adequate arrangements and systems to ensure compliance with your obligations;

- maintaining adequate resources in place, including financial, technological and human resources; and

- implementing adequate risk management systems.

Failure to meet your general conduct obligations can result in a range of penalties and enforcement action by ASIC, including but not limited to:

- Civil penalties (fines)

- Banning orders

- Enforceable undertakings

- Suspension or cancellation of your credit licence

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.