- within Litigation and Mediation & Arbitration topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- in United States

- with readers working within the Metals & Mining, Property and Law Firm industries

Article Summary

The article discusses the differences between hiring a debt collection lawyer and a debt collection agency, providing insights into the advantages and disadvantages of each option to help creditors make an informed decision.

Debt Collection Lawyers

- Advantages: They offer legal expertise, personalised approach, foreshadowing legal action, the ability to commence legal action, and fixed-fee debt recovery. Lawyers are well-versed in legal guidelines and can provide quality legal advice, making them effective for complex cases.

- Disadvantages: The main drawbacks are the higher legal costs and the fact that they may not be suitable for small debts due to the cost-benefit ratio.

Debt Collection Agencies

- Advantages: Agencies are cost-effective, have specialised expertise in debt collection, can save time and resources for businesses, and help in managing the business's reputation. They usually work on a commission basis and are effective for straightforward debt recovery.

- Disadvantages: Their ability to take legal action is limited, and they offer less personalisation in the debt recovery process.

Decision Factors

The article suggests considering the size of the debt, legal complexity, and budget when choosing between a lawyer and an agency. Larger, legally complex debts might be better handled by lawyers, while smaller or straightforward debts could be more suited for agencies.

Are you a creditor that is struggling with the debts you are owed and are looking for third-party assistance, but don't know if you want to use a debt collection lawyer or debt collection agency?

If so, you may be concerned about this decision and about your struggles with your debts in general, which can put a lot of stress on you as a creditor, especially when trying to manage other clients.

When you are seeking professional assistance with debt, it is important to make an informed and thought-out decision about which of the two key choices, debt collection lawyer or debt collection agency, would be the best suited for your business.

Contrary to common belief, they are not the same and the services that they provide and how they provide them vary, meaning one option will likely suit your specific needs more than the other.

But how will I know which decision to make, and which one is the best choice for my debt and business; is the question that you may be asking yourself.

In this article our debt recovery solicitors will discuss the benefits and drawbacks of both debt collection lawyers and debt collection agencies so that you can make an informed decision about which option is best for you.

Debt Collection Lawyers

The first of the two choices that you can make regarding the type of professional assistance that you would like to collect your debt is a debt collection lawyer.

A debt collection lawyer is a professional in the legal sect of collecting a debt. They will employ legal processes and utilise the courts and civil justice system to recover your debt.

This can be an extremely effective method of collecting debt and has several individual benefits that your business can reap if you choose to hire a debt collection lawyer.

There are, however, some drawbacks, depending entirely on what you are looking for from the matter.

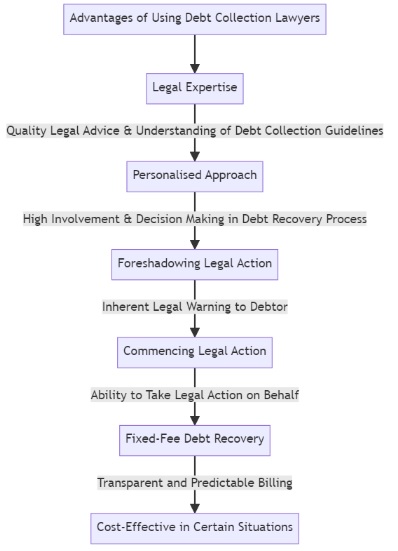

Advantages of Using Debt Collection Lawyers

There are several advantages to using a debt collection lawyers over a debt collection agency. These advantages include:

- Legal Expertise.

- Personalised Approach.

- Foreshadowing Legal Action.

- Commencing Legal Action.

- Fixed-Fee Debt Recovery.

Legal Expertise

The first and most obvious benefit to hiring a debt collection lawyer is the legal expertise that they possess and will use to recover your debt. As a professional in the legal field of debt, a debt collection lawyer will be able to provide you with quality legal advice regarding your matter.

You see, debt collection is quite a complex legal process, contrary to popular belief! This is especially true when a debt is not paid or multiple payments have been missed, as recovery action is then necessary.

However, creditors and debt collectors are limited in their collection action by Australian guidelines, which establish how they may and may not act.

Debt collection lawyers have a complex and well-versed understanding of these guidelines and can ensure they are effectively applied, and the debt is collected.

Personalised Approach

Another great benefit of hiring a debt collection lawyer to recover your debt is that they will provide a personalised approach to the collection of your debt.

When you hire a debt collection lawyer, you will still be highly involved in the debt collection process.

You will be able to make the decisions regarding how they proceed and how they generally manage the debt recovery process. If you wish for a more hands-on approach to professional debt collection, a lawyer can provide that for you!

Foreshadowing Legal Action

Another great benefit that you can reap when hiring a debt collection lawyer to recover a debt is that they provide an inherent legal warning to your debtor.

