- within Finance and Banking topic(s)

- in Australia

- with readers working within the Accounting & Consultancy, Insurance and Securities & Investment industries

- within Technology, Government and Public Sector topic(s)

- with Finance and Tax Executives and Inhouse Counsel

Key takeaways from the recent court interpretation.

The Federal Court's determination in the case of ASIC v R M Capital Pty Ltd has provided clarification on what actions taken by AFS Licensees may constitute 'reasonable steps'.

'Reasonable steps' in this context, is the standard set by s 963F of the Corporations Act for Licensees to ensure that its representatives do not accept conflicted remuneration.

Importantly, the Court noted that while Licensees are not required to take every reasonable step that could be taken, Licensees should have a correct understanding of the law and take into account all the relevant circumstances of its businesses including activities carried on by its representatives, when determining what reasonable steps to take. An incorrect understanding will not provide a defence.

Key takeaways for Licensees

Having regard to the Court's comments in the RM Capital case, Licensees should consider taking the following actions to ensure that its representatives do not accept conflicted remuneration:

Policies: Licensees must ensure a Compliance Program, that has been tailored to their business model, is in place. The Compliance Program should include a clear written policy about managing conflicts of interests, and instructions for representatives about how to avoid, disclose and control the conflicts of interest.

In addition, the Compliance Program should include a written policy specific to conflicted remuneration which includes the following provisions:

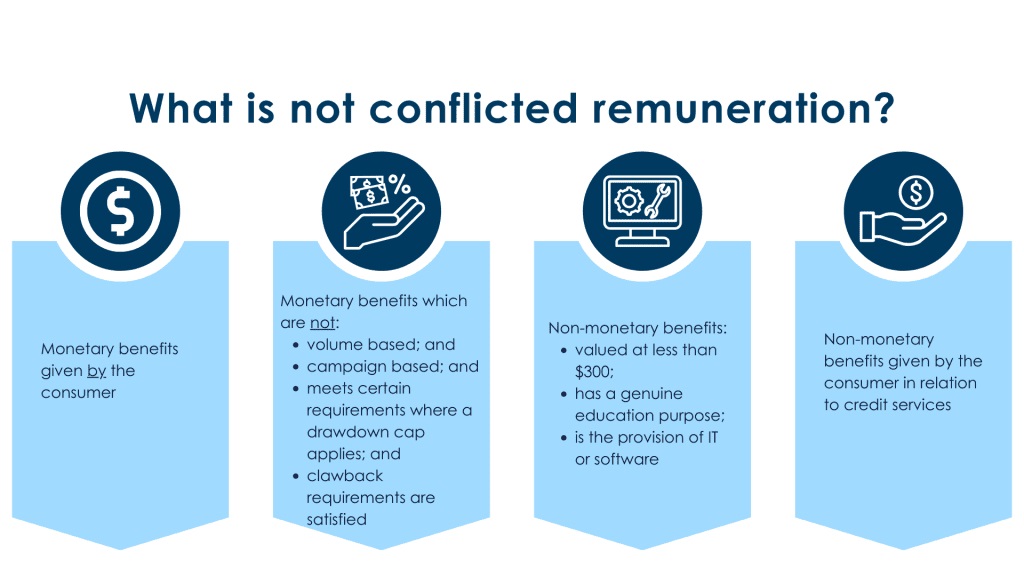

- what constitutes conflicted remuneration?

- a clear explanation of the prohibition on accepting or paying conflicted remuneration

- any relevant exceptions

- specific types of benefits that may constitute conflicted remuneration (including examples); and

- how representatives will be audited for accepting conflicted remuneration.

Such policies must be formally adopted and circulated to representatives at the time of induction and in subsequent training sessions.

Personnel: Selection and appointment of employees and other representatives must be consistent with the law and the Licensee's policies. Licensees must ensure that those involved in the provision of financial services are adequately educated, of good character, and are able to understand the law and regulation involved in the provision of financial services.

Training: Licensees must actively ensure all representatives are aware of, and adequately understand the prohibition on accepting conflicted remuneration.

Licensees should provide representatives with training on conflicted remuneration, and keep a register or record of attendance. Training should be provided during the onboarding process and also on an ongoing basis. To ensure representatives are reminded of their obligations with respect to conflicted remuneration, we suggest annual training is conducted (at a minimum).

The RM Capital case makes it clear that merely describing the prohibition on accepting or paying conflicted remuneration in a training policy is insufficient.

Products: Licensees should consider the products being promoted and recommended by its authorised representatives. In the RM Capital case, Jackson J held that RM Capital should have checked whether new products offered by representatives involved monetary or soft dollar benefits, or other arrangements which could have constituted conflicted remuneration.

Licensees should establish and consistently follow written procedures to check whether new products proposed to be recommended by authorised representatives involve conflicted remuneration. If it is not clear to the Licensee, legal advice should be sought and records of the advice received should be kept.

Monitoring: Licensees should conduct regular audits of representatives, including whether the representative has accepted any payments which haven't previously been investigated and approved as not being conflicted remuneration. Licensees should also consider conducting annual checks as to what benefits, if any, representatives had actually received, with any anomalies to be investigated.

Background

In February 2024, the Federal Court delivered judgment in ASIC's favour in the case brought by ASIC against R M Capital Pty Ltd. The Federal Court found that R M Capital breached s 963F of the Corporations Act 2001 (Cth) by failing to take reasonable steps to ensure that its authorised representative, SMSF Club Pty Ltd, did not accept conflicted remuneration.

Under s 963F of the Corporations Act, Licensees are required to 'take reasonable steps to ensure that representatives of the licensee do not accept conflicted remuneration'. In general, as outlined in s 963A of the Corporations Act, conflicted remuneration includes any benefit given to the representative that could reasonably be expected to influence the choice of financial product recommended by the representative to retail clients, or the financial product advice given to such clients.

Further Resources

- ASIC Media Release 4 March 2024

- Australian Securities and Investments Commission v R M Capital Pty Ltd [2024] FCA 151

- Conflicted Remuneration

- Mortgage Broker Conflicted Remuneration

- ASIC's Appeal on Conflicted Remuneration Case is Dismissed: Key Takeaways

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.