- in European Union

- within Privacy, Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit industries

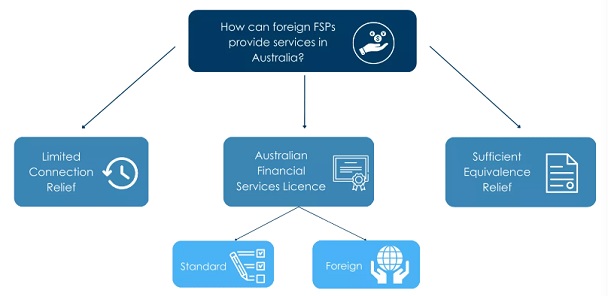

In the current regulatory landscape, foreign Financial Services Providers (FSPs) have a number of avenues available to them to provide services to clients in the Australian market.

Do you have financial services registration in a foreign jurisdiction?

Foreign FSPs regulated by a "sufficiently equivalent" overseas regulator can enter the Australian market and provide financial services to Australian wholesale clients under transitional arrangements currently available to them by applying for relief from obtaining an Australian Financial Services Licence (AFSL). The transitional relief from obtaining an AFSL will remain in place until 31 March 2024.

The following relief is available:

|

United Kingdom |

[CO 03/1099] UK regulated financial service providers |

|

United States |

|

|

Singapore |

[CO 03/1102] Singapore MAS regulated financial service providers |

|

Hong Kong |

[CO 03/1103] Hong Kong SFC regulated financial service providers |

|

German |

[CO 04/1313] German BaFin regulated financial service providers |

|

Luxembourg |

ASIC Corporations (CSSF-Regulated Financial Services Providers) Instrument 2016/1109 |

Do you already hold a foreign AFSL?

Good News! You will be able to continue operating under your financial services business in Australia under the foreign AFSL issued by ASIC.

Are you a new entrant to the Australian market?

There are a number of avenues available to new entrants into the Australian market that include:

- obtaining licensing relief (including the sufficient equivalence relief (refer above) and limited connection relief);

- applying for a foreign AFSL (although given the uncertainty as to whether the foreign AFSL regime will continue post 1 April 2024 and the limitations to targeting wholesale clients only, a standard AFSL might be the way to go); or

- applying for a standard AFSL (read more here).

Limited Connection Relief

Limited connection relief is available in circumstances where a foreign FSP is deemed to be carrying on a financial services business in Australia to wholesale clients only because the financial services business "engages in inducing, or intending to induce, a person in Australia to use its financial services". To rely on the limited connection relief, an FSP must:

- not have a presence in Australia;

- deal with wholesale clients only; and

- carry on a financial services business in Australia only providing inducement services.

The purpose of the limited connection relief is to enable infrequent, arms-length transactions by foreign FSPs.

No application is required to rely on the limited connection relief.

Foreign AFSL

The foreign AFSL regime was created with the intention of retiring the sufficient equivalence relief and requiring the foreign FSPs which previously relied on this relief to obtain a foreign AFSL. Foreign FSPs relying on the limited connection relief that are also regulated by a "sufficiently equivalent" overseas regulator are also eligible to apply for a foreign AFSL. For the purpose of the foreign AFSL regime, "sufficiently equivalent" includes:

- Danish FSA regulated FSPs

- French ACPR regulated FSPs

- French AMF regulated FSPs

- German BaFin regulated FSPs

- Hong Kong SFC regulated FSPs

- Luxembourg CSSF regulated FSPs

- Ontario OSC regulated FSPs

- Singapore MAS regulated FSPs

- Swedish FI regulated FSPs

- UK regulated FSPs

- US CFTC regulated FSPs

- US SEC regulated FSPs

- US Federal Reserve and OCC regulated FSPs

What happens when the transitional relief expires on 1 April 2024?

It is unclear at this stage what registration, relief and/or licensing requirements will need to be satisfied by foreign FSPs to continue providing services to Australian clients. Sophie Grace will publish updated information and guidance as it becomes available.