This is not to say that they will legally threaten your debtor, as threatening to take legal action that you cannot or will not take is not allowed when recovering debt.

However, their simple involvement in the matter provides the promise of legal action if they do not take action to pay the debt, as that is the natural next step with a lawyer.

You, however, do not need to take legal action if you wish and can proceed in a manner of your choice, but the warning of pending legal action may help your debt to be recovered as it shows that you are serious about the debt being paid!

Commencing Legal Action

Another great benefit of hiring a debt collection lawyer to recover your debt is that they can take legal action on your behalf if all else fails.

Legal action should be the last result in a debt recovery matter as it is generally a time-consuming and expensive process. However, sometimes it is the best option to collect your debt!

If you cannot recover the debt using other methods, such as alternative dispute resolution, then the party that you currently have acting on your behalf for your debt recovery matter can take legal action, which allows a more streamlined process if it comes to this!

Read more here: https://stonegatelegal.com.au/legal-proceedings-for-debt-recovery/

Fixed-Fee Debt Recovery

Unlike debt collection agencies that operate on commission, debt collection lawyers typically offer fixed-fee billing for undefended debt recovery cases. This covers all stages of the process, from pre-litigation steps like sending letters of demand to obtaining default judgments and pursuing enforcement proceedings. Fixed-fee billing provides transparency and predictability, eliminating the risk of unexpected legal costs.

Since lawyers are not incentivised by commission, they only charge for the work they perform. If a single letter of demand is sufficient to resolve the matter, you only pay for that single letter. This can make debt collection lawyers more cost-effective than collection agencies in certain situations.

Lawyers' Advantage in Court Proceedings

Debt collection lawyers also have a cost advantage when court action becomes necessary.

When collection agencies need to take legal action, they often outsource the work to unfamiliar lawyers, incurring additional costs to bring them up to speed. Moreover, if the agency successfully recovers the debt in court, you are still responsible for their commission on top of the legal fees.

Debt collection lawyers, on the other hand, having already done the preliminary work, can proceed directly with court action. You also avoid paying a commission in addition to legal fees.

While legal costs in debt recovery proceedings are capped, you cannot expect to recover all incurred costs. A fixed-fee lawyer can provide more certainty by allowing you to negotiate the fee upfront, taking into account anticipated costs.

CASE STUDY

We have successfully recovered a large number of debts from debtors for the fixed fee or the scale fee outlined in the UCPR. This limits the out-of-pocket expenses for our clients, and makes the process more economical for creditors.

At Stonegate Legal we offer fixed fees and scale fees for undefended debt recovery legal action. Contact us today

Disadvantages of Using Debt Collection Lawyers

There are just a couple of disadvantages to using debt collection lawyers over a debt collection agency. These disadvantages are:

- Legal Cost.

- Not for Small Debts.

We will explain these in more detail below.

Debt Collection Lawyer Costs

The first drawback that you may experience when you hire a debt collection lawyer is the cost of the service.

As debt collection lawyers generally charge on an hourly basis, it may be quite costly to hire one to recover your debt.

This is due to their valuable legal advice and experience paired with the general effectiveness of their service, but it may not be feasible for you or your business depending on the circumstances.

Some clients just don't see the value in spending more money to collect debts, and so a commission model might be better for those people.

Not for Small Debts

Another drawback that you may experience when you hire a debt collection lawyer is that they are not a good option for smaller debts.

If your debt is quite small in the scheme of things, the charge for the service may outweigh the debt itself, meaning that an ethical lawyer will often not take on the debt, because there is no point paying more than the debt amount to recover the debt. A good lawyer will usually discuss this with you.

Now the advantages and disadvantages of using debt collectors.

CASE STUDY

When it comes to recovering small debts, the decision to involve a lawyer can often lead to a paradoxical situation where the cost of recovery outweighs the debt itself. Legal fees can quickly accumulate. Lawyers typically charge by the hour, and even for small debts, the legal process can be lengthy and complex. This means that the cost of hiring a lawyer could easily surpass the actual amount of the debt you're trying to recover. At Stonegate Legal we are upfront and honest with our clients and if we do not think that it is economically viable for our clients, then we will always provide that advice.

Debt Collection Agencies

A debt collection agency is the second choice you can make and another great option that you can use when you are looking to hire a professional service to collect a debt for you!

A debt collection agency is a business that will recover your debt using industry practices, generally in exchange for a percentage of the debt. They have several great benefits and, again, some drawbacks depending on what you are looking for from the debt recovery process.

