- within Corporate/Commercial Law topic(s)

- within Government and Public Sector topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Banking & Credit and Telecomms industries

Who is required to pay the ASIC Industry Funding Levy?

The following entities are required to pay the levy each year:

- companies

- financial services licensees; and

- credit licensees.

ASIC Industry Funding Levy

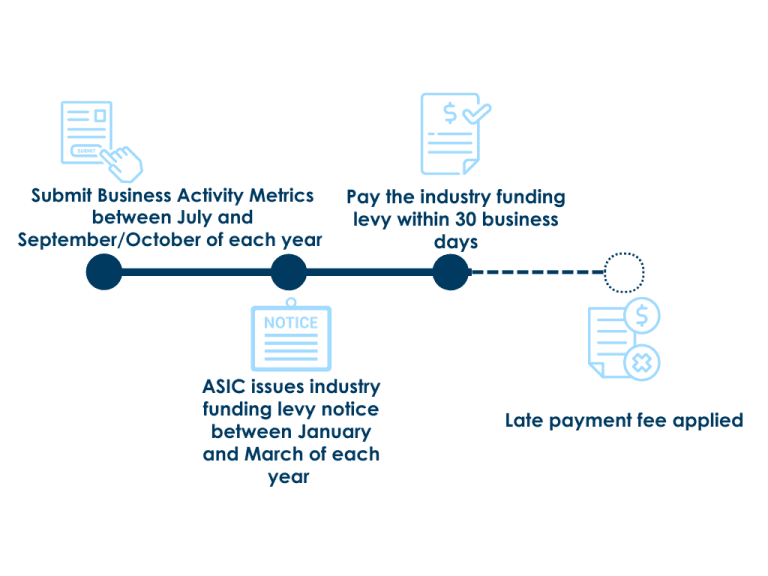

In order for ASIC to determine how much you are required to pay, you must submit your business activity metrics via the ASIC Regulatory Portal between July and September/October of each year.

The business activity metrics used to calculate levies are measured by the following business activities, including:

- revenue generated;

- total assets;

- credit provided;

- deposits held; and

- number of new and ongoing appointments.

ASIC will use these metrics to issue your industry funding levy invoice between January and March the next year. The industry funding levy invoice from ASIC must be paid within thirty (30) business days after the levy notice is issued, using BPAY, electronic funds transfer or credit card.

What happens if you don't submit the business activity metrics or pay the industry funding levy?

If you fail to submit the business activity metrics by the deadline, you will not be able to lodge this form late via the ASIC Regulatory Portal. ASIC will use the data it has available to calculate your share of the regulatory costs for the sector in which it is authorised to operate.

If you fail to pay the industry fund levy by the due date, ASIC will impose a late payment penalty which is 20% of the overdue levy amount per annum. If the industry funding levy has not been paid at least twelve (12) months after the due date, ASIC can take action to cancel or suspend the licence.

What if you can't pay the industry funding levy?

It is a criminal office under the Act if you fail to submit the business activity metrics without a A reasonable excuse may include natural disaster, delays caused by the court, serious illness or death of an officeholder.

You can request that ASIC waive your levies and penalties if you have a reasonable excuse. In order to make a request for a waiver, you will need to log into your ASIC Regulatory Portal account and complete the relevant form. You will also be required to support your request with evidence of the exceptional circumstances.

If you are facing financial hardship, you can apply for an industry funding payment plan. Similar to the waiver request, you will need to log into your ASIC Regulatory Portal account to complete the request for a payment plan. ASIC will determine if you are eligible for a payment plan based on the reasons provided in the request and the supporting documentation used to substantiate your financial hardship.

Three ways to pay your industry funding levy

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.