- within Technology, Government, Public Sector and Privacy topic(s)

- with Senior Company Executives, HR and Finance and Tax Executives

- with readers working within the Business & Consumer Services, Consumer Industries and Securities & Investment industries

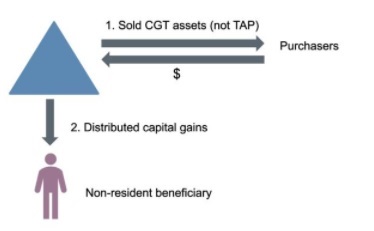

The story of Greensill's capital gains is not a happy one. But there are important lessons for advisers acting for trusts that distribute capital gains to non-resident beneficiaries.

Why were Greensill's capital gains subject to tax in Australia?

The facts in Greensill are relatively straightforward.

An Australian resident trust made a series of capital gains. The CGT assets were not 'taxable Australian property'. The trustees distributed those capital gains to a non-resident beneficiary.

The Commissioner issued assessments to the trustee for the capital gains.

In the parallel case of Martin, the Commissioner issued assessments to the Australian-resident trustee, as well as the non-resident beneficiary.

Different parts of the legislation deal with the tax treatment of capital gains made by trusts, which are then distributed to non-resident beneficiaries.

- Division 6 of the 1936 Act contains the primary provisions for taxing trust income.

- Division 115-C of the 1997 Act contains the provisions for taxing capital gains that are streamed to beneficiaries. These were the amendments that were hastily introduced by Parliament in 2011 to confirm that capital gains could be streamed to specified beneficiaries – a concept that was under challenge by the ATO at the time.

- Division 6E of the 1936 Act excludes capital gains from being taxed under Division 6 (since they would be taxed under Division 115-C).

- Division 855 of the 1997 Act contains provisions that allow foreign residents to disregard capital gains from CGT assets that are not 'taxable Australian property'.

In Greensill and Martin, the Full Federal Court concluded that:

- Division 115-C applied so that the non-resident beneficiary was deemed to have capital gains that reflected the trust's capital gains; and

- Division 855 did not apply to disregard those capital gains because the relevant capital gains were not made by the non-resident beneficiary.

The taxpayers have applied for special leave to appeal to the High Court.

The painful parts

There is no taxing point in Australia where an Australian resident trust distributes trust income with a foreign source (that is not capital gains and not franked dividends) to a beneficiary who has been a non-resident for the whole income year.

The foreign source income is not included in the non-resident beneficiary's income under section 97. This is because section 97 tests both the beneficiary's residence and the source of the income. The foreign source income is also not included in the trustee's assessable income under section 98 for the same reason: section 98 also tests both the beneficiary's residence and the source of the income.

It is hard to find a logical answer for why capital gains should be treated differently to other trust income. But the odd result occurs because there is no equivalent provision in Division 115-C for testing the source of the capital gains.

Separately, the effect of Division 855 is that there is no taxing point in Australia where either:

- a non-resident has a capital gain in relation to a CGT asset of theirs that is not 'taxable Australian property', or

- a non-resident beneficiary has an interest in a fixed trust, and that fixed trust has a capital gain in relation to a CGT asset that is not 'taxable Australian property'.

However, there is no relief for non-resident beneficiaries of discretionary trusts, or unit trusts that are not fixed trusts, who receive distributions of capital gains. This results in some sad stories.

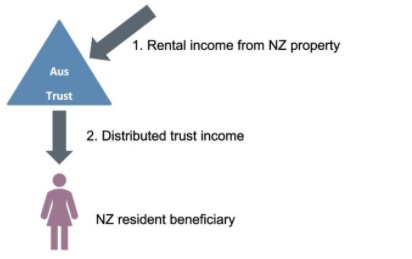

Sad story 1 – New Zealand discretionary trust with an Australian resident trustee

In this story, NZ Trust owns real property in New Zealand. One of the four trustees, Haibo, permanently relocates to Australia and becomes a tax resident of Australia. NZ Trust sells the real property in New Zealand, and distributes the capital gains to New Zealand resident beneficiaries.

Under the 1936 Act, NZ Trust is actually an Australian-resident trust, since one of its trustees is an Australian resident.

The effect is that NZ Trust makes a capital gain that is assessable in Australia.

Under Division 115-C, the New Zealand resident beneficiaries are deemed to have capital gains that reflect the NZ Trust's capital gain. There is no exclusion because the property is not 'taxable Australian property'; nor is there any exclusion because the source of the income is foreign.

Haibo, as trustee of NZ Trust, will be assessed on the capital gains that are distributed to the non-resident beneficiaries.

Sad story 2 – Australian executor of overseas deceased estate

An Australian citizen who has been living and working in the UAE for many years passes away. His sister, an Australian tax resident, is the executor of the deceased estate. She sells the estate's assets, which are investments from a UAE-based account (and are not 'taxable Australian property'). The beneficiaries of the estate include the deceased's family in the UAE.

The estate is an Australian resident trust. Distributing capital gains to non-resident beneficiaries will be problematic because of the decision in Greensill. The executor has fiduciary duties, which in these circumstances, will include taking advice on the tax consequences of the different ways the estate can be administered.

Sad story 3 – Hong Kong trust's residency status changes

HK Trust owns shares that are not 'taxable Australian property'. All of the original trustees reside in Hong Kong. One of the trustees becomes an Australian tax resident for two years, before returning permanently to Hong Kong.

Under the 1936 Act, HK Trust is an Australian-resident trust for the time that one of its trustees is an Australian tax resident.

When that trustee becomes a non-resident again, HK Trust becomes a non-resident trust. This triggers CGT event I2 for all the CGT assets owned by the Australian trust.

I don't like these stories – what should I do?

The key with these cases is identifying the issue early. In some cases, a relevant double tax agreement or the multilateral instrument, might provide relief. For example, in Sad Story 1, if the issue was identified early enough, the taxpayers might have lodged an application with the NZ IR and ATO for a competent authority mutual determination that the trust was solely a tax resident of New Zealand. Advisers and trustees need to be particularly careful in this area, as the law produces some unusual results.

Cooper Grace Ward is a leading Australian law firm based in Brisbane.

This publication is for information only and is not legal advice. You should obtain advice that is specific to your circumstances and not rely on this publication as legal advice. If there are any issues you would like us to advise you on arising from this publication, please contact Cooper Grace Ward Lawyers.

[View Source]