- within Technology topic(s)

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- in European Union

- with readers working within the Media & Information and Retail & Leisure industries

- within Media, Telecoms, IT and Entertainment topic(s)

A refresher and overview to get ready for MiCA.

The MiCA clock is ticking for part of the crypto industry. On 29th June 2023, the Markets in Crypto Assets Regulation ("MiCA") entered into force. Although the regulations won't come into effect until 1st January 2025, industry participants are strongly encouraged to start preparing for it.

1. Who is concerned by MiCA?

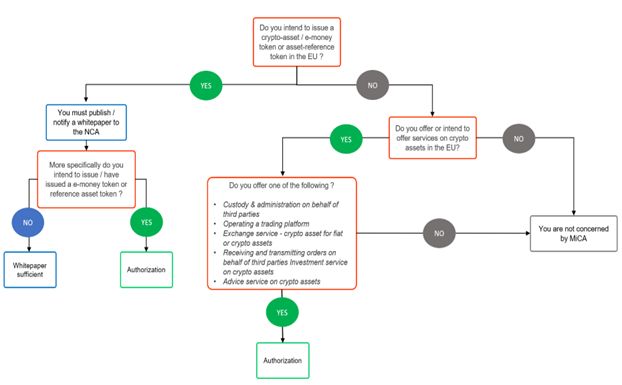

The first obvious step is to find out if you are affected by MiCA. Here is a quick test to give you an indication:

To help you navigate through this decision tree, the following elements must be clarified:

- Crypto asset: a digital representation of value or rights which may be transferred and stored electronically, using distributed ledger technology or similar technology.

- E-money token: a type of crypto-asset the main purpose of which is to be used as a means of exchange and that purports to maintain a stable value by referring to the value of a fiat currency that is legal tender.

- Asset reference token: a type of crypto-asset that purports to maintain a stable value by referring to the value of several fiat currencies that are legal tender, one or several commodities or one or several crypto-assets, or a combination of such assets;

- NCA: the regulator of the Member State to which you are subject and to which the application shall be sent, or the whitepaper shall be notified.

In order to fine-tune the scope of potential MiCA relevance, it should be noted that certain assets and/or services are excluded either (i) because they are already regulated by European legislation or (ii) because they will be regulated in the future in a "MiCA 2.0":

- Covered by European Legislation: This category includes financial instruments, securitisation positions, deposits, structured deposits, funds, pension products or schemes, social security schemes, non-life or life insurance contracts (Recital 9).

- Addressed by a future MiCA 2.0: The European Union aims at creating a harmonised and specific framework for the crypto-asset market. Given the scale of the task and the technical difficulty of the subject, the European Commission and Parliament have excluded certain assets/services, with a view to regulating them more effectively at a later stage. Among these are NFT (except for fractional NFT and those whose non-fungible or one-off nature of may be questioned, Recital 10), fully decentralized service (Recital 22), lending and borrowing (Recital 94), or staking of crypto-assets (other than asset-reference token and e-money token) to maintain a network (Title II, Art.3 lit. 3).

If you end up in a blue or green box, we recommend that you further assess the MiCA topic and obtain consultancy on how to prepare for MiCA.

2. Where does MiCA apply?

MiCA does not only concern EU-based crypto companies. As the regulation aims at protecting the European population, as soon as EU-based customers are targeted, MiCA requirements shall apply. It naturally brings about two main fallouts for Swiss players:

- Conduct a Regulatory Audit: comprehensive regulatory audit must be conducted in order to organise a future full compliance with the new regulation. In that regard, not only MiCA must be scrutinized but also the Digital Operational Resilience Act (DORA) which creates a harmonized approach of cyber resilience as well as the pilot regime for Distributed Ledger Technology (DLT) market infrastructures.

- Create Substance in the EU: stablecoin issuers and crypto-asset service providers will be requested to build substance in Europe in order to obtain the appropriate license.

3. What about reverse solicitation?

Many non-EU actors may hope to rely on the reverse solicitation to avoid the burden of preparing for MiCA. Indeed, following art. 61 of MiCA, Swiss crypto firms that are not MiCA licensed may also in the future onboard an EU client under the reverse solicitation exemption, (i.e., having to abide by the MiCA regime), if the EU client has contacted the Swiss entity at its own exclusive initiative(passive sales). But what does this entail?