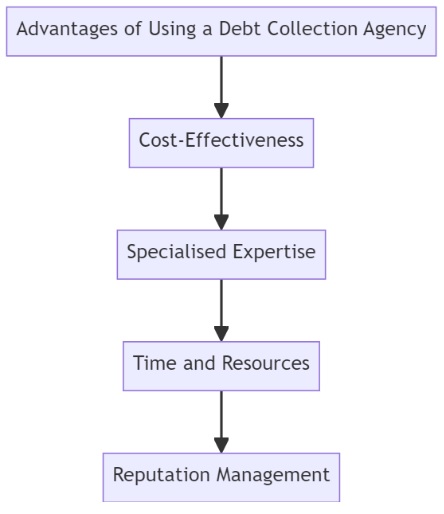

Advantages of Using a Debt Collection Agency

There are several advantages to using a debt collection agency over debt collection lawyers. These advantages are:

- Cost-Effectiveness.

- Specialised Expertise.

- Time and Resources.

- Reputation Management.

We will explain these in more detail below.

Cost-Effectiveness

Debt collection agencies are generally a very cost-effective option to choose when you are looking for professional debt recovery.

As stated previously, they take a portion of the debt rather than a set commission fee, so the amount that they take will generally be less expensive than that of a debt recovery lawyer!

We are partnered with Advance Debt Collection, who offer the following commissions:

|

DEBT AMOUNT |

COMMISSION % Rate |

COMMISSION $ AMOUNT |

AMOUNT TO YOU |

| Under $1,000 | 35% | $350.00 | $650.00 |

| $1,000 to $5,000 | 25% | $1,250.00 | $3,750.00 |

| $5,000 to $10,000 | 20% | $2,000.00 | $8,000.00 |

| $10,000 to $20,000 | 15% | $3,000.00 | $17,000.00 |

| over $20,000 | 10% | 10% of the amount | 90% of the amount |

This is also done on a no collection, no commission basis – which means if they do the work and cannot collect, they don't get paid. They only get paid when you do.

Specialised Expertise

A debt collection agency can also provide you with specialised expertise, due to their complex knowledge and experience within debt collection specifically.

This can allow your business to see fast and effective results and overall gain a deeper and better understanding of debt collection that you can apply to your other debts in your business. This can include:

- Communication Skills.

- Financial Analysis.

- Industry-Specific Knowledge.

- Negotiation Skills.

- Record Keeping.

- Skip Tracing.

This can be extremely beneficial for you and your business and can result in great success in the collection of the debt in question.

Standard Debt Collection Services include:

- Demand Letters.

- Phone Calls.

- Negotiating Payments.

- Account Settlement Arrangements.

- Account Status Reports.

Time and Resources

Another great benefit of hiring a debt collection agency to recover a debt is that they can free up time and resources for you to manage your business.

Problem debt can take a lot of your business's time and resources from you, as you have likely observed in the past and when trying to collect your current debt!

By allowing a professional to take over the debt collection process, as they do in an agency, you will have much of your time and your business resources freed up to focus on growth, business management and, of course, your other clients and debtors.

Reputation Management

Another great benefit of hiring a debt collection agency to recover a debt is that they can help manage your business's reputation.

Professional debt recovery agencies can provide a professional and united image of your business, which can benefit your reputation!

They can also help to preserve your relationship with your debtor in the future, as it is less of an intimidating appearance as opposed to a debt collection lawyer!

Disadvantages of Using a Debt Collection Agency

There are just a couple of disadvantages to using a debt collection agency over debt collection lawyers. These disadvantages are:

- Limited Legal Action.

- Limited Personalisation.

We will explain these in more detail below.

Limited Legal Action

One of the drawbacks of hiring a debt collection agency is that they are limited in the legal action that they can take if the matter goes south.

This means that you may have to hire a debt collection lawyer after all in the end if legal action is necessary and the decided next step.

Limited Personalisation

One of the drawbacks of hiring a debt collection agency is that they are also limited in the personalisation of your recovery process, and you will generally have a less involved role.

However, if you wish to hire a professional to recover your debt to free up your time and resources, this may be a benefit for you as it means that you take a more back seat role in the process and can focus on other aspects of your business.

Debt Collection Lawyer or Debt Collection Agency?

When making your decision, there are several factors that should be considered to make the right choice, including:

- Size of Debt

- Legal Complexity

- Budget

We will explain these in a little more detail below.

Size of Debt

As we have discussed lawyers work on an hourly payment schedule and agencies will generally take a percentage of the debt.

If the debt is large, then a lawyer might be the right decision in this regard. If it is smaller, then consider hiring an agency to collect the debt instead.

Cost aside, many debt collection lawyers will not accept smaller debts to recover as it is not feasible for them to cost less than the debt amounts to!

Legal Complexity

Another key feature to consider when deciding if you wish to hire a debt collection lawyer or a debt collection agency is the legal complexity of the matter.

Sometimes the debt and collection of it may be a cut-and-dry, basic process.

However, if there are complex elements of the law involved in the debt or if you anticipate that legal action may be necessary, your decision should be influenced. If this is the case, then it is wise to hire a debt collection lawyer so that they can apply their legal expertise to the matter.

