- within Corporate/Commercial Law topic(s)

- in North America

- with readers working within the Banking & Credit and Retail & Leisure industries

- within Corporate/Commercial Law topic(s)

- in North America

- in North America

- with readers working within the Retail & Leisure industries

- within Insolvency/Bankruptcy/Re-Structuring and Law Department Performance topic(s)

INTRODUCTION

The PE industry in Australia began 2025 with a cautious yet hopeful outlook. After 13 consecutive interest rate hikes, recent rate cuts have breathed new life into market sentiment. Trading conditions are also gradually stabilising, as businesses emerge from the shadows of the pandemic, global supply chain shocks and international trade turbulence.

Yet, unlike the globally driven strategies seen in Europe and the U.S., Australian PE investments are largely rooted in domestic markets. While this focus may have offered some insulation from recent external shocks such as new U.S. tariffs, it has also likely contributed to a slow recovery in deal activity through 2024 and into the first half of this year.

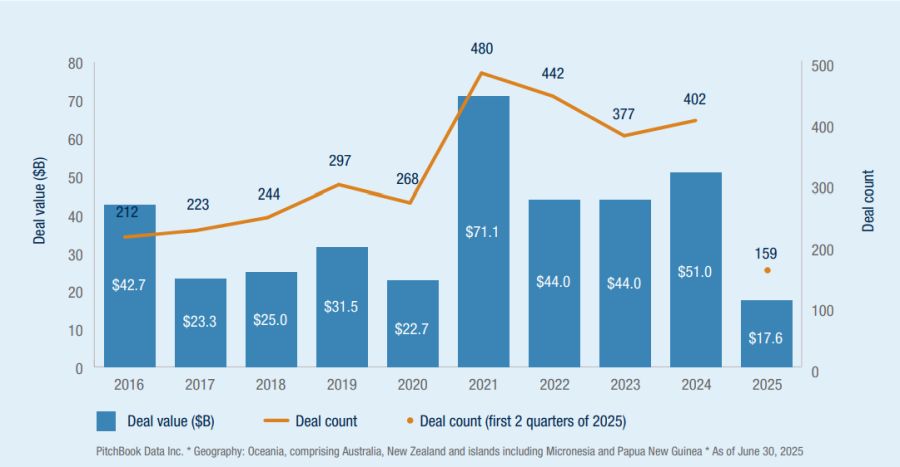

Figure 1

PE deal activity

"Our survey findings highlight the diverse strategies and efforts PE players are employing."

Softening domestic demand and a slower-than-anticipated pace of interest rate cuts have particularly complicated the path to exits since 2022. Buyers are scrutinising assets more closely, and the widening valuation gap between them and sellers has dampened trade sales. Meanwhile, IPOs – once a viable exit option for well-run mid-sized companies – have been a difficult pathway to investment realisation, with only a handful of PE-backed listings on the Australian Securities Exchange (ASX) in the past 18 months.

This exit bottleneck has left funds with a larger-than-usual number of unsold companies in their portfolios, many of which were acquired at premium valuations during the COVID deal boom, when PE investments in Australia more than tripled to A$146 billion1 .

With businesses staying in portfolios for extended periods and growing pressure from Limited Partners (LPs) to return capital, funds are being forced to work harder to enhance the value of aging assets while waiting for the exit window to reopen. Our survey findings highlight the diverse strategies and efforts PE players are employing to tackle that challenge.

CLEARER PATH TO EXITS EMERGING DRIVEN BY IMPROVED OPERATIONS

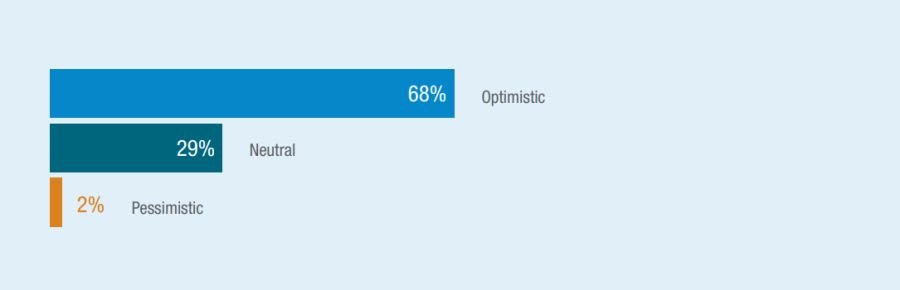

Figure 2

Q: Looking ahead to exits in the next 3 years, how would you describe your sentiment for your portfolio companies?

After three years of protracted exits, funds in our survey appear to see the path to divesting clearing – at least in the medium-term. 68% of investors expressed optimism about exit prospects over the next three years, citing improved company performance (e.g. financial metrics, leadership) as the No. 1 lever for successful exits. Additionally, 70% said they don't expect tariffs or geopolitical tensions to impact exit timing.