On January 29, 2024, ESMA published its third consultation package on the draft guidelines on reverse solicitation. According to the draft, ESMA intends to apply a very narrow understanding on the scope of "reverse solicitation". ESMA highlight that the term solicitation should be construed in the widest possible way, including any form of solicitation of EU based clients (e.g., banner advertisement, social media, face-to-face meetings, road shows, trade fairs, invitations to fill in a response form, use of influencers, etc.). Thereby, it shall not matter if the solicitation is conducted by the crypto company itself or by third parties - even without contractual relationship between the crypto firm and the third party conducting the solicitation.

The draft guidelines are under consultation (deadline April 29, 2024). MME shall provide an update on the MiCA concept of reverse solicitation as soon as the guidelines have been further clarified.

4. Why start preparing now?

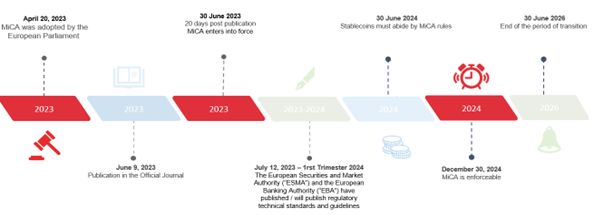

Even if MiCA does not come into effect tomorrow, the deadlines are fast approaching, especially for those actors that deal with stablecoins (asset-reference and e-money token) and/or are not regulated in any way in their home country. As a reminder, here are the most important deadlines.

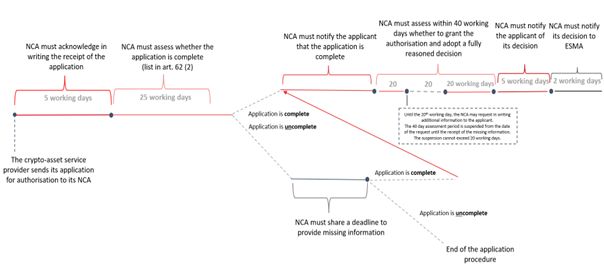

Furthermore, as you can see below, obtaining a MiCA licence can take time to secure, around three months in the best case. However, this timeframe only relates to the assessment of the application by the NCA and does not take into account the preparation time required to submit the application.

5. What do you need to prepare?

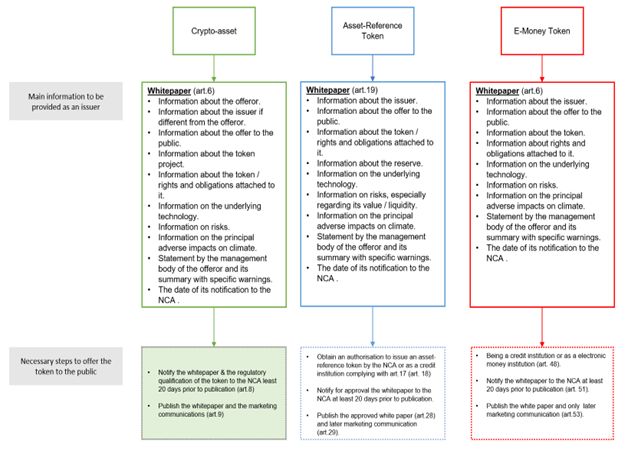

Depending on where you end up in in the decision tree above, you may be required to prepare a (i) whitepaper and/or (ii) submit an authorisation application. What does it imply?

i) Whitepaper

The requirements for issuers are directly related to the regulatory nature of the token. One may notice a gradation between the requirements for a crypto-asset token (in green), an asset-reference token (in blue) and an e-money token (in red). The most striking element is the legal status of the issuers: if the issuance of crypto-asset tokens is open, the issuance of asset-reference token requires at least a specific authorisation, while only credit institutions and electronic money institutions are allowed to offer e-money token.

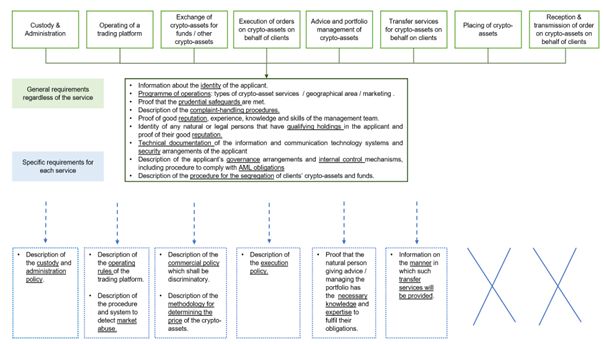

ii) Authorisation Application

Pursuant to art. 62 of MiCA the application for the authorisation submitted to the competent authority of their home member state must include the following information:

Once you have been granted with an approval to provide such service by Member State regulator, you are not automatically authorised to offer your services in the whole EU Market. You need to obtain a "passport" for you service, whose procedure must be taken into account from the beginning of the process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.