- within Privacy, Government, Public Sector and Immigration topic(s)

- with Senior Company Executives, HR and Inhouse Counsel

- in European Union

- with readers working within the Banking & Credit industries

Treasury has opened its first consultation period in relation to the proposed regulation of Digital Asset Facilities, encompassing both Platform Providers and intermediaries performing financial services in relation to Digital Asset Facilities.

Under the proposed regulation, Platform Providers and intermediaries will be incorporated into the existing Australian Financial Services (AFS) Licensing regime. The proposed regulation seeks to expand the current definition of 'Financial Products' in the Corporations Act to include a : a 'Digital Asset Facility'.

Key Elements of the Proposed Framework

Digital Asset Platforms that hold over a certain threshold of Australians' assets ($1,500 for each individual and $5m in aggregate) under the proposal will be required to obtain an AFS Licence. Businesses that provide intermediary services (e.g. brokers) in relation to Digital Assets will also be subject to the AFS Licence regime.

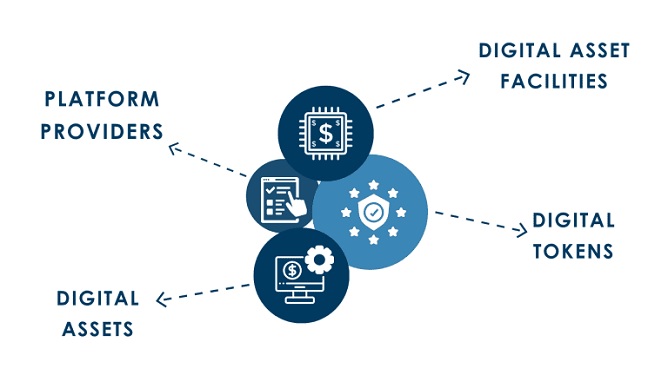

To understand Treasury's proposal, the key terms that Treasury has introduced must also be clarified:

- Digital Tokens: digital units or records in a token based system.

- Digital Assets: Digital Tokens and their associated entitlements.

- Platform Provider: the Digital Asset Facility issuer – the person or persons responsible for the obligations owed to clients under the terms of the asset holding arrangement.

In addition to the current AFSL regime's general obligations, Platform Providers will be subject to specific obligations that take into account the nature of the platforms, Digital Tokens and the associated risks to consumers, including:

- Financial Requirements: holding Net Tangible Assets of at least AUD 5m (if performing the custody function) or 0.5% of the value of the Digital Asset Facility (if utilising the services of an external custodian) as well as complying with the standard solvency, positive net asset and cash needs requirements.

- Retail Disclosure Requirements: Providing a 'Facility Guide' to any retail clients prior to providing them with any services.

- Issuing Facility Contracts: issuing a written agreement between the Platform Provider and clients that meets minimum standards.

The proposal seeks to impose obligations on:

- Digital Asset Facilities rather than the Digital Assets themselves; and

- transactional functions performed by Platform Providers in respect of digital assets that are not financial products. Treasury has coined these functions 'Financialised Functions' which include trading, staking, tokenisation and fundraising.

What Next?

Platform Providers and intermediaries which provide services in relation to Digital Asset Facilities should familiarise themselves with Treasury's proposals, the AFS Licensing requirements and start thinking about how business operations will need to change to ensure they are within the remit of the proposed regulatory framework.

Background

The Australian government is seeking to introduce a regulatory framework to address and minimise client harm in the Digital Asset space. Treasury has indicated that the proposed regulatory framework is to bring Platform Providers within a regulatory environment that governs other financial services participants that pose risks to consumers of a similar nature.

Digital Currency Exchange Providers will continue be required to be registered with AUSTRAC.

Consultation is open until 1 December 2023. Further consultation on draft legislation is expected in 2024. Once legislation is passed, a proposed a 12 month transition period will occur to allow businesses to obtain appropriate AFS Licensing.