- within Finance and Banking topic(s)

- within Finance and Banking topic(s)

- with Finance and Tax Executives

- with readers working within the Securities & Investment industries

ASIC has released Report 805 – Falling Short: Compliance with the small amount credit contract obligations. This report summarises ASIC's observations from its review of lenders issuing small amount credit contracts (SACCs). ASIC commenced the review in light of the changes to the law in 2022 and 2023 under the Financial Sector Reform Act 2022 (FSR Act).

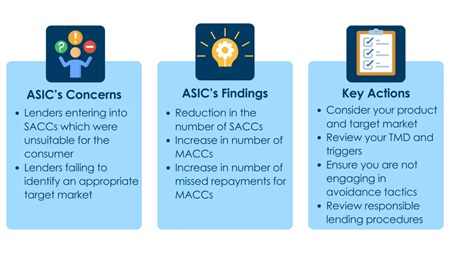

ASIC's key concerns related to providers of SACCs not meeting their obligations by:

- Entering into SACCs that were unsuitable for the consumer;

- Failing to identify an appropriate target market and distribute products within that target market.

ASIC remains concerned about any signs that SACC lenders may be using business models designed to avoid the addition requirements the FSR Act imposes on SACCs.

As part of the review, ASIC:

- Discussed issues and concerns with consumer advocates;

- Met with industry representatives;

- Reviewed intelligence and data held by ASIC;

- Examined other data from ASIC work on compliance with the design and distribution obligations;

- Obtained data from five SACC lenders

- Reviewed the websites of 14 of the largest SACC and medium amount credit contract (MACC) lenders.

ASIC's findings show that since June 2023, there has been:

- a reduction in the number of SACCs provided

- an increase in the number of MACCs provided;

- an increase in the total number of missed repayments for MACCs, but a decline in the total number of missed payments for SACCs.

Responsible Lending

The report also comments on SACC lenders' adherence to the responsible lending obligations. ASIC observed practices such as:

- offering alternative products to consumers who were ineligible for a SACC because of the protected earnings amount;

- asking consumers to consent to being provided a higher credit limit than initially sought, which may be inconsistent with the consumer's requirements;

- providing MACCs for loan amounts just above the SACC threshold, with short repayment periods;

- consolidating existing debts under SACCs into an alternative credit contract.

ASIC expects SACC lenders to carefully consider their responsible lending obligations and implement procedures which allow for differences between the products offered and the target market of consumers accessing those products. Further, ASIC states that a one-size-fits-all approach to offering SACCs will not be appropriate and lenders must ensure they review the consumer's individual circumstances. ASIC also noted that lenders must document any changes to the consumer's requirements and objectives throughout the course of an application. This can help to ensure the offering of a different product by the lender is defensible and genuinely reflects what the consumer requires.

Key Steps for SACC lenders to take

SACC lenders should:

- consider their product offering and defined target market, in light of their design and distribution obligations;

- ensure appropriate review triggers are in place in Target Market Determinations for SACCs, to ensure that lenders adequately monitor the risk of distribution outside the target market;

- consider the anti-avoidance provisions and ensure your business model is not looking to shift into other forms of credit (which may involve more risk to the consumer), to avoid the protections imposed on SACCs;

- review your responsible lending procedures and ensure they are appropriately applied to SACC consumers;

- ensure all responsible lending assessments consider the individual circumstances of the consumer and are not a one-size-fits-all approach.

The investigation of business models which are designed to avoid consumer protections is a priority for ASIC in 2025. ASIC will continue to take enforcement action in response to lending practices that cause consumer harm and therefore it is important for all SACC and MACC lenders to consider their procedures and make adjustments in light of ASIC's findings in Report 805.

Further Reading

Report 805 – Falling Short: Compliance with the small amount credit contract obligations

ASIC Media Release 25-036MR ASIC warns that payday lenders may be breaching consumer protection laws

Summary of Changes to SACCs and Consumer Leases

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.