- with readers working within the Retail & Leisure industries

- within Antitrust/Competition Law and Intellectual Property topic(s)

A targeted analysis of European sector leaders provides indications of potential focus areas

In our last blog post, we reviewed a sample of leading companies in the pharma and healthcare sector, assessing their readiness to comply with the EU Corporate Social Reporting Directive (CSRD). The first companies governed by CSRD must apply its requirements for the financial year 2024.

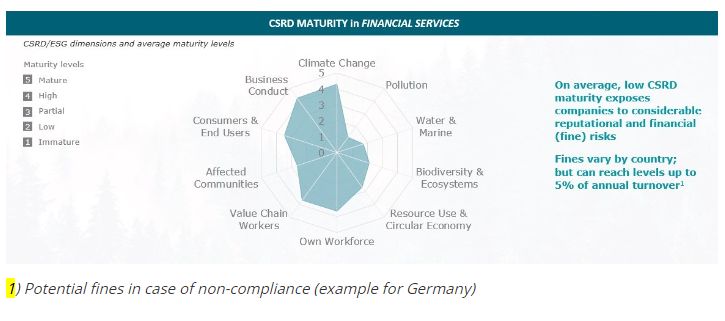

This time, we conducted a targeted analysis of five leading financial services firms in the European Union and their readiness to comply with CSRD requirements. Generally, our analysis suggests that the analyzed firms, on average, display a high maturity in "governance". However, a considerable need for action was identified for the "environmental" and "social" pillars of the CSRD.

For the "environmental" dimension, the analyzed financial services firms, on average, showed high maturity for "climate change" and partial maturity for "resource use & circular economy". However, "pollution", "water & marine" and "biodiversity & ecosystems" were assessed as either "immature" or with low maturity levels. Despite active engagement in environmental topics, these pillars don't appear to have been a focus area for the analyzed firms. By the nature of the financial services industry, the dependence on physical infrastructure, associated supply chains, and associated measures is limited. However, the industry is indirectly exposed to those pillars through their investment portfolios. Thus, measures to comply with CSRD requirements should be taken and made transparent accordingly.

For the "social" dimension, the analyzed firms were assessed, on average, with "high maturity" on almost all pillars. Yet, the maturity for the pillar "affected communities", was assessed to be "partial," indicating that the reporting on people or communities directly or indirectly exposed to risks of the respective firm or its value chain can be further improved.

Based on the results of our analysis, we believe, financial services firms may need to foster their reporting efforts for selected pillars in "environmental" and "social". Companies can conduct a comprehensive gap-analysis, mapping the current reporting and underlying activities against CSRD targets and standards to identify necessary fields of action. In particular, we recommend including the firms' investment portfolios in the analyses.

In addition, financial services firms should review and enhance their efforts for establishing an integrated reporting by combining financial, operational, and ESG targets and measures. Thus, making ESG an integrated element of business rather than a necessary, stand-alone activity – reflecting also the concept of double materiality not only in reporting but also in decision-making.

Beyond pure reporting benefits, improved information systems often enable enhanced target setting and may even stimulate increased engagement in ESG-/CSRD-related activities across the institution, unlocking currently undetected potentials.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.