Budget

Another key consideration that should be made when deciding on which of the two types of professionals suits your needs is your budget in the matter.

Again, lawyers are generally more expensive, and agencies are more affordable.

If you have a smaller budget or are concerned that the debt is simply uncollectable, an agency is probably the best choice, as many agencies charge only if the debt is collected!

Debt Collection Lawyer or Debt Collection Agency FAQ

Whether you're a business owner, creditor, or simply seeking information, these FAQs are designed to help you understand your options in debt recovery and make informed decisions.

What is the difference between a debt collector and a lawyer?

The main difference lies in their roles and methods. A debt collector, typically working for a debt collection agency, focuses on recovering debts through non-legal means such as phone calls, letters, and negotiation. They are experts in persuasion and negotiation but do not have legal authority. On the other hand, a lawyer, especially one specialising in debt collection, is qualified to provide legal advice, represent clients in court, and initiate legal proceedings. Lawyers have a comprehensive understanding of the legal aspects of debt recovery and can handle complex legal issues related to debts.

Is it worth using a debt collection agency?

In many cases, it is worth using a debt collection agency, especially for smaller or straightforward debts. Debt collection agencies are cost-effective, as they usually work on a commission basis, charging a percentage of the recovered debt. They save time and resources for businesses by handling the debt recovery process. Agencies are skilled in persistent and compliant pursuit of debts, following ethical and legal guidelines. However, for larger or legally complex debts, or when legal action is anticipated, consulting a lawyer might be more appropriate. The decision should be based on the size of the debt, the nature of the debtor, and the specific circumstances of the debt.

What distinguishes a debt collection lawyer from a debt collection agency?

A debt collection lawyer is a legal professional who specialises in recovering debts through legal processes and the court system. They offer expert legal advice and can initiate legal proceedings if necessary. In contrast, a debt collection agency focuses on recovering debts through standard industry practices, such as making phone calls and sending letters, and typically works on a commission basis.

When is it advisable to engage a debt collection lawyer?

Engaging a debt collection lawyer is advisable when dealing with large debts, situations involving complex legal issues, or when there is a high likelihood of needing to resort to legal action. Lawyers can navigate the intricacies of the legal system and provide a more tailored approach to debt recovery.

Are debt collection agencies suitable for recovering small debts?

Yes, debt collection agencies are often more suitable and cost-effective for smaller, straightforward debts. Their commission-based fee structure and streamlined debt recovery processes make them ideal for handling less complex debt situations.

What are the primary benefits of hiring a debt collection lawyer?

The primary benefits include comprehensive legal expertise, a bespoke approach to each case, the capability to initiate legal proceedings, and often a fixed-fee arrangement for debt recovery. Lawyers bring a depth of understanding of legal guidelines and can offer strategic advice tailored to the specifics of each case.

Can a debt collection agency initiate legal proceedings?

Debt collection agencies have limited capacity to take legal action. While they can handle the initial stages of debt recovery, they may need to refer cases to lawyers if legal action is required, especially in complex situations.

Is employing a debt collection lawyer generally more expensive?

Typically, yes. Debt collection lawyers may charge higher fees due to their specialised legal expertise and the tailored nature of their services. This is particularly true for complex cases where detailed legal knowledge and strategic planning are required.

How do debt collection agencies charge for their services?

Most debt collection agencies operate on a commission basis, charging a percentage of the total debt recovered. This percentage varies depending on the agency and the amount of debt. This structure can be more cost-effective for straightforward debt recovery cases.

Is a debt collection lawyer appropriate for small debts?

While debt collection lawyers can handle small debts, it may not be economically viable due to their fee structure. They are generally more suited for larger debts where the potential recovery justifies the legal costs involved.

What factors should I consider when choosing between a lawyer and an agency?

Key factors include the size of the debt, the legal complexity of the situation, and your budget. Larger and more legally complex debts may warrant the expertise of a lawyer, while smaller and simpler debts might be more efficiently handled by an agency.

Do debt collection agencies provide customised debt recovery plans?

Debt collection agencies typically follow standard industry practices and may offer less customisation compared to lawyers. However, many agencies are adept at handling a wide range of standard debt recovery scenarios efficiently.

Can employing a debt collection lawyer affect my business relationships?

It can, as the involvement of a lawyer might be perceived as more confrontational or serious. This approach can signal a firm stance on debt recovery but may also impact ongoing business relationships. It's important to weigh the potential impact on relationships against the necessity of recovering the debt.

What should I do if the debtor disputes the debt?

In cases where the debt is disputed, especially if the dispute involves complex legal issues, a debt collection lawyer is often better equipped to handle the situation. They can provide legal advice, represent your interests, and navigate any legal challenges that may arise during the dispute resolution process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.