This newfound optimism likely reflects broader macroeconomic improvements, particularly the three interest rate cuts delivered by the Reserve Bank of Australia (RBA) this year, and the fact that many Australian PE portfolios are predominantly domestically focused, which makes them less directly exposed to global tariff impacts.

Nearly four years on, the market also appears to have set aside the COVID overhang, with operating conditions increasingly normalising. Perhaps accepting that some level of global uncertainty is here to stay, funds have grown increasingly confident in their ability to protect and unlock value in a more complex market, thus paving the way for successful exits.

Figure 3

Q: What is the most critical factor influencing exit outlook?

The positive sentiment among Australian PE funds contrasts with the outlook for exits in other key PE markets. In a survey conducted by A&M's Private Equity Services team in April 2025, only 31% of U.S. funds reported a positive or very positive outlook for PE exits, and 36% expected a worsening trend. In the European survey, while optimism was somewhat higher (57%), a third of respondents expected U.S. tariffs to have an impact on exit timelines.2

CAUTIOUS OPERATORS "HOLDING AND IMPROVING" ASSETS AMID EXIT BOTTLENECK

Figure 4

Q: How are you managing aging assets in today's environment?

With more funds holding assets well beyond their original timeline, the growing backlog of aging assets is becoming a critical test of portfolio discipline.

Our survey shows that a significant majority of funds (73%) are addressing the exit bottleneck by intensifying their focus on operational improvements for existing assets. Another strategic path, highlighted by 17% of survey respondents, is to refinance the portfolio company's debt, buying time for the business to reposition the exit story while waiting for market conditions to improve.

"73% of funds are addressing the exit bottleneck by intensifying their focus on operational improvements for existing assets."

These approaches mirror strategies used by European General Partners (GPs), 50% of whom reported pursuing debt refinancing, alongside the extension of value creation programmes, in response to protracted exits. Additionally, 25% of European funds are rolling existing investments into continuation vehicles or secondary funds, which in recent years have emerged as an important alternative liquidity exit for LPs and GPs globally in a slow deal market.

In Australia too, and primarily for large, harder-to-sell assets, we have observed a number of PE funds rolling existing assets into continuation or evergreen funds, giving funds and portfolio companies time to improve operational performance and position for future sales.

A&M PERSPECTIVE: BUILD THE COMPANY TODAY FOR THE BUYER YOU WANT TOMORROW

With longer hold periods and exit windows remaining narrower than usual, aging assets demand a deliberate, portfolio-wide review beyond passive holding.

Too often, aging assets are managed with a one-sizefits-all approach, even when they face constraints and opportunities that are fundamentally different. In a difficult market, funds must focus on aligning their actions with the commercial realities of each business in their portfolio.

As one respondent in the study aptly put it when describing their approach to aging assets, a management strategy should be "more asset-specific than a broad strategy," revolving primarily around "asset performance and operations, and ensuring the business is efficiently capitalised from both a debt and equity perspective."

"Exit becomes a strategic direction that guides decision-making today."

Exit as the north star of capital allocation and operational decisions

When it comes to value creation from operational improvements, most funds are tackling earnings growth through a combination of both revenue and cost levers. However, to bring the investment thesis from good to great, the goal needs to go further and shape the company into something a buyer wants to own, and is willing to pay for, in the next one to two years.

This means making the exit case the strategic north star to guide investments, capital allocation and operational decisions. Starting with an end in mind allows funds to reverse-engineer the path to a successful exit, including:

- Identifying the most likely buyer type: e.g. trade buyer, PE sponsor, sector roll-up, IPO market.

- Understanding their value logic: what they care about, their risk appetite, and what premium they will pay for

- Building a roadmap that aligns with their investment story: not only improving profitability, but shaping the company into the kind of asset that a buyer is looking for.

This method of working backwards from the desired exit provides a clear framework for managing assets in the final years of ownership. For example:

- If a strategic acquirer values platform scale, prioritise bolt-on acquisitions and the asset's ability to integrate add-ons.

- If a buyer cares about revenue stability, refine the commercial model and go to market approach, not just topline growth.

- If IPO is the target, invest in governance, ESG positioning and investor readiness to meet public market requirements and expectations.

Under this approach, exit becomes a strategic direction that guides decision-making today. This not only sharpens how capital and leadership are deployed, but also aligns stakeholders around a shared path to liquidity.

To view the full pdf, click here.

Footnotes

1.According to S&P Capital IQ (CapIQ) data, PE investments in Australia more than tripled between 2020 and 2022, reaching approximately A$146 billion in cumulative value invested.

2. European and U.S. surveys asked respondents about the exit outlook in the next 12 months.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.